Last year was a mixed bag for the giant funds that many investors will have relied on to make a profit, according to FE fundinfo data.

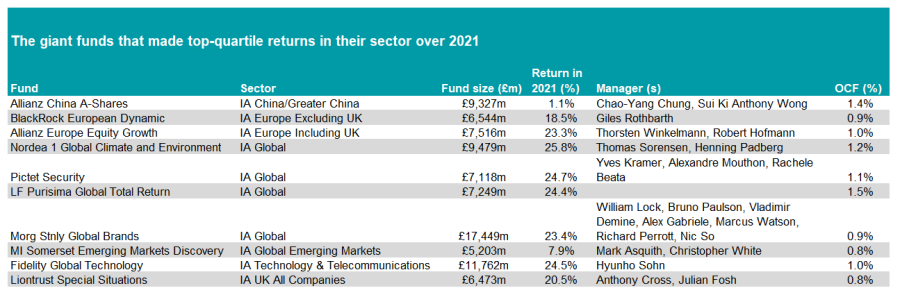

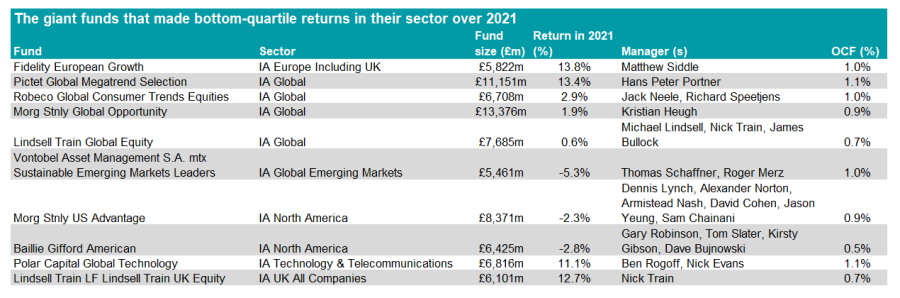

Looking at the 28 active equity portfolios that each run more than £5bn, 10 made top-quartile returns in 2021 while 10 were in the bottom quartile, with the remainder in the middle.

Liontrust Special Situations had an impressive year in 2021, returning 20.5% as FE fundinfo Alpha Managers Anthony Cross and Julian Fosh deftly managed the surge into UK equities.

The £6.4bn fund invests using the firm’s ‘economic advantage’ principle, which targets companies with a “durable competitive advantage” such as intellectual property or brand loyalty.

Around 40% of the portfolio is invested in large-cap names, while 28.6% is put towards companies in the FTSE 250 and around a fifth is in AIM stocks, which had a particularly strong year.

Source: FE Analytics

Elsewhere, four giant global funds made top-quartile returns. Morgan Stanley Global Brands was a strong performer, making the third-best return in the IA Global sector on the year as its quality-growth approach came into fashion.

Sector specialists Pictet Security and Nordea 1 Global Climate and Environment were also at the top of the sector. Both themes were strong last year as investors prioritised technology and the environment became a hot topic, particularly towards the end of the year with the COP26 conference.

Despite a down year for Chinese stocks, which plummeted as the government imposed regulations on the technology and education sector, the investors in the £9.3bn Allianz China A-Shares were spared much of the falls.

The portfolio is underweight technology stocks and does not hold any of the main protagonists – Alibaba, Tencent or Baidu – among its top 10 holdings.

On the flipside, it was a year to forget for the investors that backed Nick Train’s two giant funds – Lindsell Train Global Equity and UK Equity, as both sat in the bottom quartile of their respective Investment Association (IA) sectors. The global fund made 0.6% in 2021, while the UK fund made 12.7%.

Towards the end of 2021, the manager said: “I will not make flippant or complacent predictions about prospects for Lindsell Train Limited, as we experience arguably the worst period of relative investment performance in our 20-year history.

“We assure you, we remain disciplined and serious in our efforts to invest in assets with the potential of protecting or enhancing the real, after-tax purchasing power of your savings.”

Source: FE Analytics

Baillie Gifford American – another stalwart for investors – has enjoyed a meteoric rise over the past decade, up 766.6%, but over 2021 it lost 2.8% as its large bets on technology stocks as extreme valuations finally caught up with some of the large US tech stocks.

With higher inflation a negative for the sector – as it increases the discount rate on their future earnings – and hope of an economic recovery causing investors to move towards value names, these companies were sold off in 2021.

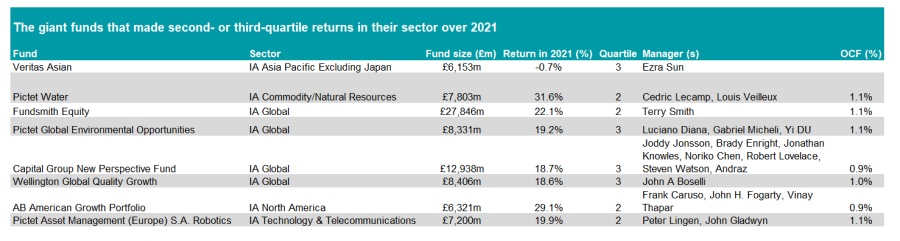

Those that entrusted veteran stock picker Alpha Manager Terry Smith had an interesting year, with his Fundsmith Equity fund beating the average IA Global peer but failing to beat the MSCI World index for only the second time in its history.

Source: FE Analytics

However, it should be noted that Smith has never failed to beat the IA Global sector average, and in the two years that he has not beaten the market (2021 and 2016) he has done so by less than 1 percentage point combined (83 and 8 basis points respectively).

He headlines the group of giant funds that made second-quartile performances in 2021, while Veritas Asian, managed by Alpha Manager Ezra Sun, leads those that were in the third quartile of their sector.

Like the Baillie Gifford fund above, the portfolio, which sits in the IA Asia Pacific Excluding Japan sector, is heavily weighted to technology (30.2% of the fund) and China (32.3%), explaining its lack of form in 2021. Overall the fund lost 0.7%.