With inflation running at 6.2% in the UK, there are few options for investors to generate a real rate of return (inflation-adjusted) through dividends or bond coupons alone.

Global equity portfolios have become increasingly vulnerable to persistently high inflation, while bonds are falling in value as central banks have stopped quantitative easing (QE) and started raising interest rates.

Despite this backdrop, investors wishing to take advantage of their ISA allowance still have some options within the investment trust universe for alternative sources of income.

James Sullivan, head of partnerships at Tyndall Investment Management, said: “Something akin to the kid in the candy store, there is today a plethora of investment trusts offering the investment community exposure to the hugely diverse alternative universe.

"Like the candy, not all these investments will be good for one’s health as many concepts remain largely immature.”

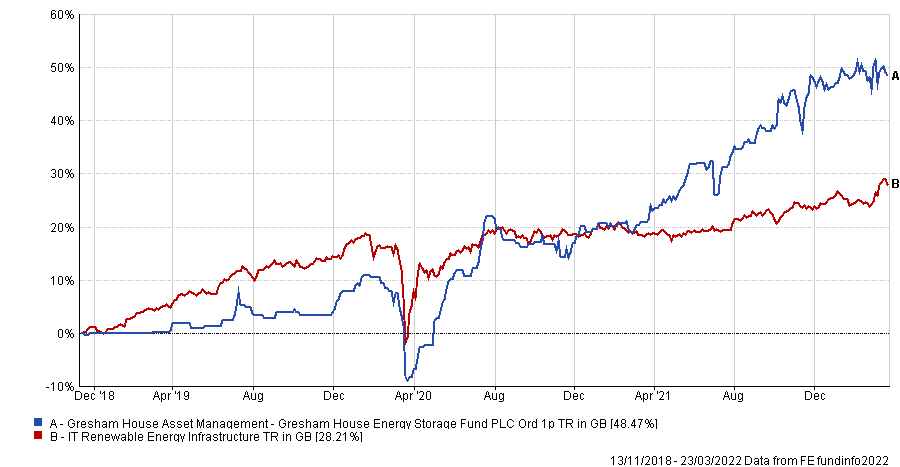

However, one vehicle that he said stands out as being “roadworthy” was the Gresham House Energy Storage, which listed in 2018 when the concept of battery storage was still in its relative infancy.

He said: "At a time when most countries are pursuing a green agenda in some form, being able to harness and redistribute this environmentally friendly yet somewhat erratic power source has proven to be troublesome.

“This catalysed the need for storage and the capability to balance power output, offering a more predictable and reliable output.”

Sullivan noted the trust’s 17 projects which equal to 425 megawatts (MW) of power: “To put this into perspective, it is estimated that 1MW would meet the needs of around 160 homes, therefore this trust alone can power the equivalent of circa 70,000 homes,” he said.

"The trust currently yields close to 5.4%; a 46% premium to the FTSE 100 which currently yields 3.7%. Pair this with price and net asset value stability, then it is an attractive and diversified source of income.”

Total return of Gresham House Energy Storage since inception

Source: FE Analytics

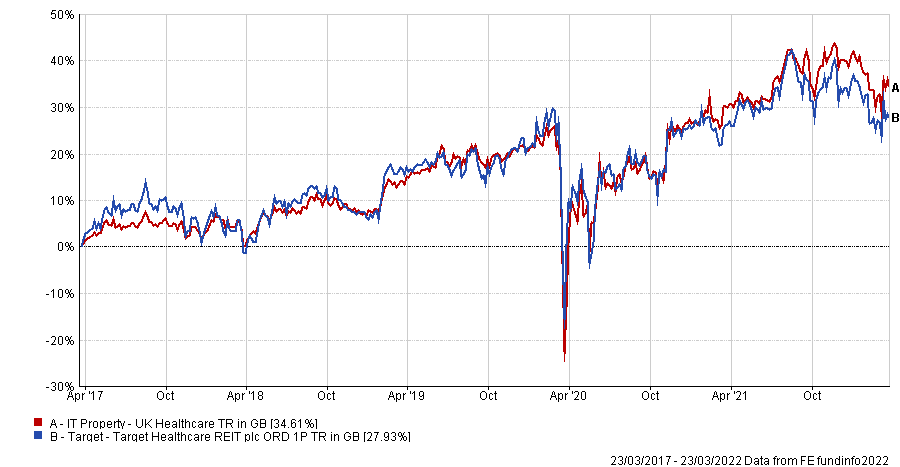

James Clark, senior fund analyst at Hawksmoor, highlighted the Target Healthcare REIT as another potential alternative income trust to add to an ISA, which he said is on his firm’s private client buy list.

“We recently flagged this REIT internally as presenting a good entry or top-up point, trading on a small discount to NAV and currently yielding 6.2%,” he said.

The owner of high-end UK care homes offers full en-suite facilities and a very high proportion of wet rooms for residents, which Clark said are “of utmost importance”.

“Target Healthcare lead manager Kenneth MacKenzie is on a real mission to improve the quality of care for the elderly, with the ethos and quality of care offered by care home operators (to whom the REIT leases properties) being just as important as the extent and specifications of their properties,” he said.

“The trust is aligned with very strong supply and demand dynamics in the UK care home market, and benefits from long-term, inflation-linked rental contracts.”

He also highlighted the trust’s “solid” interim results which included a 3.4% total return on its net-asset-value (NAV), a 2.2% like-for-like portfolio valuation increase and a 2.8% like-for-like increase in contracted rent.

Total return of Target Healthcare REIT over 5yrs

Source: FE Analytics

Ben Yearsley, director at Fairview Investing, went with the Downing Renewables & Infrastructure Trust as his pick.

“If you want alternative income these days then the trust world has plenty of options, however most are infrastructure linked in some form,” he said. “The big problem for investors is that lots of these kinds of trusts trade on large premiums, which brings me to Downing’s relatively new offer.”

First, he pointed to the trust’s relatively modest premium of less than 1%, which is due to it being still fairly small, so bigger investors have not yet started to buy it.

“As the name suggests this trust is basically a renewable energy generating trust; Downing has many years’ experience investing in this space through its highly regarded IHT scheme,” he said.

“Probably the key differences between this trust and similar alternatives is that it focus on the Nordic regions for their investments and also Hydroelectric power. It can and does still invest in the UK, and also all forms of renewable energy.”

Yearsley said the trust is a good way for investors to play into two major themes that are emerging today: the rise in importance of energy security and the cleanliness of energy.

Total return of Downing Renewables & Infrastructure trust since inception

Source: FE Analytics

Dzmitry Lipski, head of funds research at interactive investor, went with the BMO Commercial Property Trust, managed by the “highly experienced” property investor Richard Kirby.

He said it offers diversified exposure to UK property with a bias towards prime properties – which would normally be classed as defensive.

The trust’s exposure is primarily in the most prime locations such as London and the Southeast and its largest assets include St Christopher's Place Estate and a Newbury Retail Park. Currently the trust yields more than 2%.

Total return of BMO Commercial Property Trust since inception

Source: FE Analytics

Lipski said the recent suspensions of property open-ended funds shows that the closed-end fund structure seems “most appropriate” to access illiquid assets such as property.

“Despite these challenges, the long-term fundamental case for property as an asset class remains intact,” he said. “Yields and valuations still look attractive relative to other asset classes, and property remains a solid option to generate income and diversify an investor’s portfolios.”

| Trust | Sector | Fund Size(£m) | Fund Manager | Yield | OCF | IT Net Gearing | IT Pub. NAV Discount | Launch Date |

| BMO Commercial Property Trust Limited | IT Property - UK Commercial | 852 | Richard Kirby | 3.35 | 0.85 | 27.17 | -14.43 | 18/03/2005 |

| Downing Renewables & Infrastructure Trust VCT Plc | IT Renewable Energy Infrastructure | 141.5 | Tom Moore, Tom Williams | 3.37 | 10/12/2020 | |||

| Gresham House Energy Storage Fund PLC | IT Renewable Energy Infrastructure | 581.2 | 5.32 | 1.26 | 0 | 17.51 | 13/11/2018 | |

| Target Healthcare REIT plc | IT Property - UK Healthcare | 674.8 | 5.1 | 1.55 | 27.69 | 0.61 | 07/03/2013 |