The vast majority of funds in the Investment Association universe were in negative territory after the first nine torrid months of 2022, research by Trustnet shows.

With three-quarters of the year already gone, there seems to be little respite to the worries that have caused the market to sell off – such as surging inflation, interest rate hikes, a looming recession, the Russia/Ukraine war and renewed political uncertainty in the UK.

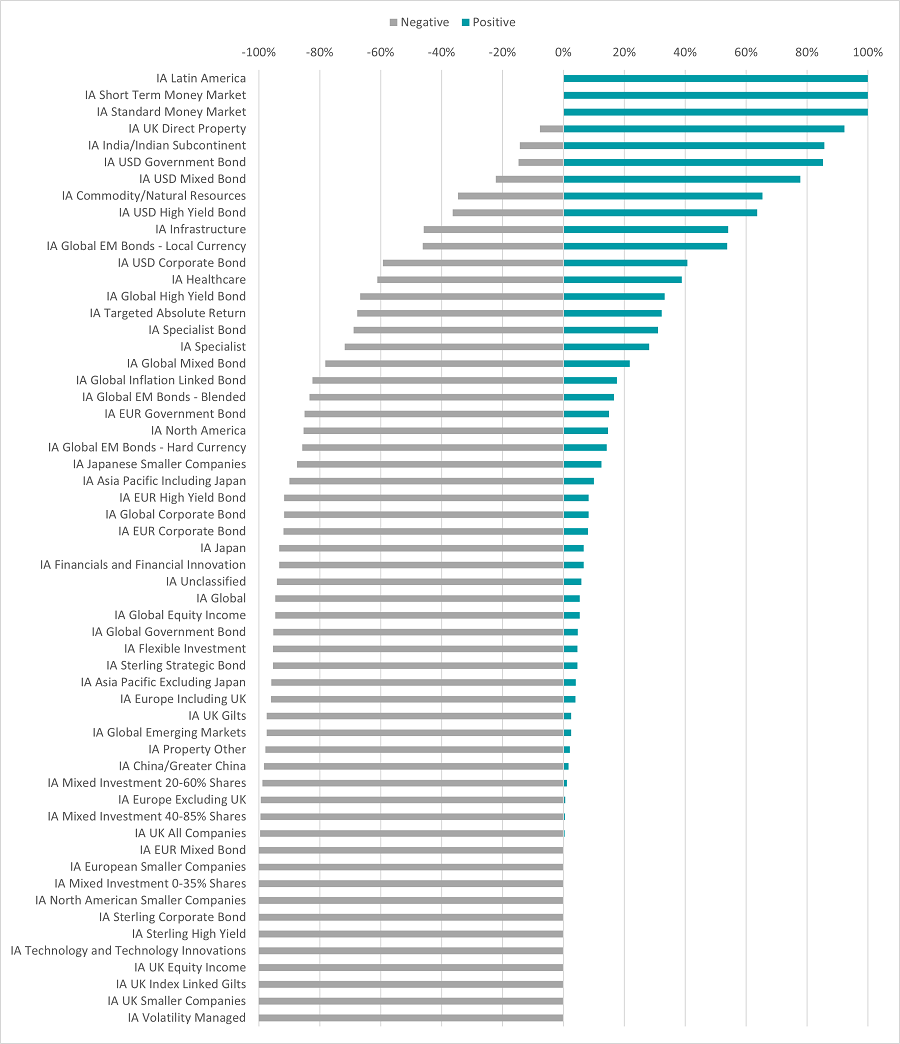

This has translated into weak performance across the board this year for funds - FE fundinfo data reveals that 10.3% of funds have generated a positive return over the past nine months.

What’s more, the above figures have been flattered to some degree by the weakness of the pound, which has boosted returns from non-sterling assets. When they are re-run in local currencies, the percentage of the Investment Association making a positive return drops to just 6.4%.

Within different sectors, there have been varying degrees of success. All nine funds in the IA Latin America sector, for example, have made a positive return in 2022 so far as the region benefits from higher commodity prices; the average fund here is up 19.1%.

Likewise, more than 85% of funds in the IA UK Direct Property, IA India/Indian Subcontinent and IA USD Government Bond sectors are in the black this year, although their returns are far below those posted by Latin America funds.

% of funds in each sector making positive and negative returns

Source: FE Analytics. Total return in sterling between 1 Jan and 30 Sep 2022

But there are 11 sectors where every single fund has made a loss over the year so far, including IA UK Smaller Companies, IA UK Equity Income and IA Technology and Technology Innovations.

Some of the biggest sectors in the Investment Association universe have the bulk of their members in the red, including IA Global and IA UK All Companies.

Just 27 funds out of the 502 in the IA Global sector – or 5.4% - have made a positive return this year. These include Jupiter Global Value Equity, JOHCM Global Opportunities and Lazard Global Equity Franchise but the sector’s really big names are sitting on losses.

In the IA UK All Companies sector, just one fund - Invesco FTSE RAFI UK 100 UCITS ETF – made positive returns in the first nine months of 2022 and even then it was only up 0.34%.

Of those funds that have made positive returns over the year-to-date, the highest has come from strategies that invest in energy stocks.

Source: FE Analytics. Total return in sterling between 1 Jan and 30 Sep 2022

This should come as little surprise – energy commodities have jumped in price this year because of the Russia/Ukraine war and the funds that invest in companies linked to their fortunes have surged.

Exchange-traded funds such as Xtrackers MSCI USA Energy, iShares S&P 500 Energy Sector and SSGA SPDR S&P U.S. Energy Select Sector have topped the Investment Association leaderboard for most of 2022 as a result.

In addition, a handful of ‘systematic’ funds that aim to make positive returns in any market environment have cemented spots at the top of the performance tables this year, including Winton Trend, AQR Systematic Total Return and NB Uncorrelated Strategies.

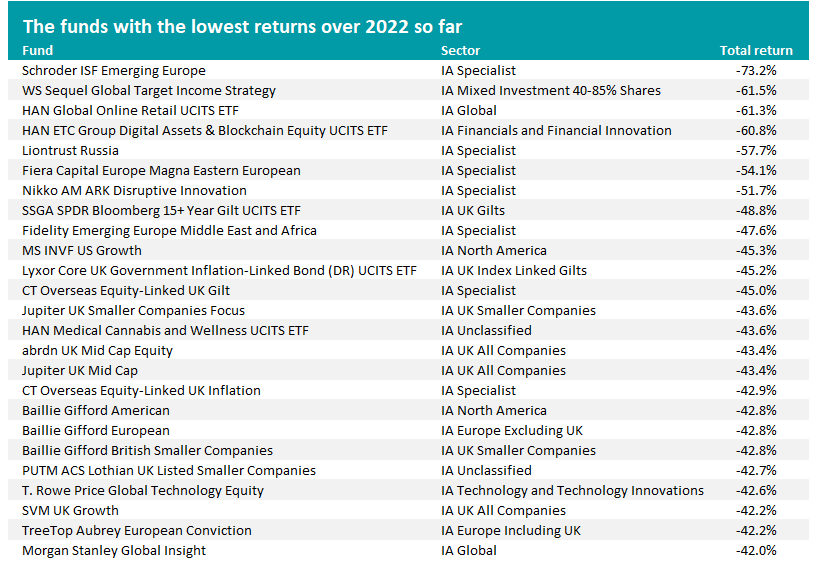

On the other hand, the year’s worst performers are more of a mixed bag.

Source: FE Analytics. Total return in sterling between 1 Jan and 30 Sep 2022

Among the themes in the list of 2022’s biggest losses are the Ukraine and sanctions on Russia (Schroder ISF Emerging Europe, Liontrust Russia), the rotation away from growth stocks (Nikko AM ARK Disruptive Innovation, Baillie Gifford American), a pullback in tech and crypto (HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF, T. Rowe Price Global Technology Equity) and weakness in the gilt market (SSGA SPDR Bloomberg 15+ Year Gilt UCITS ETF, Lyxor Core UK Government Inflation-Linked Bond (DR) UCITS ETF).

Ending on a sector level, the five best performing sectors over 2022 so far are IA Latin America (average fund up 19.1%), IA Commodity/Natural Resources (up 12.6%), IA India/Indian Subcontinent (up 5.9%), IA USD Government Bond (up 5.7%) and IA USD Mixed Bond (up 2.8%).

The heaviest average losses, meanwhile, have come from IA UK Index Linked Gilts (down 40.1%), IA UK Smaller Companies (down 31.1%), IA European Smaller Companies (down 30.4%), IA UK Gilts (down 25.1%) and IA Technology and Technology Innovations (down 24.5%).