Investors in Japan still need to be wary of “stubborn” management teams with no intention of unlocking the value contained in their business – especially when urged to by outsiders.

This is according to Richard Aston, manager of the CC Japan Income & Growth Trust.

It is nearly a decade since the late Japanese Prime Minister Shinzo Abe introduced ‘Abenomics’, which included ‘three arrows’ of economic reforms.

The third of these, a growth strategy based on supply-side reforms, deregulation and government support to boost corporate competitiveness, was one of the driving forces behind the launch of CC Japan Income & Growth.

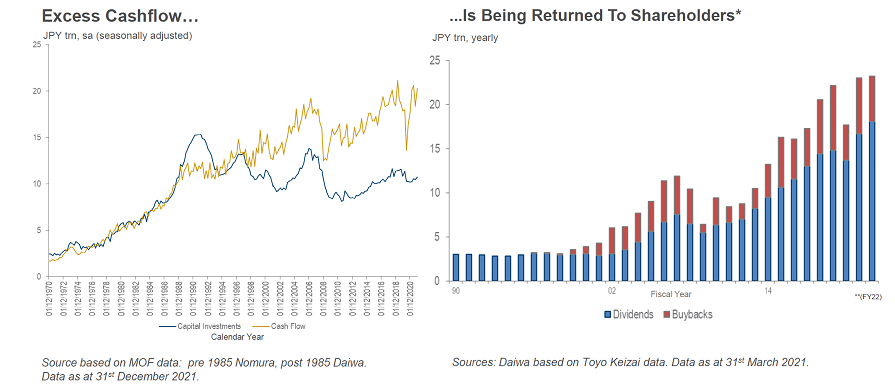

The trust was launched in 2015, partly in a bid to take advantage of an emerging trend among cash-rich Japanese companies that, encouraged by the government, were returning money to shareholders through dividends and share buybacks.

Performance of trust vs sector and index since launch

Source: FE Analytics

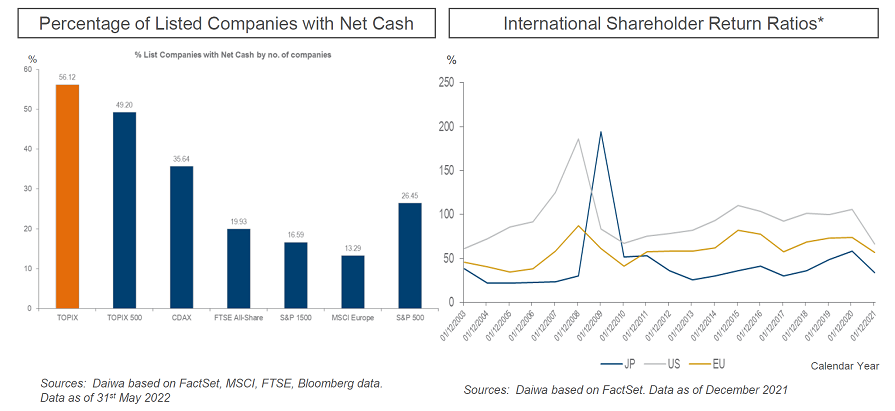

And while this has proved to be the case – the value of dividends and buybacks in Japan has steadily increased since then – the percentage of Topix companies with net cash positions remains more than twice that of the S&P 500, and almost three times that of the FTSE All Share.

Aston said assuming a cash-rich company would be automatically inclined to pass this money on to shareholders would be a mistake.

“There are a lot of very, very cheap stocks in Japan, but equally there are a lot of very, very stubborn management teams,” he explained.

“There are a lot of traditional practices in Japan that mean it can be very difficult for an outside investor, and certainly a minority investor, to generate value that might be inherent in the stock price.

“We'd rather invest in companies where valuations are attractive and the management team recognises the value it should be distributing to shareholders in a manner that investors are familiar with in other markets.”

CC Japan Income & Growth has more of a growth focus than a value one, differentiating it from most income trusts. Aston looks for companies with solid balance sheets that are generating strong cashflows which they are reinvesting to capture further growth while returning any surplus to shareholders.

The manager does not look for a high headline yield and is more interested in the consistency of dividends, so he will not be on the receiving end of a share price fall if the payout is suddenly cut.

Aston said that in the early days of the trust, to some extent he just had to trust company managers who claimed they were committed to new and progressive dividend policies. Then the pandemic came along – and to his relief, he found that most of them really meant it.

“It wasn't really until 2020 that we were able to confirm what we heard over the four or five years prior to that, which was that companies were giving a greater consideration to consistency of dividends in particular,” Aston continued.

“Obviously, the global economy experienced quite a significant downturn during 2020, but actually, if you look at the flow of dividends in Japan, they were very robust, certainly in comparison with other markets like Europe and the UK.”

As an example, the manager pointed to Dip, a recruitment website primarily focused on the growing part-time labour market.

The manager didn’t hold it going into the pandemic, but bought in on share price weakness in 2020.

“What was particularly interesting about this stock is that when the share price and business conditions started to deteriorate in early March 2020 when Japan introduced the lockdown, it quickly responded by saying it was changing its dividend policy,” he continued.

“Rather than having payout ratio-driven dividends, it announced it would pay out a higher percentage on average over time and wouldn’t be cutting the dividend from the level it achieved in 2019.

“That clarity, that visibility on the dividend, combined with the share price fall, meant the yield became much more attractive and gave us the opportunity to invest in a company that we hadn't been able to before.”

Many commentators have questioned whether Abenomics has achieved its aims. Aston pointed out that Japan experienced its longest period of growth in 30 years between 2011 and 2018, and inflation is now above the 2% target for the first time since 2015.

While the figure of 2.4% is well below the levels seen in other developed markets – and interest rates remain close to zero – the manager pointed out this doesn’t mean investors should load up on long-duration growth stocks that thrive when these measures are low.

“Valuations of long-duration stocks are driven by the global cost of capital rather than the rates in Japan, as foreigners are active participants in the Japanese equity market,” he warned.

“We have seen the high correlation between the NASDAQ and TSE Mothers indices as evidence of this.”