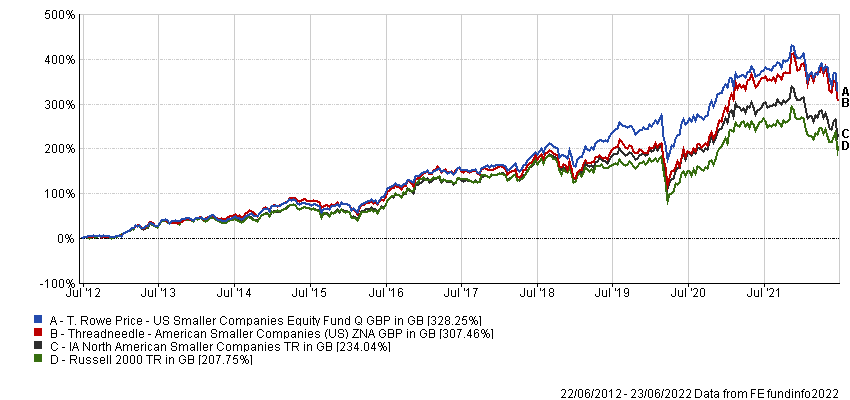

When it comes to the best fund in the IA North American Smaller Companies sector, it is something of a two-horse race. T. Rowe Price US Smaller Companies Equity and Threadneedle American Smaller Companies are first and second respectively over five and 10 years, and in the top quintile of their sector over three.

Performance of funds vs sector and index over 10yrs

Source: FE Analytics

But which one should you buy?

Process

In terms of process, Nicolas Janvier of Threadneedle American Smaller Companies appears to have a more clearly defined strategy, looking for companies that are improving.

“A lot of fund managers tend to say they invest in the best of the best, meaning higher quality companies,” he said.

“You generally don't find us using that kind of language. We believe alpha is captured by finding companies that are getting better from a fundamental perspective, meaning they are gaining market share, which is translating into higher profitability and a higher return on invested capital.”

Meanwhile, Curt Organt, who runs T. Rowe Price US Smaller Companies Equity, takes opportunities wherever they present themselves.

“Our strategy utilises the full opportunity set, from deep value to aggressive growth, across industries and sectors,” he said.

“Generally, we are looking for high-quality companies that we expect to compound value over time.

“Analysts may uncover out-of-favour companies with strong potential for improvement, or companies that may appear fully valued, but whose long-term growth potential is underappreciated.”

Consistency and risk control

Janvier said that what separates his strategy from others is the ability to deliver predictable and consistent returns.

“People tend to focus on the total return versus the benchmark, but if you look at the performance history of our strategy, it's the risk-adjusted return that really stands out,” he explained.

“We're not more clever than other people, we don't have a philosophy and process that other people haven't considered. We're just really disciplined about how we execute it. And we're really focused on risk control.

“On the basis of the information ratio, which is effectively your risk-adjusted returns, the strategy always tends to be near the top of the peer group from that perspective.”

Janvier is right about this – Threadneedle American Smaller Companies is the second-best fund in the entire sector over the past 10 years in terms of its Sharpe and information ratios, which measure risk-adjusted returns. It also has the third-lowest maximum drawdown over this time.

Risk-adjusted ratings

Source: FE Analytics

Meanwhile, it has beaten its average peer and the Russell 2000 index, the most common benchmark in the sector, in seven of the past 10 calendar years – again putting it second out of all its peers.

The only fund that has beaten it in this regard is T. Rowe Price US Smaller Companies Equity, which has outperformed the IA North American Smaller Companies sector and Russell 2000 index in nine of the past 10 calendar years. It also tops the tables for both measures of risk-adjusted returns mentioned above over the past decade and has the lowest max drawdown.

Performance of funds vs sector and index

Source: FE Analytics

It is worth noting that the market environment we are entering appears to be completely different from the one in which these performance figures were generated. However, T. Rowe Price US Smaller Companies Equity has lost less than its sector and the Russell 2000 so far this year, while Threadneedle American Smaller Companies is doing better than its sector, although not the index.

Assets & charges

One area where the Threadneedle fund may have the edge is in size, which is an important consideration when it comes to small caps, as these funds can be constrained about where they can invest if assets under management become too large.

At £679m, Threadneedle American Smaller Companies is less than one-third the size of the $2.8bn (£2.3bn) T. Rowe Price US Smaller Companies Equity fund.

However, Janvier pointed out this is less of a consideration for small-cap funds in the US than in other regions, which is why he invests in companies up to $10bn in size.

“Instead of saying ‘small cap’, I prefer to say ‘smaller cap’, because in the US we're talking about companies that are very mature in their life cycle, and would be considered large cap in virtually every other market of the world,” he said.

Threadneedle American Smaller Companies has lower ongoing charges of 0.88%, compared with 1.12% from T. Rowe Price US Smaller Companies Equity. However, in a Trustnet article published earlier this year, Janvier’s fund was named on a list of those billing investors double the stated ongoing charges figure (OCF) once additional costs were included.

Analyst views

T. Rowe Price US Smaller Companies Equity managed to edge out Threadneedle American Smaller Companies on most performance measures, but when it comes to which fund most analysts prefer, the answer was neither.

While these two funds are head and shoulders above their peers in terms of performance over the past decade, they feature on few recommended buy-lists.

The clear winner in this regard is Artemis US Smaller Companies, managed by Cormac Weldon. It comes recommended by Hargreaves Lansdown, interactive investor, Square Mile Investment Consulting & Research and FE Investments.

While it was only launched in 2014, it is the second-best performer in its sector over this time, behind only the T. Rowe Price fund.

Analysts from FE Investments said: “Weldon adapts the portfolio to changing markets, based on where he sees the most potential returns at the time. He has had huge success investing in the US, but remains humble and will admit it if stocks haven’t played out as he expected them to – something we really value from a fund manager.”