Funds that invest using environmental, social and governance (ESG) principles have dominated the past three years, and many recently launched global funds in the space have rocketed to the top of the performance charts, according to a Trustnet study.

In this series, we look at the funds launched in 2018 that have risen to the top quartile of their sector over the past three years. Having previously tackled the UK, emerging market, multi-asset and US sectors, this week we looked at the global market.

There were significantly more entrants in the IA Global sector than any other peer group covered, with 11 newly launched funds sitting in the top quartile of the sector over three years.

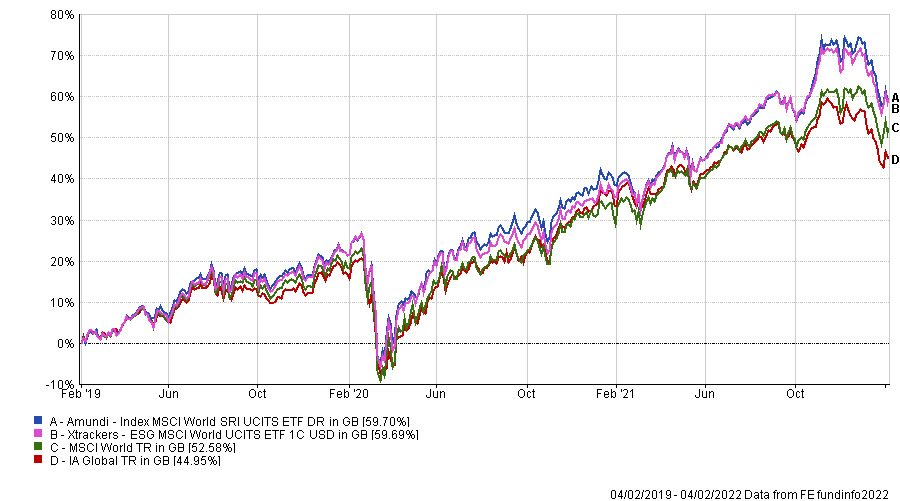

The standout winners were passive ethical funds, with several exchange-traded funds (ETFs) notching up strong returns in their first three years. The £2.3bn Xtrackers ESG MSCI World UCITS ETF and £1.9bn Amundi Index MSCI World SRI UCITS ETF have already attracted a large amount of investors’ cash since launch and have made impressive returns of 58.7% and 59.1% respectively.

Total return of funds vs sector and MSCI World index over 3yrs

Source: FE Analytics

Although they track different indices, the portfolio holdings are similar. Microsoft is the largest weighting in both funds, with electric carmaker Tesla second, while they share five of the top 10 positions in common overall.

Fellow ESG passive funds JPM Global Research Enhanced Index Equity (ESG) UCITS ETF and Lyxor MSCI World ESG Leaders Extra (DR) UCITS ETF also crack the list.

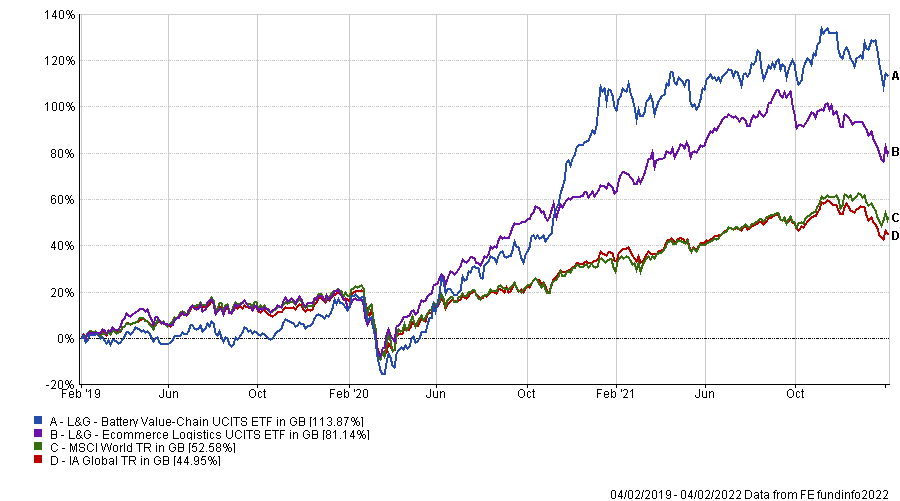

However, it was the more niche areas that performed best. L&G Battery Value-Chain UCITS ETF tracks an index of mining companies that produce metals in batteries or in energy storage stocks.

The theme has been a strong performer in recent years as the rise of electric vehicles has put the onus on battery manufacturers and mining companies to ramp up production to meet demand.

Over the past three years the fund has made 113.9%, the second-best return in the IA Global sector and more than double the MSCI World index.

Total return of fund vs sector and MSCI World index over 3yrs

Source: FE Analytics

Another L&G fund – the Ecommerce Logistics UCITS ETF – also achieved top billing in its first three years, making 81.1% – the seventh-best in the IA Global sector.

The underlying benchmark index is made up of companies that are leaders in the logistics space, but have a link to e-commerce and technology.

Despite the recent technology sell-off, it has lost just 6.4% in 2022 so far, at a time when the majority of big tech names have dropped much further – the Nasdaq is down 11.7% so far this year.

Turning to active managers, ESG continued to be the main theme, with the likes of BNY Mellon Sustainable Global Equity, Montanaro Better World and Wellington Climate Strategy all making top-quartile returns over three years.

Montanaro Better World is the largest of the three with assets under management (AUM) of £698m. Managed by Charles Montanaro and Mark Rogers, the five FE fundinfo Crown-rated portfolio invests in companies that have a positive impact on the world, while also being profitable and well managed.

It has nothing in the energy sector or mining stocks, with the bulk of the fund invests in technology and healthcare companies.

The fund has had to overcome a torrid start to the year, down 20.1%, but remains a top performer over three years thanks to its exceptionally strong years in 2019 and 2020, when the fund made back-to-back top-quartile returns.

Total return of fund vs sector and MSCI World index over 3yrs

Source: FE Analytics

The only non-ESG funds on the list were the Threadneedle Global Focus portfolio, run by FE fundinfo Alpha Manager David Dudding, and Fiera Capital Global Equity fund, headed by Nadim Rizk and Andrew Chan.

The former has ridden the coattails of the US tech sector, with Microsoft, Alphabet and Amazon its three largest holdings. In total, the fund has 71% invested in the US, 10 percentage points more than the MSCI World index.

Although not a stated part of the strategy, the fund does however use responsible investing research to consider the risks of potential holdings.

The Fiera fund has also benefitted from the strong performance of tech stocks, with Alphabet, Microsoft and Mastercard among its largest holdings. However, the portfolio uses a quality-growth strategy that includes the likes of Johnson & Johnson and Nestle among its largest positions.

This has helped this year, as the fund is down 6.8% – 0.6 percentage points less than the average IA Global peer. However, the managers said that they were not looking at the short-term performance of the fund.

In the latest factsheet, they said: “Our investment horizon is best measured in years, conceivably decades, not months or quarters.”

| Fund | Sector | Fund size | Fund managers (s) | OCF | Launch date |

|

Amundi Index MSCI World SRI UCITS ETF |

IA Global | £1,903m | Amundi | 0.18% | 11/09/2018 |

| BNY Mellon Sustainable Global Equity | IA Global | £71m | Yuko Takano | 0.82% | 22/01/2018 |

| Fiera Capital Global Equity | IA Global | £242m | Nadim Rizk, Andrew Chan | 1.97% | 08/06/2018 |

| JPM Global Research Enhanced Index Equity (ESG) UCITS ETF | IA Global | £439m | Piera Elisa Grassi, Raffaele Zingone | 0.25% | 10/10/2018 |

| L&G Battery Value-Chain UCITS ETF | IA Global | £753m | Legal & General Investment Management Limited | 0.49% | 17/01/2018 |

| L&G Ecommerce Logistics UCITS ETF | IA Global | £346m | Legal & General Investment Management Limited | 0.50% | 17/01/2018 |

| Lyxor MSCI World ESG Leaders Extra (DR) UCITS ETF | IA Global | £517m | Lyxor | 0.00% | 22/03/2018 |

| Montanaro Better World | IA Global | £698m | Charles Montanaro, Mark Rogers | 0.96% | 10/04/2018 |

| Threadneedle Global Focus | IA Global | £190m | David Dudding | 0.90% | 17/04/2018 |

| Wellington Climate Strategy | IA Global | £220m | Alan Hsu | 0.99% | 07/11/2018 |

| Xtrackers ESG MSCI World UCITS ETF | IA Global | £2,315m | Xtrackers | 0.20% | 24/04/2018 |