The FAANGs will no longer be the global leaders they once were by the end of this market rotation, according to Richard De Lisle, manager of the De Lisle America fund.

Mega-cap technology companies Meta, Amazon, Apple, Netflix and Alphabet (commonly known as the FAANGs) have been some of the most desirable stocks to hold over the past decade as the growth-biased market boosted valuations through the roof.

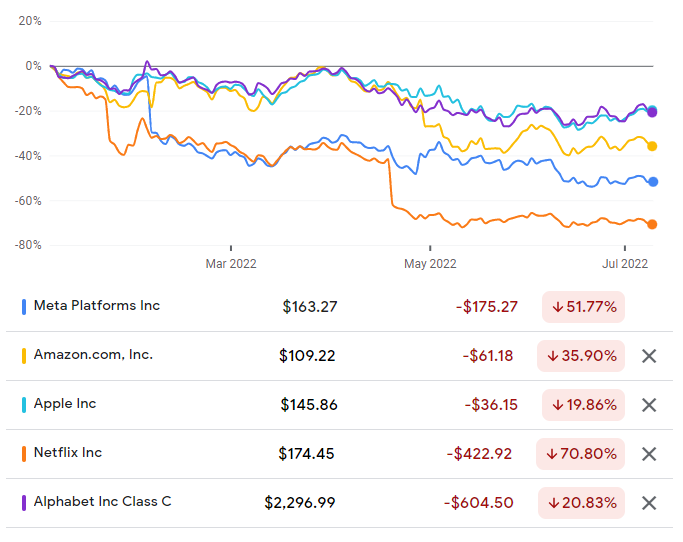

However, their share prices have dropped significantly since the start of the year as high inflation and steep interest rate hikes have rattled the growth stocks.

De Lisle said: “We’re getting a reminder of how quickly tech stocks evolve even though people think they’re going to be around forever – the fact is they will be around for less time than you think.

“The negativity in technology is feeding on itself. It has become apparent that technology is a cyclical sector as it always has been, but people presumed it wasn’t because it hasn't been for a long time.”

Share price of FAANGs since the start of the year

Source: Google Finance

Whilst those who’ve held these stocks since before the downturn will be nervously watching their assets decline, those who previously found them too expensive may look to buy them at a far cheaper price.

Although this may be tempting, De Lisle said that the FAANGs simply won’t return to where they were at the top of global markets. While cheaper share prices may present a strategic entry point for some, investors should not get overexcited, he argued.

These companies will certainly survive this period of economic hardship, but they won’t grow at the massive rates they were for much of the past decade and they won’t make a great investment moving forward because “the FAANGs are the story of the last cycle and are never coming back in the same way,” according to De Lisle.

While he didn’t entirely rule out buying a tech stock if it got to a low enough valuation, he noted that it is unwise for investors to keep them on a pedestal.

“I think that by the time we come out the other side of this, there won't be FAANGs. The acronym will have changed. I'm quite prepared to accept that those companies will no longer be leading the charge,” he said.

David Coombs, manager of Rathbone’s multi-asset fund range, agreed that investors need to be selective. He has taken the opportunity to add Apple to his portfolios despite previously being very bearish on the company as volatile markets have dragged down the share price.

He said that it does not have the same innovation it had a 10 years ago, but he sees potential in the company.

On the other hand, Coombs “is never going to buy Netflix” because it does not look attractive at its current valuation.

Chris Metcalfe, chief investment officer at IBOSS, agreed that the FAANGs will be replaced with a new set of winners.

He increased exposure to the Rathbone Global Opportunities fund and an S&P 500 tracker, which both contain the FAANGs but does not think their share prices will reach the dizzying highs they were at before the market shift.

Metcalfe said: “I think one good thing that’s come out of this is that the euphoria has gone out a lot of this stuff, which is a good thing from a long-term investor’s point of view.

“People were just piling in and were making money hand over fist but that's all come to a halt now because it’s so sensitive.”

De Lisle pointed out that the most desirable company to own before the tech bubble burst in 2000 was tech company, Cisco. It is still around today but has fallen from the spotlight just as fellow technology company, Intel, did before then.

It’s too early to predict what could overtake the FAANGs and become the next global leaders, but industrial and commodity companies could outperform in the next few years if the market looks anything like it did in the 1970s, according to De Lisle.

“If you look at the S&P 500 today, there's nothing really coming up with a big market cap that could take over the leadership,” he said.