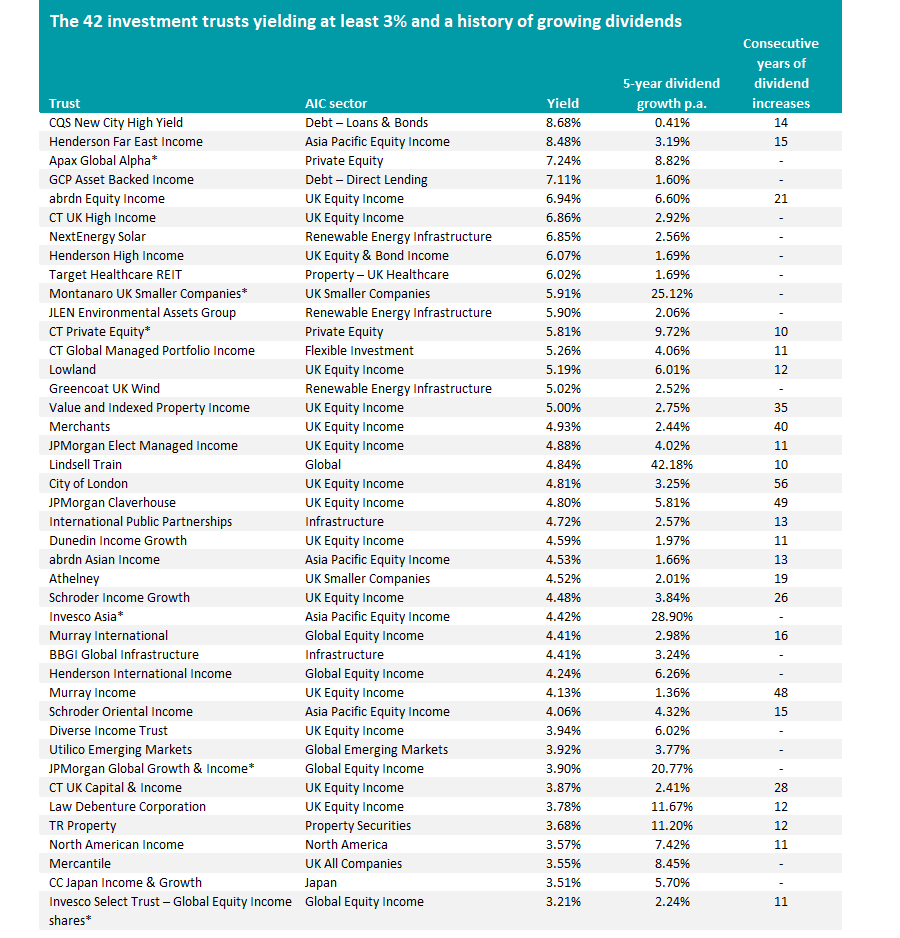

Lindsell Train, Murray International and Mercantile are among the 42 high-yielding investment trusts that have a good record of dividend growth, analysis by the Association of Investment Companies (AIC) shows.

With the cost of living crisis putting a strain on everyone’s wallets as UK inflation stands at a 40-year high of 9.4%, trusts offering high pay-outs could be an attractive option.

Interest rates on savings accounts are less than 1% on average, according to the AIC, so a trust with increasing dividends is better placed to keep up with the rate of inflation.

That’s why the AIC narrowed down the search down to the 42 trusts with yields above 3% and a five-year record of increasing dividends.

Source: Association of Investment Companies. * These companies have paid dividends out of capital profits over the past five years, or have a target dividend set at a fixed percentage of the investment company’s NAV which may include distributions from capital profits

CQS New City High Yield was the highest paying. The bond fund had a yield of 8.7% and increased its dividend pay-outs over the past 14 years.

On the equities side, the Henderson Far East Income fund was the highest yielding at 8.5%.

However, the portfolio which increased its dividends the most over the past five years was Lindsell Train, which boosted pay-outs 42.2%, bringing the yield to 4.8%.

Eight trusts on the list were some of the AIC’s Dividend Heroes, a title given to portfolios that have increased pay-outs for over 20 consecutive years.

The highest yielding of these Dividend Heroes was Abrdn Equity Income at 6.9%; the others are Value and Indexed Property Income, Merchants, City of London, JPMorgan Claverhouse, Schroder Income Growth, Murray Income and CT UK Capital & Income.

Annabel Brodie-Smith, communications director of the AIC, said: “With inflation rising and savings rates still low, these 42 investment companies might offer a way for savers to increase their income.”