Investors that need to find reliable income without the volatility may be best served thinking outside the box, according to experts.

While traditional equity has struggled so far this year, and many open-ended income funds have held up better than expected, income trusts have struggled.

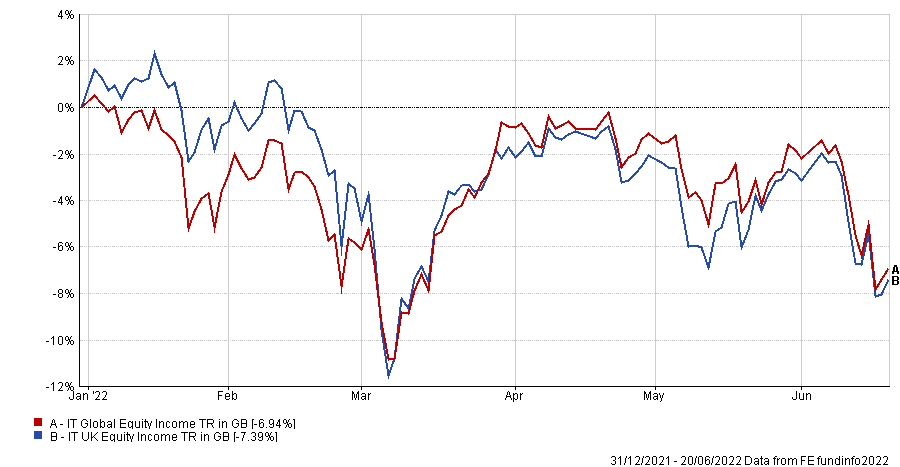

The IT Global Equity Income and IT UK Equity Income sectors are down around 7% each year-to-date, as the below chart shows.

Total return of sectors YTD

Source: FE Analytics

As such, of the four experts asked by Trustnet, none selected a traditional equity trust for income, although David Johnson, an analyst at Kepler Trust Intelligence, suggested investors may want to take a look at Middlefield Canadian Income.

While Canadian equities may not seem like an obvious choice, he said that they “offer an attractive option for income investors to hedge against inflation”.

“The Canadian market, and by extension MCT, is well positioned for today’s environment, thanks to the strong presence of high-quality financial companies as well as energy-related stocks, which are beneficiaries from a rise in global interest rates,” he said.

This should allow the trust to continue to pay a dividend despite the recent market falls, as it has little exposure to the tech giants – these have been among the stocks worst affected by rising rates and inflation as these affect the value that investors put on future growth expectations.

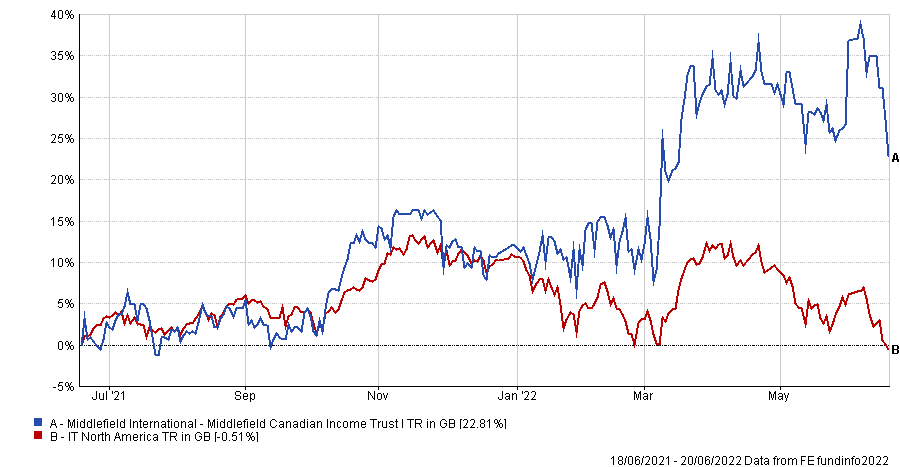

The trust has struggled to keep pace with the IT North America sector over the long term, as it has been hampered by its penchant for dividends and the inability to buy US tech giants.

However, over the past year it has been the second-best performer in its sector, up 22.8%, while its average peer is down 1.6%, as the below chart shows.

Total return of trust vs sector over 1yr

Source: FE Analytics

Johnson noted the trust’s energy allocation (c.15%) is split between cyclical and price-sensitive producers and stable, price-insensitive pipelines, while the financials allocation (c.25%) is particularly attractive.

“Canadian banks are amongst the most attractive, as Canada is home to six of the safest banks in North America. Canadian banks have proven more resilient than their British or American peers, having better weathered past economic crashes in far better shape,” he said.

Away from equities, Matthew Read, senior analyst at QuotedData, suggested there could also be value in bonds, which have had a tough year as central banks have raised interest rates around the world.

CQS New City High Yield was his pick. The trust has had a phenomenal run recently, making the highest return in the IT Debt – Loans & Bonds sector over five and 10 years, while it is flat year-to-date at a time when its average peer has lost 5.1%.

Total return of trust vs sector over 10yrs

Source: FE Analytics

Manager Ian Francis has “long thought that central bankers’ caution was creating a real risk of the inflation genie getting out of the bottle and has been positioning CQS New City High Yield’s portfolio accordingly,” said Read.

Financials – which tend to benefit from rising interest rates – and real assets, account for a large part of NCYF’s portfolio, while Francis also thinks that the UK economy is more vulnerable to inflation than Europe and the US, and so has been increasing the trust’s exposure to overseas assets, while also increasing its exposure to equities.

“CQS New City High Yield tends to be in demand and trades at a premium, but drips stock out once the premium hits 5 to 6%, so this tends not to become excessive. It also offers a yield of 8.3%, so investors are paid to wait,” said Read.

Turning to alternatives, Monica Tepes, head of investment companies research at finnCap, suggested investors should consider the £3.1bn International Public Partnership (INPP) trust.

Here, she said investors get inflation-linked assets. She estimated that for a 1% increase in inflation, its portfolio returns should increase 0.7%.

“Second is the safety of payment receipts. Its cashflows are government backed and it has investments in regulated utilities, energy & transmission, transport, education, health, justice, military housing and digital infrastructure,” she said.

The trust is well diversified, with more than 100 investments in total. While most of its assets are in the UK, it does have projects in Europe, Australia, and North America.

Last up, Emma Bird, research analyst at Winterflood, highlighted the Impact Healthcare REIT as a reliable source of income in an inflationary and rising interest-rate environment.

The property specialist provides well-managed exposure to UK care homes and is comprised of 128 healthcare properties, of which 126 are let on fixed-term leases of 20 to 35 years.

These are then subject to annual upward-only RPI-linked rent reviews, with a floor and cap at 2% per year and 4% per year respectively on 99 leases and at 1% per annum and 5% per annum respectively on nine leases. In addition, the fund owns two healthcare facilities leased to the NHS with annual, uncapped CPI-linked uplifts.

“We believe that the portfolio's long-term, inflation-linked leases with no breaks are appealing, with their fully repairing and insuring nature and the embedded rent cover penalties offering additional security,” she said.

“The inflation linkage should support the fund’s progressive dividend policy and is likely to appeal to a growing number of investors in the current environment of rising inflation expectations.”

| Fund | Sector | Fund size | Yield | OCF | Gearing | Premium/discount | Launch date |

| International Public Prtnrship | IT Infrastructure | £3,154m | 4.6% | 1.18% | 2.1% | 11.3% | 09/11/2006 |

| Impact Healthcare REIT | IT Property - UK Healthcare | £405m | 5.7% | 1.53% | 26.7% | 7.5% | 07/03/2017 |

| Middlefield Canadian Income Trust | IT North America | £135m | 4.0% | 1.14% | 24.4% | -6.7% | 06/07/2006 |

| CQS New City High Yield Fund | IT Debt - Loans & Bonds | £255m | 8.3% | 1.25% | 9.7% | 8.1% | 07/03/2007 |