Just a handful of investment trusts have made positive returns in 2022, after soaring inflation, interest rate hikes and geopolitical tension caused a broad-based sell-off.

The first half of 2022 was one of the worst opens to a year in recent history and, although sentiment has improved in the past few weeks, positive progress has been a challenge almost across the board.

With this in mind, we looked at how the mainstream equity and flexible investment trusts are holding up this year.

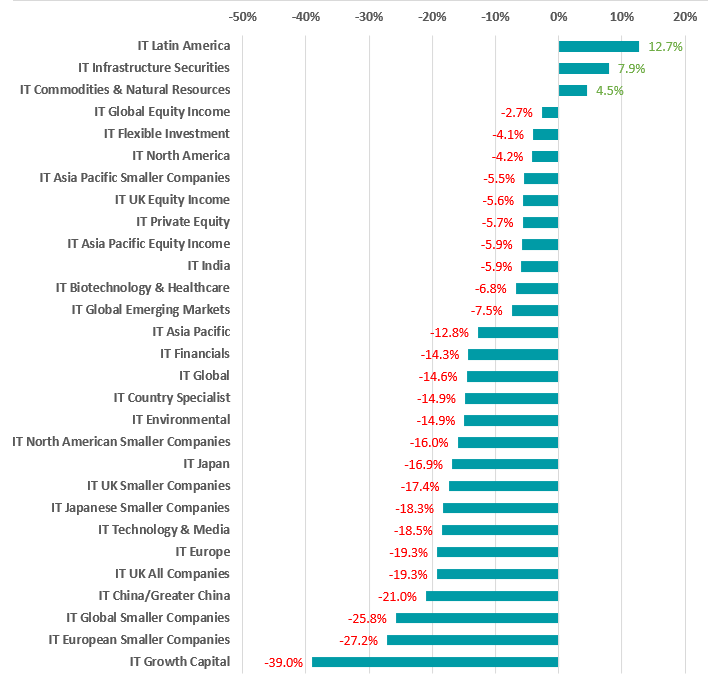

As the chart below shows, most trust sectors have posted a loss since the start of 2022 – in keeping with what has been seen in the open-ended fund universe.

Only three of the peer groups we looked are showing a positive average return for 2022: IT Latin America, IT Infrastructure Securities and IT Commodities & Natural Resources. These trusts invest in assets widely considered to offer inflation protection, which is proving especially attractive given today’s soaring inflation.

Total return of main AIC sectors in 2022

Source: FE Analytics. Total return in sterling between 1 Jan and 10 Aug 2022

Given the risk-off sentiment that has dominated markets for most of 2022, the worst average returns came from the IT Growth Capital sector, where trusts invest in unquoted shares of early to maturing companies.

IT European Smaller Companies, IT Global Smaller Companies and IT China/Greater China are also showing significant losses for the year so far but IT UK All Companies isn’t too far behind these riskier sectors.

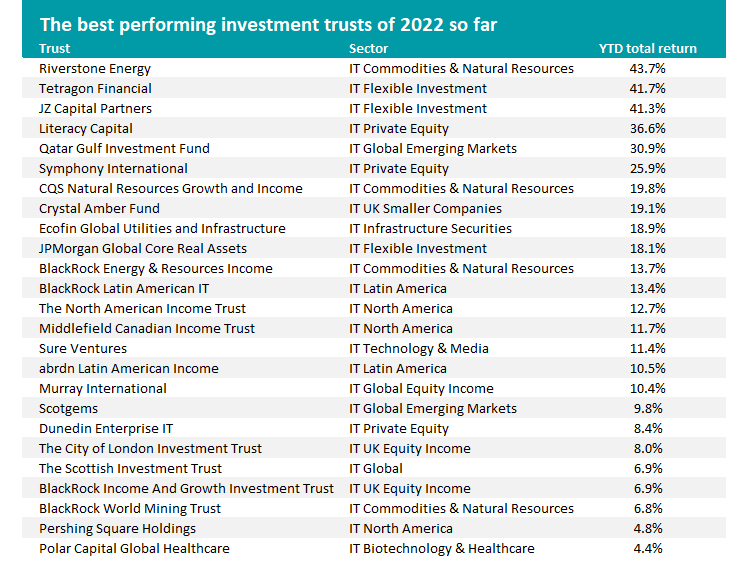

Turning to individual investment trusts and only 41 of the 219 we looked at have managed to generated a positive return this year.

The highest return from the mainstream AIC sectors has come from Riverstone Energy, which is up 43.7% over the period under review.

Source: FE Analytics. Total return in sterling between 1 Jan and 10 Aug 2022

The trust invests in the global energy industry across all sectors and has around 20 holdings spanning oil & gas, midstream and energy services in the US, western Canada, Gulf of Mexico, Latin America and Europe.

As energy commodities have soared in price because of supply bottlenecks and Russia’s war with Ukraine, funds such as Riverstone Energy that invest in the space have generated very high returns.

Indeed, the table above – which reveals the 25 best-performing investment trusts in 2022 – shows that many of these year’s leaders invest directly in energy and other commodities companies (BlackRock Energy & Resources Income, CQS Natural Resources Growth and Income) or counties that are commodity exporters (Qatar Gulf Investment Fund, BlackRock Latin American IT).

A look at the very bottom of the performance tables, however, shows that JPMorgan Russian Securities has suffered the biggest loss. Of course, this is down to Russia being sanctioned and frozen out of financial markets after it invaded Ukraine.

Source: FE Analytics. Total return in sterling between 1 Jan and 10 Aug 2022

The bulk of the table is made up of trusts that invest in unquoted or small companies, which investors have been selling out of as they worry about higher interest rates and the risk of an economic slowdown.