BAE Systems, Pearson and Glencore crown the list of the top-performing FTSE 100 stocks over the past 12 months, but there were even more significant returns made on AIM, data from AJ Bell shows.

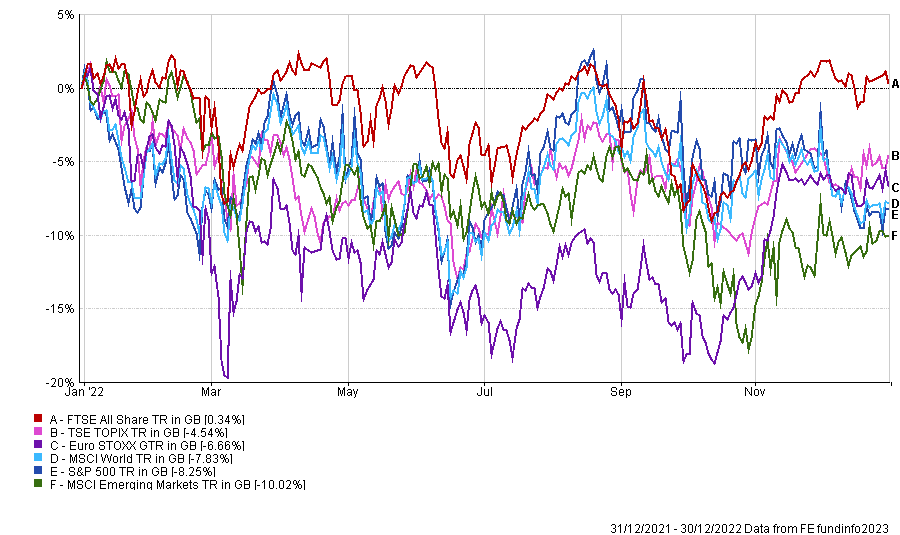

The UK market was the top-performing region in 2022, with the FTSE All-Share index up 0.34%. While this may be an underwhelming overall figure, it is significantly higher than the losses of 10% for the MSCI Emerging Markets, 8.3% for the S&P 500 and 6.7% for the Euro Stoxx.

Performance of indices over 2022

Source: FE Analytics

Much of this can be explained by the composition of the FTSE 100 index, which makes up around 80% of the All Share. Maligned for much of the past decade for being full of ‘old economy’ stocks, last year the market held firm as mining, oil and defence companies rose.

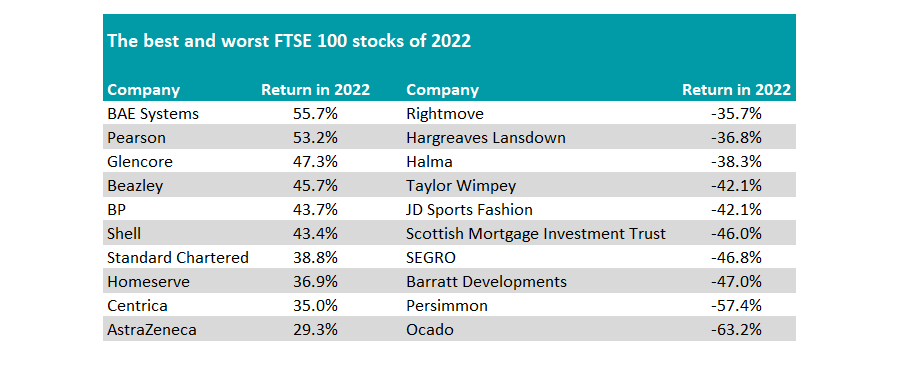

Indeed looking at the below table, some FTSE 100 firms made impressive returns in 2022, led by BAE Systems. The defence company had been out of favour with investors as governments slashed budgets, but the war between Ukraine and Russia brought the sector firmly back to the fore.

In November, Sophie Lund-Yates, equity analyst at Hargreaves Lansdown, said: “There are a few things that BAE is beholden to, and one of those is government defence budgets.

“We’ve learned that many of the countries the defence giant operates in are upping their defence spending in response to the more threating geopolitical climate. This should feed into a sticky source of revenue for the group.”

The share price was up 55.7%, narrowly beating education firm Pearson, which rose 53.2%. A true 'deep value' pick for many years, the company consistently achieved results throughout 2022 and investors rewarded the stock, which had been on significantly de-rated multiples.

Last month, Neil Wilson, chief market analyst at Markets.com, said: “Pearson has risen thanks to a big turnaround and push towards digital with a new subscription service that places it as a Netflix for education.

“A takeover offer from Apollo and stake building by activist Cevian highlighted the fundamental merits of the business.”

Mining firm Glencore was third, while BP and Shell both cracked the top 10 as commodity prices galvanised on the back of lower demand. A barrel of Brent crude oil ended 2022 53.7% higer than at the end of 2021, while the Bloomberg Commodity index (a basket of several commodity types including oil, agriculture and minerals) was 30.8% higher.

Source: AJ Bell

At the other end of the spectrum, 'pandemic winners' came under the cosh as investors decided that the Covid gains were no longer sustainable.

Delivery firm Ocado rocketed in 2020 but has slipped back since as more people returned to shopping in person rather than online. The cost-of-living crisis didn’t help either, with people moving away from upmarket chains such as M&S, which it is partnered with. Shares were down 63.2% in 2022, the worst of all FTSE 100 names.

Housebuilders Persimmon and Barratt Developments were second and third respectively as investors worried that rising interest rates would lead to higher mortgage costs.

Additionally, the cost-of-living crisis has meant many people can no longer afford to move house, which is predicted to lead to a house price crash at some point in the coming 12 months.

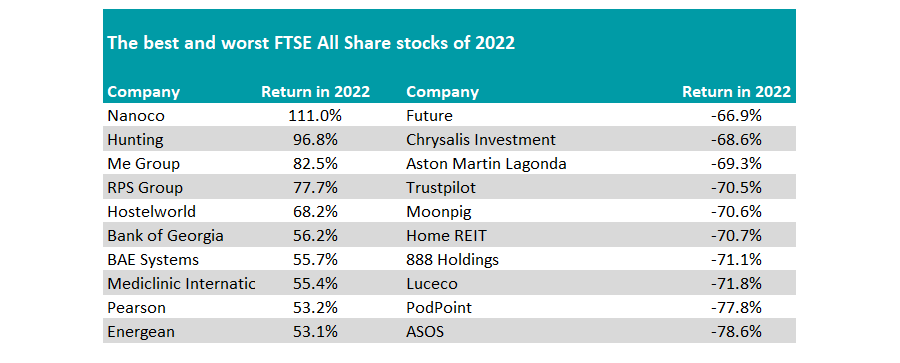

Looking further down the market, Nanoco was the top performer on the FTSE All Share index, making 111%. The quantum dot maker (a technology that makes television pictures sharper) is currently suing Samsung Electronics for alleged infringement of its technology used in the firm’s light-emitting diode TVs. The trial begins on Friday.

Hunting, a UK business that provides services to the oil & gas industry, was up 96.8% on the year, while photobooth and vending machine firm Me Group was third, up 82.5% as it beat earnings forecasts and rejected a bid early in the year.

Source: AJ Bell

Conversely, ASOS was the worst hit stock on the FTSE All Share, with the online shopping boom reversing. Customers are heading back to the shops while the cost-of-living crisis has made young people (its target audience) tighten their belts. Shares fell 78.6%.

This also affected the likes of Moonpig, which cut annual sales forecasts as Royal Mail strikes impacted orders, while the cost-of-living crisis meant fewer people had the money to spend on the card delivery firm.

In December, Adam Vettese, analyst at social investing network eToro, said: “The hedge funds currently shorting Moonpig will be licking their lips following the greeting card company’s half-year results. The shorters are betting against the firm having a tough Christmas as households tighten their belt due to the cost-of-living crisis.

“There are signs that is happening, with the firm this morning slashing its full-year revenue outlook, reporting flat sales and a large slide in earnings.”

Magazine publisher Future also dropped in 2022 as chief executive Zillah Byng-Thorne announced she is to leave the business this year, selling hundreds of thousands of pounds worth of shares. The firm also said it only expected “modest” profit growth this year.

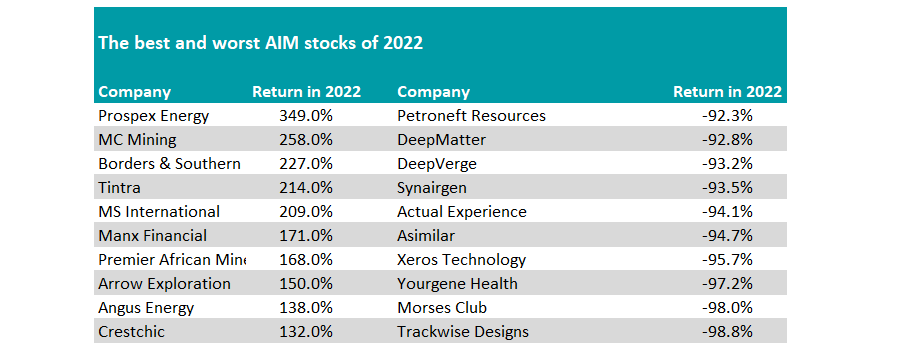

However, the biggest movements were on AIM. Prospex Energy, the oil and gas junior, rose 349% on the year, while fellow producer Borders & Southern Petroleum rose 227%. Splitting the two was MC Mining, a junior thermal and coking coal specialist in South Africa, which was up 258%.

Source: AJ Bell

At the other end, Trackwise Designs’ shares are suspended having dropped 98.8% on the year. The printed circuit board maker had previously warned that additional funding would be required after a lossmaking first half.

The top 10 all lost more than 90%, including biotechnology firm Synairgen and healthcare firm Yourgene Health as well as tech firm DeepVerge and data company DeepMatter.