The Bank of England’s emergency intervention in gilt markets on Wednesday should be seen as a tacit admission that the UK will default on its debt, according to Carmignac’s Abdelak Adjriou.

However, Adjriou, who manages the Carmignac Portfolio Global Bond fund, said this didn’t mean the UK will fail to pay the coupons on its bonds, but that holders of these instruments will have to accept negative real returns once inflation is taken into account.

Last Wednesday, the Bank of England pledged to buy £65bn worth of gilts to prevent a liquidity crisis in defined benefit pension schemes, following chancellor Kwasi Kwarteng’s disastrous mini-Budget.

By doing this, Adjriou said the Bank of England is switching from a deflationary policy to an inflationary one, even though CPI is currently at 9.9%.

“What the UK is telling you is that, because it has such high levels of debt, there is a level of rates where the government cannot pay its debt without causing systemic risk, so the holders of government bonds are going to suffer,” he said.

“Two weeks ago, the Bank of England was telling us it was going to sell bonds in the market. And now it is saying it is going to buy the bonds because interest rates and debt are too high.

“This means that the UK, in my view, has said officially that it is defaulting, but not by not paying, because either you default by not paying back, or you default by leaving inflation to run.”

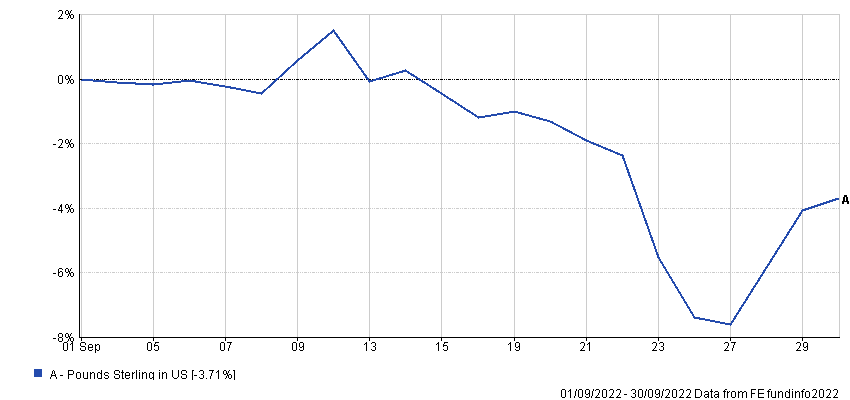

It is worth noting that the pound has recovered its losses since the mini-Budget, which analysts claim is because the Bank of England will hike rates aggressively once pension funds are in a better shape to cope.

Performance of currencies in September

Source: FE Analytics

And the UK is not the only country facing problems. Adjriou said this is the worst global macroeconomic environment since the end of the Second World War, combining every crisis seen over the past 40 years: stagflation, an energy shock, a tech bubble and now a sovereign debt crisis.

But like every other crisis, he said this one will eventually pass.

“There are four steps in a bear market,” he explained. “The first step is higher yields. The second step is buyers and sellers fighting, so you have bear market rallies, but the trend is down.

“The third step is the capitulation of investors and the final step is the capitulation of central banks, at which point there may be a rebound.

“We are between the second and the third steps, and some bonds, not all, are starting to present opportunities, like US Treasuries. The Fed hasn't capitulated, but the risk is clearly asymmetric. I’m not saying yields can't go higher – they could, by 20 to 25bps, for example. But we are towards the end of this rising-yield cycle.”

Adjriou said it is difficult to see fixed income opportunities away from dollar-denominated assets, as even though the currency looks expensive on most metrics, the fundamentals that have driven it higher are still in place. For example, the US is a net exporter of gas, and is one of the few developed markets whose economy can cope with higher interest rates.

He added that the dollar will only start to weaken if oil & gas prices fall or if the Federal Reserve pivots and starts to cut rates, which he can’t see happening for a few months at least.

In the longer term, though, he said the US is one of a number of major developed markets that, just like the UK, could be forced to ‘default’ on its bonds by allowing inflation to run far above interest rates.

However, he said that none of them are in as bad a position as the UK.

“The UK is just ahead of time, the US and Europe will face the same problem,” he continued. “It just happened in the UK because the government decided to help people with energy bills and [unfunded] tax cuts.

“We know now the market doesn't like the tax cuts. So I think this project is over. But today the chancellor said he’s not going to change, so I think he wants to get finished by the market. The UK is in a very difficult spot.”