Major US technology companies have released disappointing third-quarter results, spoiling the market’s positive mood around earning season.

Alphabet and Meta were the first to disappoint, followed on Friday by Amazon and Apple. Weighing significantly on these companies’ results were their online advertising results, which slowed down at an unwelcome speed.

The downturn was expected, but its swiftness spooked the markets. Between 25 and 27 October, the Nasdaq index, often used as a measure for the health of the US tech industry, lost five percentage points.

These results have left investors uneasy, exacerbating wider concerns around a weakening global economy.

To make sense of what happened and what we might expect going forward, below is Trustnet’s latest tech round-up.

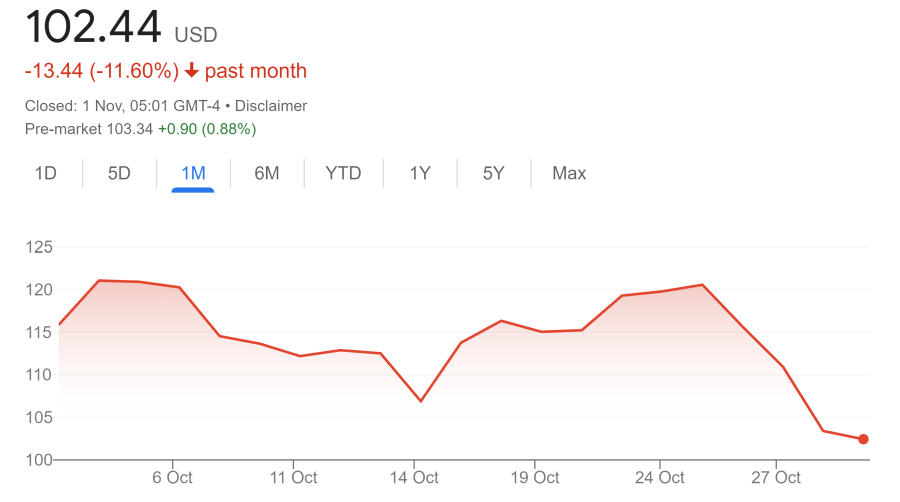

Amazon

Starting with what was probably perceived as the biggest fiasco, according to Matt Britzman, equity analyst at Hargreaves Lansdown, Amazon disappointed the market “largely and across the board”.

Revenue was well behind expectations of $140-$148bn, but the biggest worry for investors came from the guidance for the fourth quarter.

“Traditionally the most important period of the year for e-commerce, the guide for final quarter operating income, coming in at $0-4bn, was a disappointment.”

The core e-commerce business has come under pressure from changing shopping habits that went from the lockdown-driven boom to a cost-of-living squeeze, as consumers have less disposable income.

“Clearly, Amazon went too big too soon on its expansion plans and it’s had to put the brakes on to try and get costs back under control. Operating costs were up close to 18% in the third quarter, so those cost-cutting actions haven’t made their way through as fast as we’d like to see, weighing heavily on the bottom line,” said the analyst.

Amazon’s attractive cloud business AWS also disappointed on revenue growth, coming in lower than the 30% markets were looking for.

“Weakness in this area suggests enterprises may be considering where to allocate capital and upgrading cloud tech given such an uncertain backdrop could be something that gets kicked down the road,” said Britzman.

Some positive news came from the advertising business, which fared much better than Meta’s and Alphabet’s, “but that’s only a small piece of the pie”, he noted.

Stock price over 1 month

Source: Google Finance

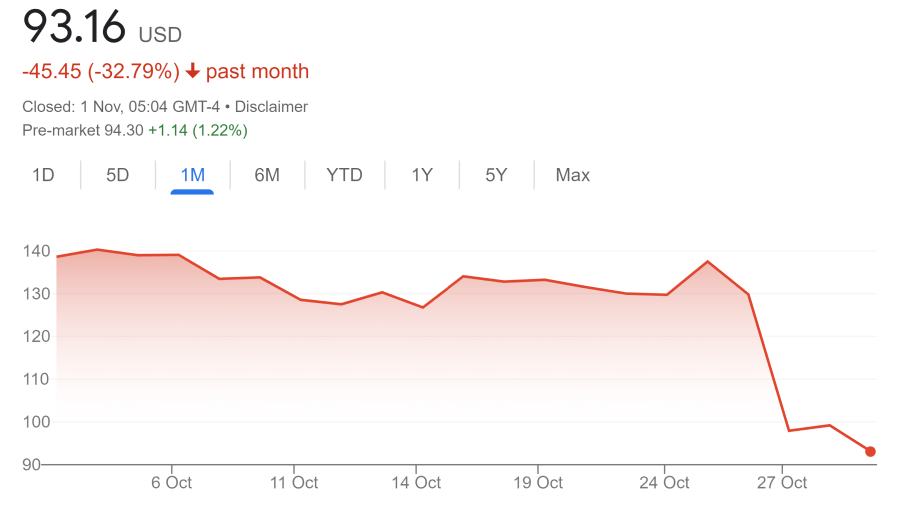

Meta

According to Neil Campling, head of TMT research at Mirabaud Equity Research, Meta faces the risk of being “the next generation fossil”.

“The frustration for Meta investors is that Mark Zuckerberg seems to be wearing a pair of Oculus VR [virtual reality] glasses and hasn’t realised that his VR isn’t aligned to R (aka Reality, aka Returns, aka Responsibility to shareholders). Investors wanted one clear message: rein in the costs. Instead, they are targeting 2023 expenses of circa $96-101bn against the $93bn forecast, a potential 19% increase.”

“If the fourth quarter comes in at the mid-point of guidance, it means a -7% revenue growth number year-on-year: an all-time low and one that doesn’t justify a ramp in operating expenses and collapse in free cash flow.”

To those who want to be bullish, Meta bought back a lot of its stock showing that it believes in itself and the valuation. However, Campling said: “Go ask IBM investors in 2005 whether that was a good trade. Like IBM symbolises dinosaur tech 1.0, so Meta faces the risk of being the next generation fossil.”

Stock price over 1 month

Source: Google Finance

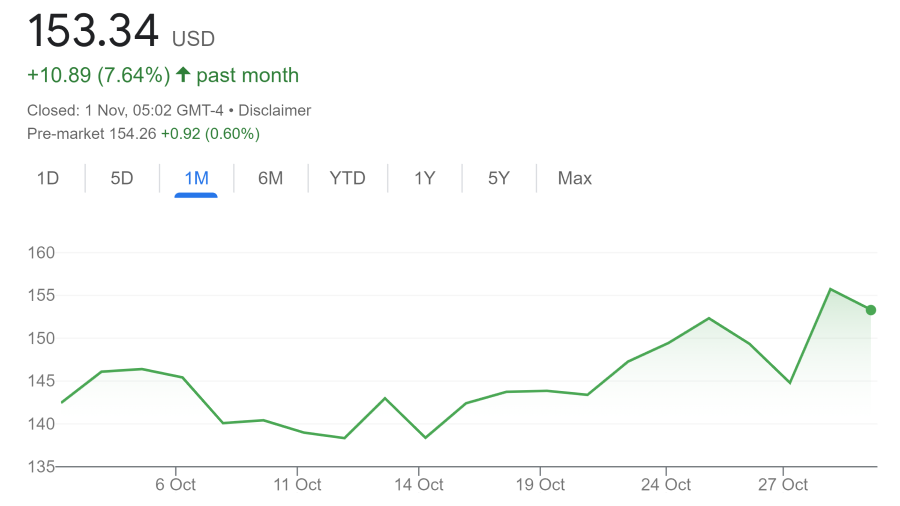

Apple

Apple has not cracked like the other tech firms and Ben Barringer, equity research analyst at Quilter Cheviot, said the company showed how it can be done.

Hardware grew strongly, with the iPhone continuing to drive revenue and tech upgrades to the MacBook helping sales.

“What is interesting is the fact that Apple is seeing more demand for Pro models of the iPhone, suggesting people are willing to part with their cash for quality – something that will ultimately boost Apple’s bottom line.”

The services division did come in below consensus estimates, as much of this is driven by advertising and lower App Store usage, which is now facing some cyclical headwinds, explained Barringer. But while we should expect a slowdown in the next earnings report, the company continued to hold up well, unlike its big tech rivals.

“Interestingly, Apple has also addressed some ESG [environmental, social and governance] issues by saying its iPhones will now be made with 100% recycled rare earth metals. This is a positive step to sustainability and there are further steps to reduce the carbon footprint of the supply chain, and we look forward to more creative solutions from such an innovative company,” he added.

Stock price over 1 month

Source: Google Finance

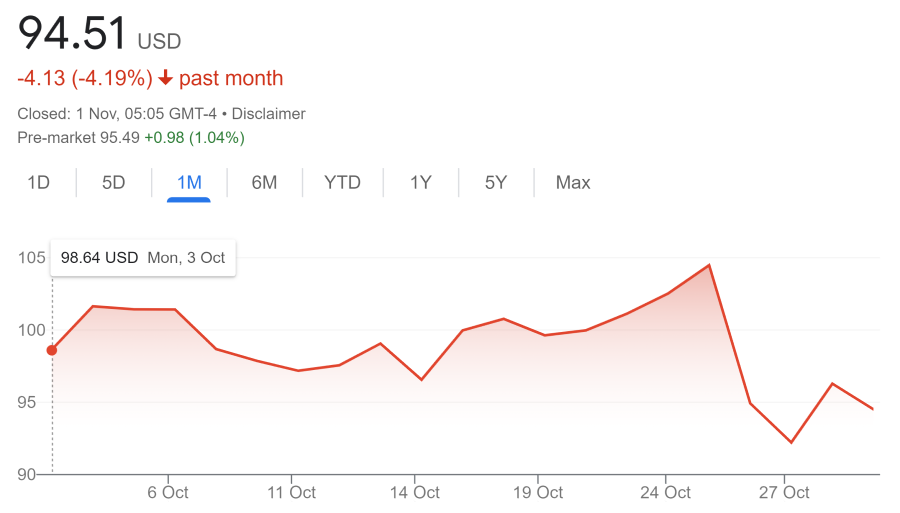

Alphabet

Alphabet’s full-quarter revenue rose 6% while advertising revenues alone grew 2.6%, but both dashed expectations. YouTube advertising revenue was down $100m. The total group operating profit came in 18.5% lower amid rising total costs and expenses.

Yet Taymour Tamaddon, portfolio manager of the T. Rowe Price US Large Cap Growth Equity strategy, found reasons to remain bullish on the long-term prospects for the digital advertising space, despite the current headwinds.

"Whether the decrease in digital advertising spending is a downturn or just a stabilisation from the spectacular growth in recent years, the near-term impact of the post-pandemic environment is undeniable, as companies that overextended during the pandemic are now pulling back. Longer term, however, we anticipate spending growth to resume to a more normalised path,” he said.

The powerful tailwinds that have supported the rapid growth in digital advertising over the past decade – growing internet penetration, rising popularity of smartphones, increase in social media usage, rising penetration of e-commerce, increased investment in technology and digital platforms – “are very much intact,” according to Tamaddon.

Moreover, the shift toward e-commerce, which is turning more consumers away from bricks and mortar retail and toward online shopping, is creating greater opportunities for digital advertisers to reach an ever-growing online consumer audience. Going forward, ad spending in the US is anticipated to surpass $300bn by 2025, which would account for roughly 75% of all media spending.

Stock price over 1 month

Source: Google Finance

The final story of the week was the conclusion of Elon Musk’s buy-out of social media giant Twitter for $44bn. Neil Wilson, chief market analyst at Markets.com, said it was poor timing for the controversial chief executive and tech entrepreneur, who had tried several times to stop the purchase throughout the year.

“In light of the carnage in big tech, Musk’s buying Twitter looks to be one of the worst deals ever done. The only bright spot: could Musk buying Twitter show the others how to trim the enormous fat on some of these companies?,” he asked.