The emerging markets are an enigma to many investors. While the sector is made up of a basket of countries from Asia, Europe and Latin America, much of its returns come from one place: China.

On the whole, the market has had a reasonable decade, doubling investors’ money over the past 10 years, but with so many variables, it can be almost impossible to know how to approach it.

In this series, we look at investment style (growth versus value) and market capitalisation, as well as whether active funds have beaten the benchmark, to work out what has been the best way to play each major market over the past decade.

Previously we have looked at the UK and Europe, where smaller companies funds were the clear winners, while in the global and US studies, large-cap passive funds came out on top. The picture was less clear in Japan, however, where active small-cap strategies and large index trackers both scored well.

This week, we have turned to the emerging markets, where again, the results are somewhat mixed. On the face of it, smaller companies have beaten their large-cap rivals. The MSCI Emerging Markets Small Cap index has made 136.6% over 10 years, while the MSCI Emerging Markets Large Cap index has made 102.4%. However, this hides an underlying difference.

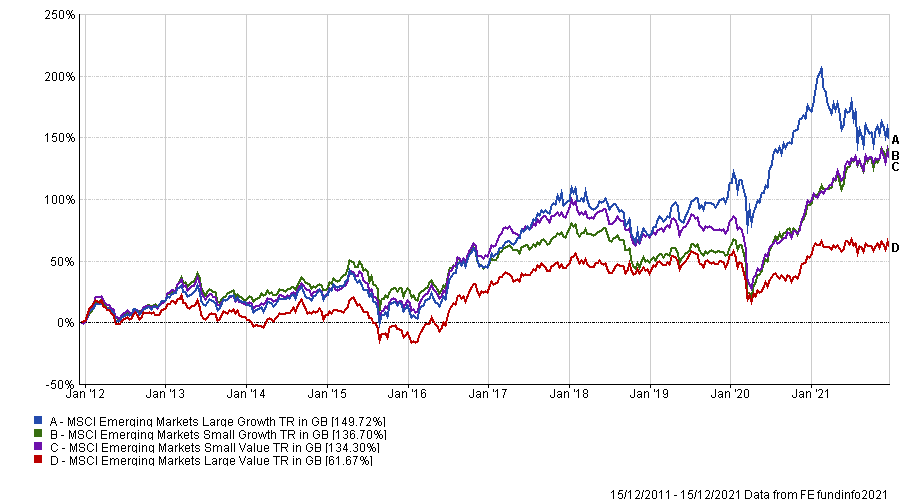

When breaking this down by investment style, the large emerging market companies with a growth bias have clearly beaten smaller companies with the same style.

However, large-cap value stocks have been woeful, making half the returns of the small-cap value index, as the below chart shows. So a large-cap growth strategy would have worked well, as would a broad smaller companies approach.

Total return of indices over 10yrs

Source: FE Analytics

Turning to the active versus passive debate, the broader MSCI Emerging Markets index has returned 101.5% over the past decade, while the average fund in the IA Global Emerging Markets sector has made just 95%.

This is despite many managers pointing to the lack of research in the region compared with developed markets such as the US, which should lead to greater potential to beat the market.

It may be explained by the dominance of high-growth technology stocks (21.8% of the index) and relative lack of value names from the energy (5.6%) and mining (8.4%) sectors.

However, of the active funds in the sector that have a long enough track record, more have beaten the index (39) than have failed (32).

The best fund of the past decade has been the BNY Mellon Global Emerging Markets fund, which has been managed by Ian Smith and Paul Birchenough since December 2020. They took charge following the departure of veteran stockpicker Rob Marshall-Lee, who joined Odey Asset Management.

It has made investors 242.8% over 10 years, more than double the gains of the market, by investing heavily in technology names. The sector makes up 28.2% of the fund, while it is underweight energy stocks (0%) and financials (15% versus 19.5% in the index).

Baillie Gifford Emerging Markets Leading Companies, another large-cap fund that is managed with the same growth approach as many others run by the same group, is the fourth-best performer over the past decade, up 173.6%.

The £1.1bn fund includes the likes of Alibaba, Samsung Electronics and Tencent among its top 10 holdings, as well as Brazilian e-commerce firm MercadoLibre.

Mtx Sustainable Emerging Market Leaders is fifth on the list. Again, the $7.4bn (£5.6bn) fund is overweight technology stocks, particularly in China, where 41.9% of the portfolio is invested.

The other two among the top five active funds are small-cap specialists. The $2bn JPM Emerging Markets Small Cap fund has been managed by FE fundinfo Alpha Manager Amit Mehta since 2007, with co-manager Austin Forey joining him in 2015.

It was the only other fund in the sector outside of BNY Mellon Global Emerging Markets to make investors more than three times their money (205.8%).

Unlike the large-cap funds above, technology is only the fourth-largest allocation in the portfolio, behind consumer staples, financials and consumer discretionary stocks.

Templeton Emerging Markets Smaller Companies came in just behind its small-cap peer, returning 189.7% over 10 years. This fund has a technology bias, with almost a quarter of the portfolio in high-growth tech names, while it has nothing in energy stocks.

| Fund | Sector | Fund size | Manager name(s) | OCF |

| Baillie Gifford Emerging Markets Leading Companies | IA Global Emerging Markets | £1,122m | Will Sutcliffe, Roderick Snell, Sophie Earnshaw | 0.76% |

| BNY Mellon Global Emerging Markets | IA Global Emerging Markets | £268m | Paul Birchenough, Ian Smith | 0.84% |

| JPM Emerging Markets Small Cap | IA Global Emerging Markets | £1,479m | Amit Mehta, Austin Forey | 1.06% |

| Templeton Emerging Markets Smaller Companies | IA Global Emerging Markets | £412m | Chetan Sehgal | 1.49% |

| Vontobel Asset Management Sustainable Emerging Markets Leaders | IA Global Emerging Markets | £5,581m | Thomas Schaffner, Roger Merz | 1.01% |