Fund managers think that emerging market stocks could lead the market in 2022, a closely watched survey has found, as inflation and its effect on interest rates become the main issue driving investor sentiment.

The latest Bank of America Global Fund Manager Survey asked asset allocators where they think markets are heading during 2022 as the global economy recovers from the Covid-19 pandemic while contending with new headwinds – such as surging inflation.

The survey polled 345 fund managers (who run a combined $1.1trn in assets) between 5 and 11 November. Below, Trustnet takes a look at some of the market forecasts they made.

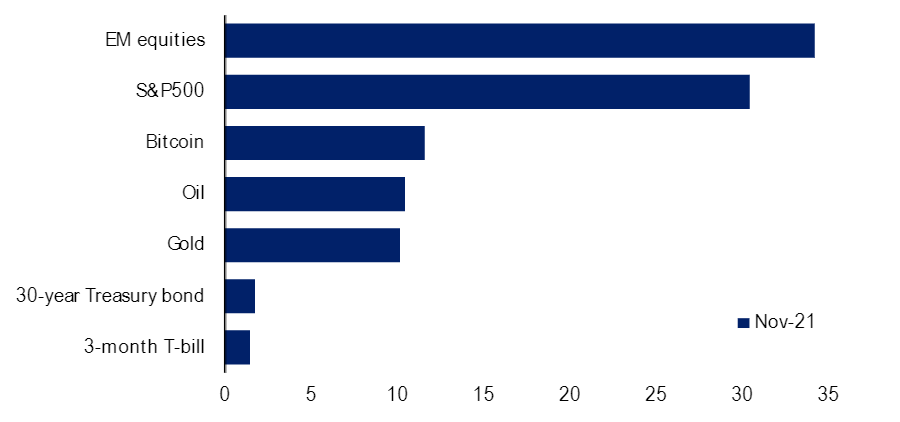

The assets that fund managers think will produce the best returns in 2022

Source: BofA Global Fund Manager Survey

When asked which assets they expect to perform strongest in 2022, the winner was emerging market equities – cited by 34% of the survey’s respondents. US equities were in second with 30% backing them, while bitcoin came third with 12%.

Elsewhere in the BofA Global Fund Manager Survey, we find that fund managers are currently underweight emerging market equities, although this underweight has narrowed during November. According to FE Analytics, the MSCI Emerging Markets index is up just 3.3% over 2021 so far, compared with a 23.6% gain for developed markets (MSCI World).

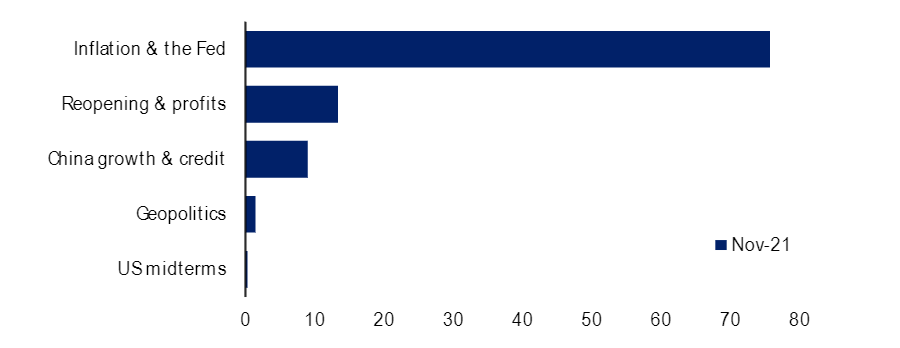

Investors expect inflation & the Fed to be the top driver of markets in 2022

Source: BofA Global Fund Manager Survey

Inflation & policy moves by the US Federal Reserve are expected to be the main drivers of markets next year. Around three-quarters of fund managers highlighted this issue, significantly more than opted for thereopening & profits or Chinese growth.

Inflation is a hot topic around the globe but the US is one of the places where it is most closely watched by investors, given the Fed’s ability to move markets. Earlier this month, US consumer price inflation jumped 6.2% – its biggest surge since December 1990 – and put more pressure on the central bank to lift interest rates.

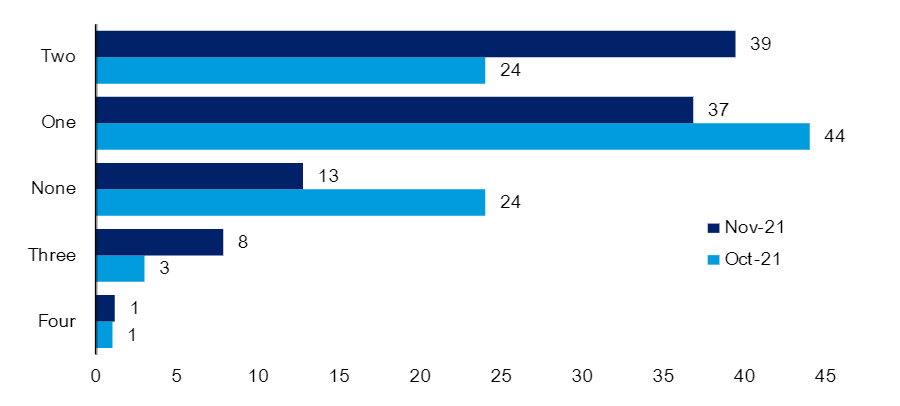

Investors expect 1.5 rate hikes in 2022

Source: BofA Global Fund Manager Survey

Some 39% of fund managers think the Fed will raise rates twice across 2022 (up from 24% in last month’s survey) and 37% expect one hike. Only 13% are saying the Fed will not lift rates next year (down from 24% a month ago).

Eight in 10 asset allocators think that the US central bank will start tightening policy by the first half of 2023 and the average expectation for the first rate hike is October 2022.

“Investors are not expecting the Fed to tighten aggressively (i.e. buy-in for Powell narrative on transitory inflation and modest tapering),” Bank of America added.

How fund managers see the global economy trending in the next 12 months

Source: BofA Global Fund Manager Survey

On the question of where both the global economy and inflation are heading in 2022, fund managers appear to be in the ‘boom’ camp – 65% expect above-trend growth and above-trend inflation next year.

Expectations of stagflation (below-trend growth and above-trend inflation) have eased since last month’s survey, but with 29% of fund managers holding this view it’s still the second most popular stance.

The ‘Goldilocks’ scenario of above-trend growth and below-trend inflation is expected by just 3% while only 2% think the world is heading into recession (where both growth and inflation would be below-trend) in 2022.

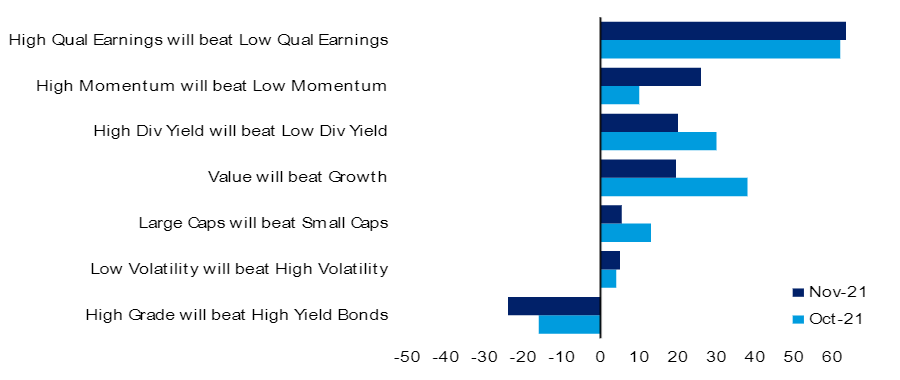

Over the next 12 months, fund managers think that…

Source: BofA Global Fund Manager Survey

When considering which investment factors are likely to work over the coming year, there is still a consensus among fund managers that stocks with high-quality earnings will outperform those with low-quality earnings.

There has been a big jump in those tipping high momentum stocks over low momentum – a net 26% of investors think high momentum will outperform, an increase of 16 percentage points since the October edition of the survey.

However, there was a big fall in number of managers expecting value investing to beat growth and large-caps to outperform small-caps.