Active, equity, bond and passive funds all feature in the most popular sustainable funds of the past five years as investors engage with this growing trend through a variety of portfolios.

Sustainability is an umbrella term for various types of funds including ethical, environmental, social and governance focused (ESG), socially responsible investing (SRI), positive and negative screening and impact funds. All are variations of the same goal, investing for better social and environmental outcomes via ‘good’ companies.

A decade ago this was a niche part of the market, but with social awareness on these issues growing and governments focusing more on these targets, investors have taken more and more notice.

Last year, investment into responsible funds accounted for around a third of overall industry sales and 2021 is set to break that record, according to data from AJ Bell.

Laith Khalaf, head of investment analysis at AJ Bell, said: “There’s no doubting the strength of the sustainable investment tide.”

The latest Investment Association (IA) data found that investors have put more than £1bn into responsible investment funds for the seventh month in a row this year.

It hasn’t just been the general interest in issues linked to sustainable funds that have drawn in interest, ultimately these types of portfolios have delivered outperformance.

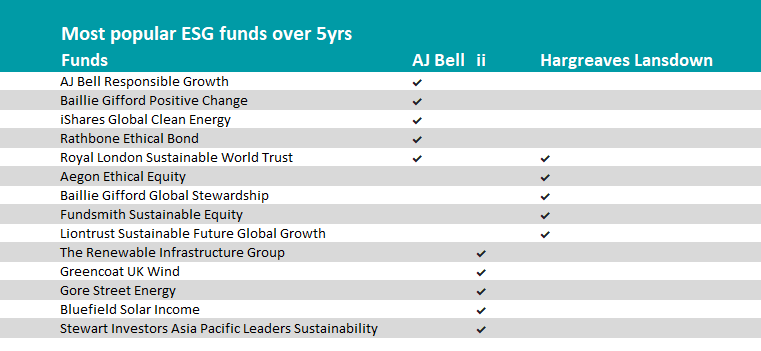

To see which ESG funds have been capturing the most inflows Trustnet asked fund platforms AJ Bell and Hargreaves Lansdown which ESG funds had been the most bought over five years. Trustnet also asked interactive investor (ii) whose data only goes back three years.

Source: AJ Bell, interactive investor and Hargreaves Lansdown

Predominantly on the list are portfolios investing in the ‘E’ of ESG. Myron Jobson, personal finance campaigner for interactive investor, said that four out of the top five most popular ESG funds among ii investors focused on the ‘E’.

The only name reoccurring in more than one list was Royal London Sustainable World Trust.

The £3bn fund has been the best performer in the IA Mixed Investment 40-85% Shares sector over 10 years, making 316%.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

It has held this top spot across shorter time frames, consistently making high returns through different market environments.

Along with consistent outperformance it has also experienced consistent inflows since launch in 2009, Khalaf said.

“When combined with an ESG approach and a long standing management team, it’s easy to see why this fund has proved popular,” he added.

Led by FE fundinfo Alpha Manager, Mike Fox, the managers invest in a mix of equities and bonds, primarily the former. But all options comply with Royal London’s sustainable investment process, which is grounded in the idea that the sustainability of a business will drive its financials.

Looking at the rest of the list and two Baillie Gifford funds appear: Baillie Gifford Positive Change and Baillie Gifford Global Stewardship funds.

Both follow the fund houses’ approach of a concentrated portfolio focused on growth stocks, which has generally been the best way to deliver high returns in the past decade, as ultra-loose monetary policy and record low interest rates benefitted this style. Generally ESG favour a growth process, partly the reason for the theme’s strong performance last year.

Baillie Gifford Positive Change is run by Kate Fox and Lee Qian. Launched in 2017 it has made the second best returns in the IA Global sector, 132%.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

Its performance has slipped to the fourth quartile recently as growth portfolios generally took a performance hit during the recent value rally in markets. This is also the case for Baillie Gifford Global Stewardship.

The £3bn fund’s sustainability criteria centers on four themes: social inclusion and education, environment and resource needs, healthcare and quality of life and ‘base of the pyramid’. A stock has to engage with at least one to be held in the fund.

Baillie Gifford Global Stewardship takes a different sustainability approach by applying a negative screen, excluding ‘sin sectors’ and only investing in companies that have a net positive benefit for society. Over five years it made the fourth best returns in the IA Global sector of 180%.

Another popular option was a BlackRock’s ETF, iShares Global Clean Energy. Khalaf said renewable energy generally has been a big investment theme as governments have upped their climate change campaigns. He said that this ETF in particular “saw tremendous gains and inflows in 2020.”

Focusing on the same theme was Guernsey domiciled The Renewables Infrastructure Group.

Performance of trust vs sector and benchmark since launch

Source: FE Analytics

The £2.6bn trust invests in infrastructure that contribute towards a zero-carbon future. It’s currently running at a 7.6% discount and has a dividend yield of 5.5%.

Another big hitter on the list was Liontrust Sustainable Future Global Growth. Launched in 2001 it’s one of the oldest sustainable funds available to investors and managers and Peter Michaelis and Simon Clements have a long history investing in this part of the market. Co-manager Chris Foster joined early last year.

The £2bn fund follows Liontrust’s Sustainable Future process, looking for companies within three themes: improving people’s quality of life either through medicine, technology or education; driving the improvements into the efficiency which scarce resources are being used; and helping to rebuild a more stable, resilient and prosperous economy.

Since launched it has made some of the highest returns in the IA Global sector. The 371.4% it has returned was seventeenth best over the past 10 years.

Other popular funds were Rathbone Ethical Bond, Aegon Ethical Equity, Fundsmith Sustainable Equity and Bluefield Solar Income.