Picking low-cost strategies can be a savvy way for investors to make the most of the upside during the good times. Yet it is also a strong option during tougher periods too.

When times are increasingly volatile, as they are now, a higher ongoing charges figure (OCF) means that investors are paying more hefty fees for losses.

James Norton, head of financial planners at Vanguard, said: “There is no doubt that these are testing times for investors. Given our behavioural bias for action, it is very hard to sit there and do nothing. Our instinct is to take action when we perceive something is not right.

“Likewise, we are tempted to try and tinker with our portfolios when they fall in value. No one can predict the markets, but with inflation at historically high levels, investors should focus on what they can control – investment costs”

Imagine a scenario in which the annual investment return is 0%. The table below shows what would happen to £100 under different cost scenarios.

The hypothetical investor would lose almost 15% of their capital after 10 years if they paid 1.5% a year and virtually a third after 20 years if their costs totalled 2%.

How much investors would lose with different costs and no returns

Source: Vanguard

To build on this further, if your total costs of investing, including fund, platform, transaction and potential advice costs are 2% a year, you have to make at least 2% annually on your investments just to make sure you don’t lose money. If your investment return is 5%, that’s almost half of it gone already.

Put into pounds and pence, assuming a 5% return a year, Norton suggested that an investor 30 years from retirement with a £100,000 pot and paying 0.4% in total costs would have a pot of £287,770 on retirement. However, had they paid 2% in total costs, after 30 years they would have a pot of just £178,260.

“Ultimately, keeping costs down is essential to your long-term investing success,” said Norton.

Last month Trustnet looked at how regular savers and those with a cash pot already built up can save money by switching to the cheapest fund platforms.

Here, we look at fund fees and in particular the OCF, although it is worth noting that this does not take into account transaction costs.

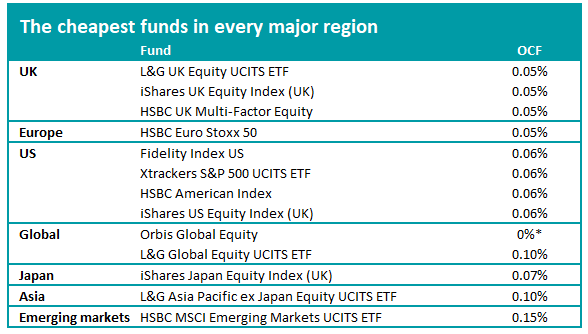

The cheapest region in the world to invest in is the UK, with three funds charging just 0.05% to investors. L&G UK Equity UCITS ETF, iShares UK Equity Index (UK) and HSBC UK Multi-Factor Equity all charge the same although track different indices.

The former tracks the Siolactive Core United Kingdom Large and Mid Cap index while iShares fund follows the FTSE All Share (net of tax) and the HSBC portfolio tracks the FTSE 350 excluding investment trusts.

Source: FE Analytics *Orbis charges a performance fee.

In Europe, the HSBC Euro Stoxx 50 is the cheapest, charging the same as its UK peers, while in the US the low-cost option comes in four varieties from Fidelity, Xtrackers, HSBC and iShares. All charge 0.06%.

Rising another basis point, investors looking for exposure to Japan but wanting to pay as little as possible should note the iShares Japan Equity Index (UK), which costs 0.07% per year.

There is one cheaper fund technically. The Orbis Global Equity fund has a unique fee structure whereby investors do not pay if the fund fails to reach its target returns, something which it has not done in recent years and therefore is free.

When the fund beats the MSCI World index, 40% of the outperformance is taken as a performance fee. When the fund underperforms the benchmark, 40% of this underperformance is paid back to the fund, with refunds offered to investors.

For a more straightforward option, the L&G Global Equity UCITS ETF is the cheapest at 0.1%, which has the same cost as the cheapest Asia fund – L&G Asia Pacific ex Japan Equity UCITS ETF.

Finally, the most expensive region is the emerging markets, with the HSBC MSCI Emerging Markets UCITS ETF coming out the cheapest at 0.15%.