Those holding UK trusts over the past decade could have seen a sizable return on their investment, with the IT UK Equity Income and IT UK All Companies sectors up 83.8% and 69.5% respectively, according to data from QuotedData.

But it is the trusts in the IT UK Smaller Companies sector that have particularly stood out. The sector as a whole ranked within the top quartile of all investment trust sectors over the past decade, with the average trust making 164.9%.

However, high inflation, tightening monetary policy and unpopular government budgeting has dragged these sectors into the red in 2022.

While the performance of the underlying holdings has been hit, these trusts have also been hampered by worsening investor sentiment. As such, people have sold more than the underlying holdings have dropped, meaning that many UK trusts are currently trading at a significant discount to their five-year average.

Although it is difficult to buy at a time when most others are selling, the widening discounts have opened up a tactical entry point for investors.

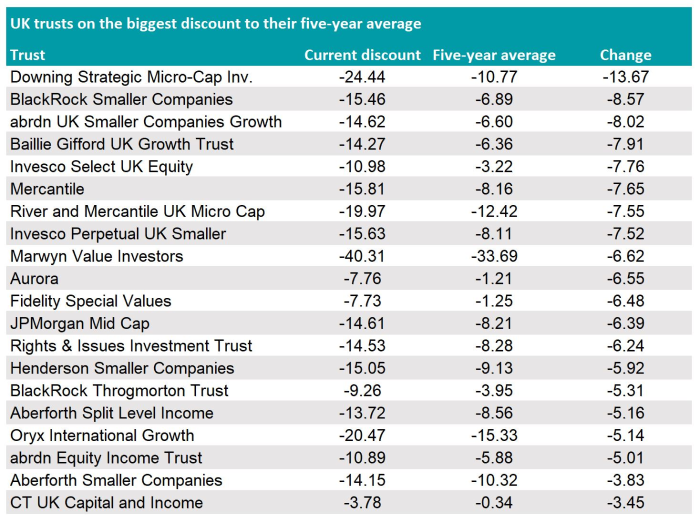

In the table below, we removed any trusts below £10m, as discounts can be moved by small trading volumes, as well as those that have widened their discount by less than 5 percentage points.

Source: QuotedData

Trusts in the IT UK Smaller Companies sector were the worst hit, with the sector average discount at 18.2% (4.9 percentage points lower than the five-year average of 13.3%).

In fact, more than half (60%) of the trusts on the list were in the IT UK Smaller Companies sector.

Trusts investing primarily in small-cap companies are very reliant on the economy performing well, which has not been the case this year, according to James Carthew, head of investment companies at QuotedData.

As a result, many trusts within the IT UK Smaller Companies sector have tumbled down along with the rest of the UK market.

This is partly why the Downing Strategic Micro-Cap trust was the worst hit on the list, with the discount 13.7 percentage points lower than its five-year average of 10.8%.

Fellow micro-cap specialist, River and Mercantile UK Micro Cap was also down a considerable 7.8 percentage points from 12.4% discount it sat at over the past five years.

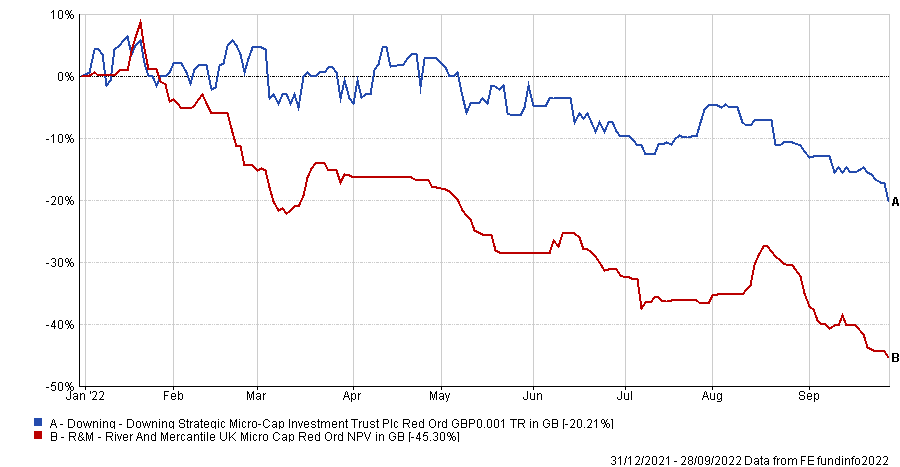

Returns for the Downing and R&M have declined 20.2% and 45.3% respectively this year due to their sensitivity to market movements.

Total return of trusts in 2022

Source: FE Analytics

Carthew said: “Their focus on UK micro-caps means that their returns are heavily dependent on the health of the UK economy and that is in dire straits right now.”

Likewise, he added that “liquidity is prized” during market downturns and this is an element that is often lacking in micro- and small-cap businesses.

“Trading in the shares of micro-cap companies can be quite thin and so investors build in a liquidity discount when deciding how much they would pay for a trust investment in microcap stocks,” Carthew said.

Although they don’t focus exclusively on the micro end of the spectrum, the BlackRock Smaller Companies and abrdn UK Smaller Companies Growth are also on some of the largest discounts compared to their historical averages.

The BlackRock trust is down 6.9 percentage points while abrdn has widened its discount by 6.6 percentage points.

Contrastingly, trusts within the IT UK Equity Income and IT UK All Companies sectors fell less severely from their five-year averages, with the average discount widening by 3.8 percentage points for each sector to 5% and 11.9% respectively.

Average IT UK sector average discounts over the past five years

| Sector | Current Dicount | Five-year average | Change |

| UK Equity Income | -5% | -1.3% | 3.8 |

| UK All Companies | -11.9% | -8% | 3.8 |

| UK Smaller Companies | -18.2% | -13.3% | 4.9 |

Source: QuotedData

Of the trusts in this category, the Baillie Gifford UK Growth portfolio is selling at the biggest discount to its five-year average. It is currently trading at a 14.3%, which is 7.9 percentage points lower than its recent historical norm.

Similarly, the £1.8bn Mercantile investment trust is trading at 7.7 percentage points behind its historical average.

However, both the Baillie Gifford and Mercantile trusts are underperforming the rest of the IT UK All Companies sector this year, down 37.3% and 36.7% respectively.

They are still narrowly outperforming over the past five years, but the lead they gained on the sector has closed significantly in 2022.

Total return of trusts vs sector over the past five years

Source: FE Analytics