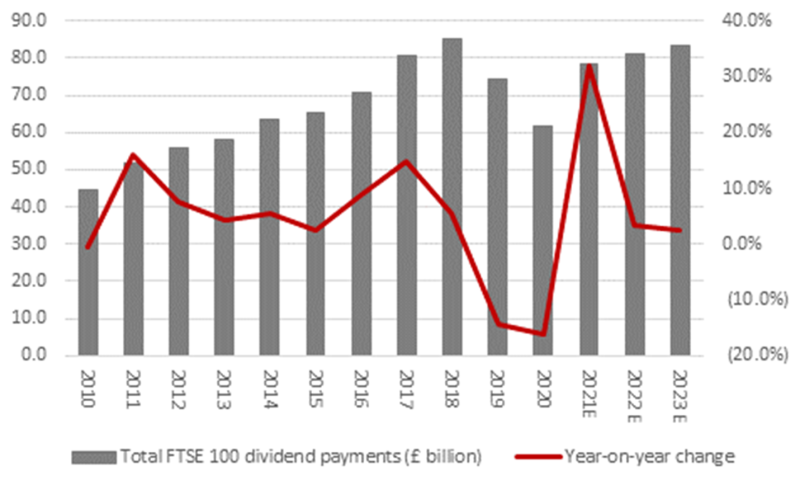

Cash returns from the FTSE 100 are expected to reach their second-highest level at £114bn this year, according to AJ Bell’s Dividend Dashboard report.

The investment group predicted that dividends amounting £81.2bn will be paid out in 2022 while noting that £32.7bn in share buybacks have already been announced, which means this year’s cash returns are to exceed 2021’s total by £2.7bn.

This combined pay-out was only exceeded when cash returns hit £127.5bn in 2018.

Annual FTSE 100 cash returns

Source: Company accounts, Marketscreener, analysts’ consensus forecasts

With corporate confidence recovering to pre-pandemic levels, 97 companies in the FTSE 100 index are expected to pay dividends this year compared to 91 in 2021 and 85 in 2020. During the pandemic, firms slashed dividends and hoarded cash to shore up their balance sheets.

While stronger profits have encouraged businesses to pay dividends, AJ Bell investment director Russ Mould suggested that some are still hesitant.

He said: “It appears that companies may be leaning more toward share buybacks when it comes to returning cash to shareholders.

“This could be down to a desire to preserve dividend cover at newly rebuilt levels, the UK government’s 1.25 percentage point increase in dividend taxes, or the pensions’ regulator’s threat to challenge dividend payments made by firms with pension deficits, or a mixture of all three.”

Likewise, research by Janus Henderson predicted that dividend cover in the UK will recover to its pre-Covid level of 1.1x this year but will lag the global average.

It forecast that the £2.2trn in global pay-outs this year would mostly be driven by a 14% increase in from North America, emerging markets and Asia Pacific ex Japan.

AJ Bell’s Dividend Dashboard expects the highest dividend payer this year to be Rio Tinto with a total pay-out of £7.4bn, while Shell and Glencore will be runners up with £5.6bn and £5.3bn respectively.

The top 10 dividend payers are predicted to pay a total of £42.2bn in 2022, with many of them from the energy sector.

In fact, oil & gas companies have been forecast to deliver a combined pay-out of £13.4bn, the highest across all other sectors as severed imports from Russia drive up the price of energy commodities.

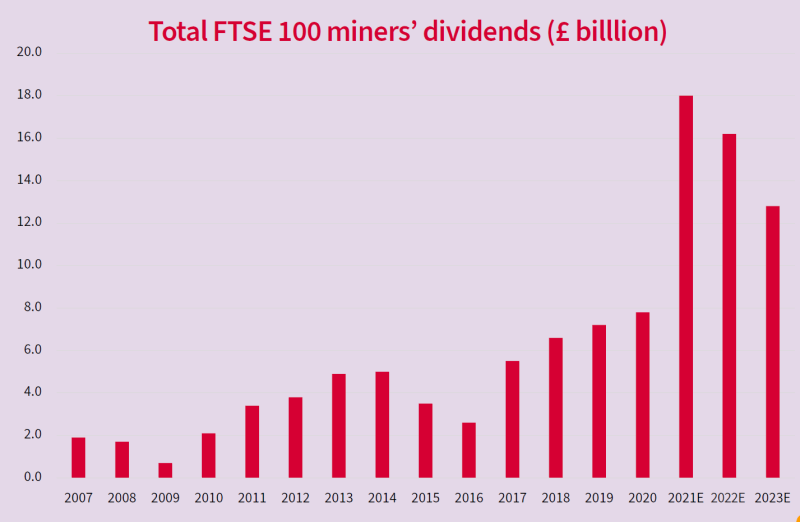

But dividends from mining companies are expected to drop by £15bn this year after relative success in 2021. Mould said that higher operating costs are likely to put a strain on pay-outs from these companies.

Source: Company accounts, Marketscreener, analysts’ consensus forecasts. Excludes special dividends

He added that the anticipated drop of £3.8bn in dividends from the financial sector will likely be “flattered by write-backs relating to the bad loan provisions they took in 2020”.

In terms of growth, mining company Glencore is expected to fare the best with a £2.9bn increase to shareholder pay-outs this year, absorbing many of the cuts from other commodities companies.

Shell will not just be the second-highest dividend payer, it will also be the second-highest grower with an extra £655m in pay-outs.