The Rathbone Global Opportunities fund is a popular option for investors looking for growth exposure around the world, with its assets under management reaching a substantial £3.7bn since launching in 2001.

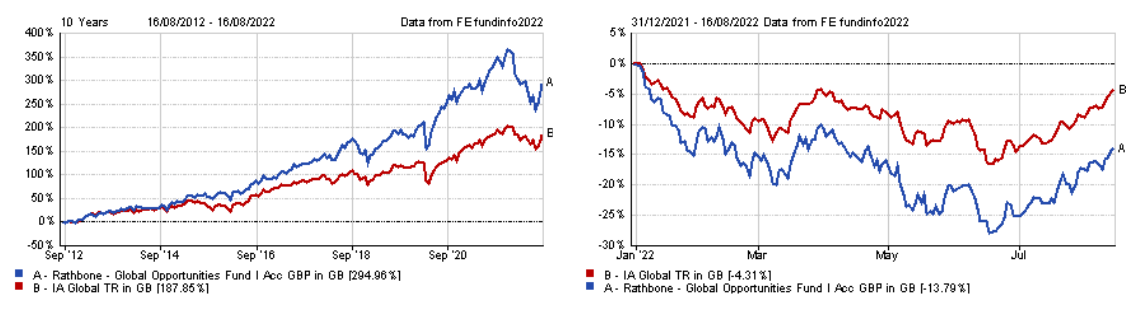

The fund is up 295% over the past decade, storming 107.1 percentage points ahead of the IA Global sector.

However, it has dropped from its leading position down to the bottom quartile since the start of the year as rising inflation and interest rates tugged down on the performance of growth funds.

Total return of fund vs sector over 10 years and in 2022

Source: FE Analytics

It appears investors who hold the fund are not put off by this short-term underperformance, with just £12.8m exiting the fund over the past six months.

Here, Trustnet asks experts which funds can be held alongside Rathbone Global Opportunities to act as a diversifier when it is down.

Pzena Global Focused Value

Scott Spencer, investment manager at Columbia Threadneedle, said the Pzena Global Focused Value fund would complement the Rathbone fund if held within the same portfolio.

The main differentiator is their investment styles – the Pzena portfolio leans towards value investing, which juxtaposes Rathbone’s growth bias.

Spencer said: “The team focus on stocks that appear in only the cheapest quintile of the global universe and then apply fundamental analysis to understand why. The focus is on normalised earnings and companies who for some shorter-term reason are earning below their normal earning potential.”

It is up just 11.4% over the past 10 years as the fund fought against a growth market, but it has thrived this year as value swings into vogue, rising 5.4%.

It may not have the most impressive long-term returns, but a small allocation to the fund could offset some of Rathbone Global Opportunities’ underperformance in market downturns.

Likewise, its largest allocations to energy and gas companies such as General Electric, Shell and Edison International, which account for the top 11.6% of assets, offer exposure to a part of the market which has thrived this year.

Schroder Global Recovery

Chris Rush, investment manager at IBOSS, has confidence in the Rathbone fund to deliver long-term returns, but uses Schroder Global Recovery as a diversifier.

Its value style offers exposure to a different investment approach, but its regional weightings are the crucial diversifier.

Rathbone Global Opportunities holds the majority of its assets in the US (67.8%), whereas Schroder Global Recovery has 27.6% allocation to the country, 42.3 percentage points below average exposure in the benchmark MSCI World index.

Instead, it leans most its geographical weightings on the UK and Europe at 48.2%, compared to the benchmark’s 16.1% exposure.

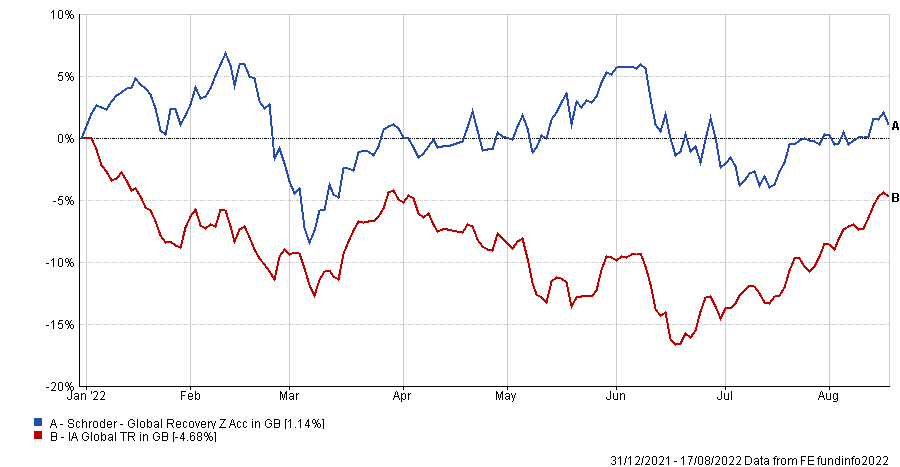

Schroder Global Recovery is up 88.4% since launching in 2015, which is lower than the IA Global sector average over the period. However, it has returned 1.1% so far this year unlike most of its peer group, which has been in decline.

Total return of fund vs sector in 2022

Source: FE Analytics

Although value funds look appealing at the moment, Rush said that trying to make a call between growth and value is “fraught with risk,” so having exposure to both is the safest option at protecting capital.

He added: “Both the Schroder and Rathbone teams have managed investor money within their respective styles through various market conditions. Experience we feel may be vital as we approach a period of increased uncertainty.”

Havelock Global Select

James Sullivan, head of partnerships at Tyndall Investment Management, said the Havelock Global Select fund would be a good pairing to the Rathbone portfolio in gaining an even global exposure.

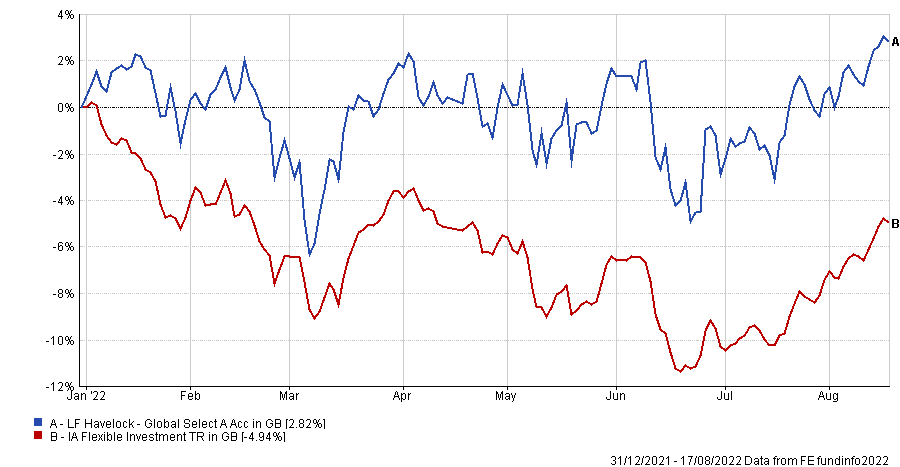

It is up 31.9% since launching in 2018 and has continued to make a positive return of 2.8% since the start of the year despite the difficult market environment.

Total return of fund vs sector in 2022

Source: FE Analytics

One of the main appeals for Sullivan is its “remarkably low” correlation with the Rathbone fund of 0.48 over the past three years.

"It is that low correlation that is so attractive and enhances the factor diversification within a portfolio,” he said.

Sullivan added that an investor who had a 50/50 portfolio of both funds over the past three years would have benefited from the best exposure to global equities.

The Havelock Global Select fund has strong growth characteristics but with more of a quality value bias, according to Sullivan.

He said that this should help in “offsetting the more explosive qualities of James Thomson, who is no stranger to exposing investors to the racier end of the market as part of his delivery of performance”.