Chinese stocks have suffered from a long and severe decline that began after a regulatory crackdown by the Chinese Communist Party (CCP) in early 2021.

The Chinese government took aim at the country’s technology giants to curb anticompetitive behaviour, increase its data security and ensure that tech companies encourage ‘common prosperity’.

Elsewhere, Chinese stocks in sectors such as consumer discretionary and travel have been hampered by China’s zero-Covid policy, while growing fears over the indebtedness of the country’s property sector has also held back the materials, financial and real estate sectors.

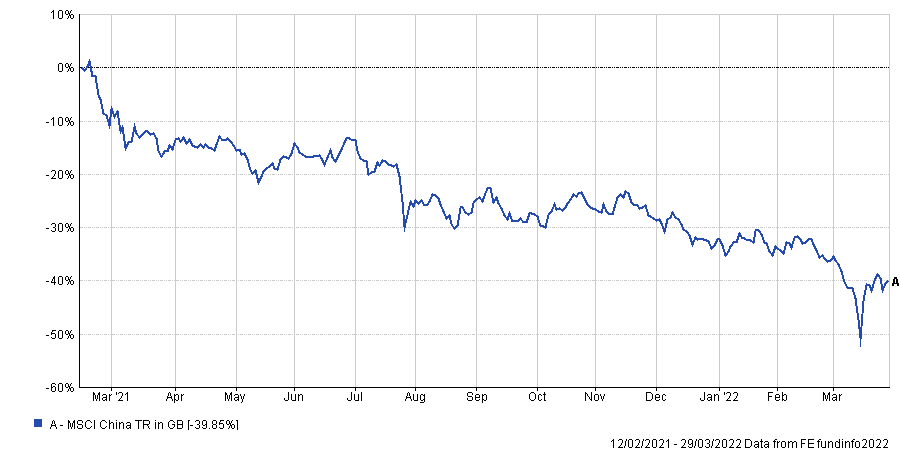

The recently announced Covid lockdown of Shanghai, the financial centre and industrial powerhouse of the country, has further dampened sentiment in the region. Chinese stocks are down roughly 40% from its highs in February of 2021.

Performance of MSCI China index since February 2021

Source: FE Analytics

However, when it comes to technology stocks, which make up almost a third of the MSCI China index, it is possible that the sector could be forming an investable bottom.

Two weeks ago, Chinese tech stocks jumped after the country’s vice premier Liu He called for a swift finish to its crackdown on internet companies, while also pledging support to the economy and capital markets.

Kunjal Gala, lead portfolio manager for global emerging markets at Federated Hermes, said that, from a sentiment perspective, Chinese technology stocks have “clearly bottomed out”.

He said the U-turn by Chinese policymakers indicates that they have understood that their ‘common prosperity’ programme was not helping the economy.

“As a result of all the regulatory changes, large internet companies have now laid off tens of thousands of people, so it's not helping the real economy, which goes against the principles of [president] Xi Jinping,” he explained.

“He wants the real economy to prosper, he wants prosperity for everybody and, he wants stability in the economy. That's why they have realised that probably they've gone too far in terms of curbing the innovative companies in the economy.”

While Chinese technology equities may have passed a major milestone from a regulatory and sentiment perspective, Gala said the question now is whether the fundamentals and earnings have bottomed out.

“My most educated guess is that 2022 is still a year of transition,” he said. “We are unlikely to see large internet companies go back to the previous growth rates.

“Maybe from 2023 onwards we will see that earnings momentum pick up but of course the markets are very smart and will start pricing in such a situation early on.”

If Chinese equities do look like they are on the verge of a bottom, Trustnet asked experts which Chinese funds they think investors should consider for exposure.

The FE fundinfo five-crown rated FFSA Greater China Growth fund was highlighted by two fund pickers as a compelling option for investors.

Emma Wall, head of investment analysis and research at Hargreaves Lansdown, praised the manager Martin Lau and his team’s “great pedigree” of investing in China.

Indeed, Lau is a Trustnet FE fundinfo Alpha Manager, meaning he has maintained a consistently high alpha score with a proven track record in both rising and falling markets.

Wall also highlighted the fund manager’s focus on stewardship and environmental, social, governance (ESG) factors.

“Stewardship forms part of the fund management team’s philosophy, meaning they focus on ESG issues and engage with companies to make ensure they meet good governance standards,” she said.

Amaya Assan, head of fund origination at Square Mile Investment Consulting and Research, also praised the management team.

She said: “They have a rigorous research process where company and country visits help build their collective knowledge and assessment of a business's growth sustainability, franchise, financial strength and management.”

She also highlighted the fund’s emphasis on stewardship. “They believe that companies that ignore their impact on the environment, or that do not look after their customers, employees, suppliers and the larger community are unlikely to be rewarding long-term investments.”

Performance of fund over 10yrs

Source: FE Analytics

Although Assan expects the fund to outperform the MSCI Golden Dragon index over rolling five-year periods, given its conservative bias and emphasis on quality, she warned it might struggle when investors “are chasing certain themes” or when “riskier stocks are in demand”.

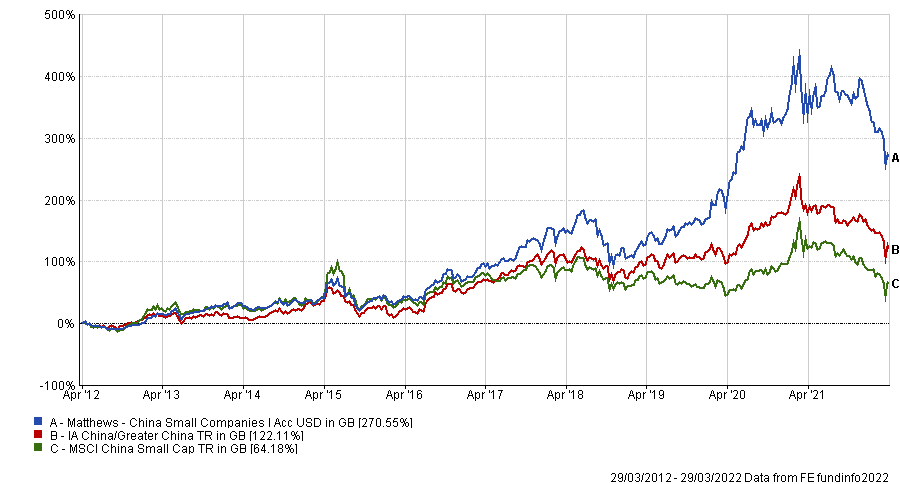

James Sullivan, head of partnerships at Tyndall Investment Management went with the Matthews China Small Companies fund.

He said: “Investing in China is a little like opening the batting against the great West Indies side of the 1980s. It comes with a degree of pain, hostility and at times embarrassment, but if one hangs around at the crease long enough, there is the potential for a big score.”

He singled out the Matthews China Small Companies fund, which invests at least 80% of its assets into Chinese- or Hong Kong-listed companies no larger than $5bn.

Sullivan noted how it has outperformed the iShares MSCI China Small Cap index over the past decade by more than 200 percentage points with marginally lower volatility.

“This impressive set of numbers helps demonstrate the inefficiencies in the market that can be exploited by capable active management,” he said.

Performance of fund over 10yrs

Source: FE Analytics

Sullivan added: “China, small cap, and technology all wrapped up in one fund is unlikely to be for the conservative investor; however, but if one is able to see off the new ball and dig in, the growth potential is frightening.”

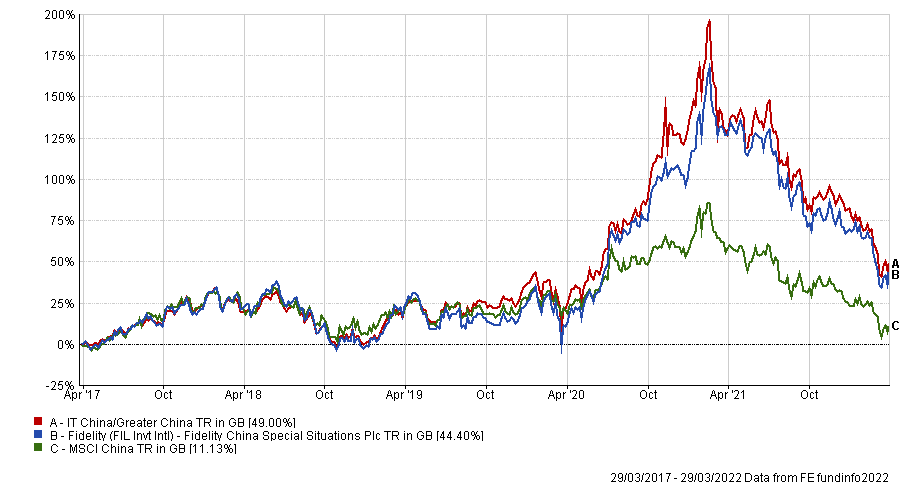

Tracy Zhao, senior fund analyst, interactive investor, highlighted the Fidelity China Special Situations Investment Trust as her pick. The trust’s bias towards mid and small caps provides a good opportunity for long-term growth.

“The trust structure allows it to be flexible and it has the power to use leverage to take on short-term market opportunity, with no detriment to liquidity,” she said.

“Portfolio manager, Dale Nicholls, and his team have excellent knowledge of the Chinese market as well as a strong understanding of its political culture, reducing the shock of potential regulatory impact.”

Zhao noted how the trust has less than 2% invested in real estate, which should limit its exposure to any worries in the Chinese property market.

“The Chinese stock market is the second largest in the world after that of the United States, making it too large to ignore,” she said.

“Ultimately, when investing in China, investors do need take additional considerations, such as country risk, regulation risk, and any geopolitical tensions – therefore investors would benefit from taking a long-term approach.”

Performance of trust over 5yrs

Source: FE Analytics

Although the trust has declined almost 50% from its peak in February of 2021, Zhao said the risk-reward payoff could look “appealing” for investors wanting to dip their toes into Chinese equities.

| Fund | Sector | Fund Size(£m) | Fund Manager | Yield (%) | OCF (%) | IT Net Gearing | IT Pub. NAV Discount | Launch Date |

| Fidelity China Special Situations Plc | IT China/Greater China | 1354.3 | Dale Nicholls | 1.78 | 1.08 | 1.44 | -2.44 | 19/04/2010 |

| FSSA Greater China Growth | IA China/Greater China | 643.5 | Martin Lau, Helen Chen | 0.53 | 1.07 | 01/12/2003 | ||

| Matthews China Small Companies | IA China/Greater China | 451.8 | Andrew Mattock, Winnie Chwang | 1.25 | 29/02/2012 |