The upcoming year could be a brighter one for UK markets with a positive change in investor sentiment after months – even years – of being on the outskirts.

A recent Association of Investment Companies (AIC) poll revealed that the industry’s pessimisms about the UK may be shifting after managers pegged it to be the top-performing region in 2022, with 25% of the votes.

This is in direct contrast to the investment sentiment demonstrated throughout 2021, as Calastone data revealed that November was the sixth consecutive month of outflows from UK equities (net £464m).

Its unpopularity has meant that UK valuations are currently at lower levels versus other markets, with some arguing that companies are now too lowly priced – one part of the UK’s investment opportunity next year.

Valuations have been a big buzzword in 2021 with some markets experiencing record-high valuations. This was particularly noticeable in the US, where several mega-caps stocks had their share prices massively inflated. The UK has experienced the opposite, with valuations stooping to discounted levels.

JO Hambro managers James Lowen and Clive Beagles said, they were “utterly bemused by valuations in the UK stock market”, at the moment, claiming that prices were well below the levels they should be given the strength of the UK’s economic outlook for 2022.

They said: “Rarely, if ever, have the relative attractions of the UK and our fund been brighter than this, yet very few investors seem to be interested,” they said.

FE fundinfo Alpha Manager Alex Wright echoed Lowen and Beagles points, telling Trustnet that UK equities were “significantly undervalued” compared with global markets, but were “reasonably valued” in absolute terms.

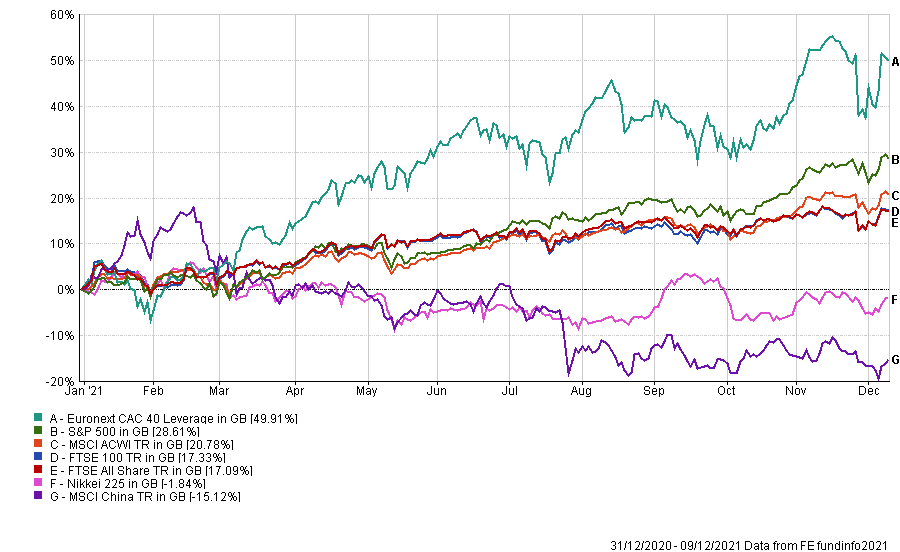

The UK is predominantly made up of value and cyclical stocks, which fallen out of favour with investors when growth-quality stocks have rallied, hence the discounted rates. This bias has caused the major UK indices to underperform against their developed market peers, shown in the graph below.

UK indices versus other indices year-to-date

Source: FE Analytics

Another reason behind the discounted valuations are lingering Brexit concerns. Despite the UK finalising a trade deal almost exactly a year ago, Sue Noffke, head of UK equities at Schroders, said that the perceived significant, political and economic risks of Brexit remained and had continued to depress valuations.

She said: “We believe the extent of the valuation discount is completely unwarranted. The ratings of all variety of UK-listed companies are being negatively impacted.”

This situation has led to a lot of merger and acquisition (M&A) activity in the UK, with listed companies being swallowed up by overseas private equity buyers.

Noffke said: “Somebody’s buying UK shares, it’s just not stock market investors at present.”

Although these muted valuations might be frustrating in terms of reflecting the UK’s true worth it also offers an investment opportunity going into the new year, whereby investors can access good global and domestic brands at a cheaper rate.

Martin Walker, head of UK equities at Invesco, said: “Simply put, we believe that UK equities present opportunities for a catch-up trade, which valuation-focused investors like us can aim to capitalise on.”

Another positive for the UK going into 2022 is its sharp rise in initial public offerings (IPOs), which Ben Russon, manager of several UK equity funds at Franklin Templeton, expected to continue.

By the end of 2021’s third quarter, UK equity markets had seen the highest rate of IPOs since 2014. Part of this was down to postponed IPOs from 2020 coming through, but Russo said it “indicates that risk appetite is returning for both businesses and investors”, who see the UK as an ideal place to domicile their businesses.

Russo said he remained “cautiously optimistic” about the “strong opportunities” for UK equity investors and added that “headline risks are potentially being overplayed by the media.”

Not everyone agreed on the latter point, as Simon Brazier, manager of the Ninety One UK Alpha fund, said that inflation “remains the biggest source of uncertainty for the future”, along with wage growth and interest rates.

“I believe that will determine the investment outcome for the next year – and maybe years – ahead,” he said.

The manager added that 2022 could be “tricker” economically as central governments start to pull back on their stimulus and markets experience a “tightening cycle” on monetary policy. This could put more pressure on consumers who could be asked to take on that pricing burden.

“Having said that, putting the glass-half-full hat on, if we do see a post-pandemic normalisation with consumers back out spending, then we may see certain areas of the economy, such as leisure and travel, doing much better,” Brazier added.

Covid also remains a key concern for all markets, not just UK.

Wright said that the “final shudders of the Covid-19 pandemic should work their way through the global economy in 2022”, but the new Omicron variant could be a downside risk to global markets and the UK if it is found to have greater health risks.