Investors are increasingly ranking environmental, social and governance (ESG) factors alongside performance when selecting funds but there are only nine UK funds that combine top ratings for both their track record and sustainability, Trustnet research shows.

In this series, we are revealing how many funds hold both five FE fundinfo Crown Rating – which puts them in the top 10% of funds for investment performance in recent years – and AAA status under the MSCI ESG Fund Ratings – which examines the ESG scores of underlying holdings, funds’ ESG momentum and exposure to the worst-rated companies.

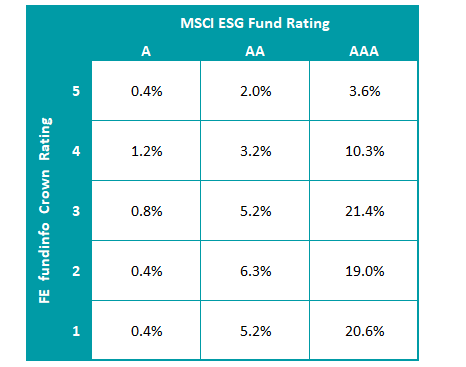

Across the entire Investment Association universe, there are 2,205 funds that have both a FE fundinfo Crown Rating and a MSCI ESG Fund Rating but only 2.1% of these have been given five crowns for their performance and AAA status from MSCI on their ESG stance.

Here, we turn our attention to the three main UK equity sectors: IA UK All Companies, IA UK Equity Income and IA UK Smaller Companies. The headline point is that just nine funds – or 3.6% of the 252 that are eligible – have top ratings for both performance and ESG.

Distribution of UK equity funds by FE fundinfo Crown Rating and MSCI ESG Fund Rating

Source: FE fundinfo, MSCI

One thing to note is that UK equity funds stack up pretty well for ESG as 96.8% of the funds we looked at have an MSCI ESG Fund Rating of AA or AAA – which makes them ‘ESG Leaders’ under MSCI’s methodology. The remaining 3.2% all have an A rating, which is the top end of the ‘ESG Average’ group.

When it comes to the individual UK funds holding five FE fundinfo Crowns and a AAA ESG rating from MSCI, the most recognisable name is probably the £3.1bn Royal London Sustainable Leaders Trust, which is headed up by FE fundinfo Alpha Manager Mike Fox, George Crowdy and Sebastien Beguelin.

The investment process used by Fox and his team has been in place since 2003 and revolves around finding best-in-class companies that are aiming to contribute to a more sustainable society, while avoiding those in controversial areas of the market. Accordingly, MSCI rates 81% of its underlying holdings as ‘ESG Leaders’ while none are classed as ‘ESG Laggards’.

Analysts with FE Investments said: “The team’s investment style brings something different to UK equity funds as it combines the sustainable principles with in-depth company financial analysis. Furthermore, the fund is distinguishable from its ethical peers, who focus predominantly on negative screening whilst this team goes a step further and screens companies to isolate those that are contributing to the transition to a sustainable world.

“As such, it is a very good candidate for investors who specifically want exposure to companies that are making a positive impact for society or operating in a sustainable manner.”

Performance of Royal London Sustainable Leaders vs sector over 10yrs

Source: FE Analytics

The only other fund on the shortlist with a dedicated sustainable approach is the £126m Ninety One UK Sustainable Equity fund, which is run by FE fundinfo Alpha Manager Matt Evans.

Evans has worked on ESG strategies for some time – having previously run the Threadneedle UK Ethical fund - and joined Ninety One in 2017 with the aim of launching Ninety One UK Sustainable Equity.

The process behind the fund looks for companies that are aligned with 10 sustainable themes, including accessible finance, sustainable infrastructure, climate change and clean energy, and protecting eco-systems. MSCI says 58% of its holdings are ‘ESG Leaders’.

Other large funds with five FE fundinfo Crowns and a AAA ESG rating, but are not dedicated sustainable strategies, include Martin Walker’s £1.1bn Invesco UK Opportunities fund and Michael Clark and Rupert Gifford’s £578m Fidelity Moneybuilder Dividend fund.

The nine funds that made the shortlist in this research are completed by CT UK Equity Alpha Income, ES R&M UK Equity Income, Fidelity Enhanced Income, IFSL CAF UK Equity and Invesco Income & Growth.