People with excess cash during the current cost-of-living crisis should squirrel it away in a savings account, according to experts, despite the market starting to slow.

Cash savings proved popular in 2022 when they were a safe haven to stocks and fixed-income markets that simultaneously plunged.

It was the first time in years that investors could make meaningful returns, after central banks raised interest rates, moving on from the tightening monetary policies initiated more than a decade ago.

Some may question, with markets down and bonds paying higher rates, whether it is still a sensible decision to have a significant pot of cash in 2023, given that many investments now look cheap.

Anthony Willis, investment manager in the multi-manager team at Columbia Threadneedle Investments, believes that now is the time to top up the piggy bank, not yet crack it open. Although there might be opportunities in stock picking and corporate bonds, he believes 2023 “may well see further downside”.

“Valuations for equities have moved lower, but do not yet appear to be at levels associated with a market bottom,” he said.

“Something will likely be determined by the depth of the likely recession and the impact on corporate earnings. In this environment, returns look harder to come by.”

Tim Bennett, head of education at Killik, said holding more cash was a natural response to concerns that emerged in 2022 and are still present today – such as market volatility, more hawkish central banks, decreasing job security and shrinking earnings visibility.

“There are many things capable of keeping people awake this year still, most of which are a hangover from 2022,” he said.

“People might still hold on to cash for emergencies, psychological comfort, or to have money available when good entry points into investment opportunities might crop up in the future. Hence, it is important that your money is both accessible but also not languishing somewhere that pays no interest.”

For this reason, Bennett invites savers to keep an eye on rates and “not be afraid to shop around for a better deal”.

This is especially true now that the market shows signs of cooling off and almost 70% of accounts are paying below base rate (3.5%), as noted by Rachel Springall, finance expert at Moneyfacts.

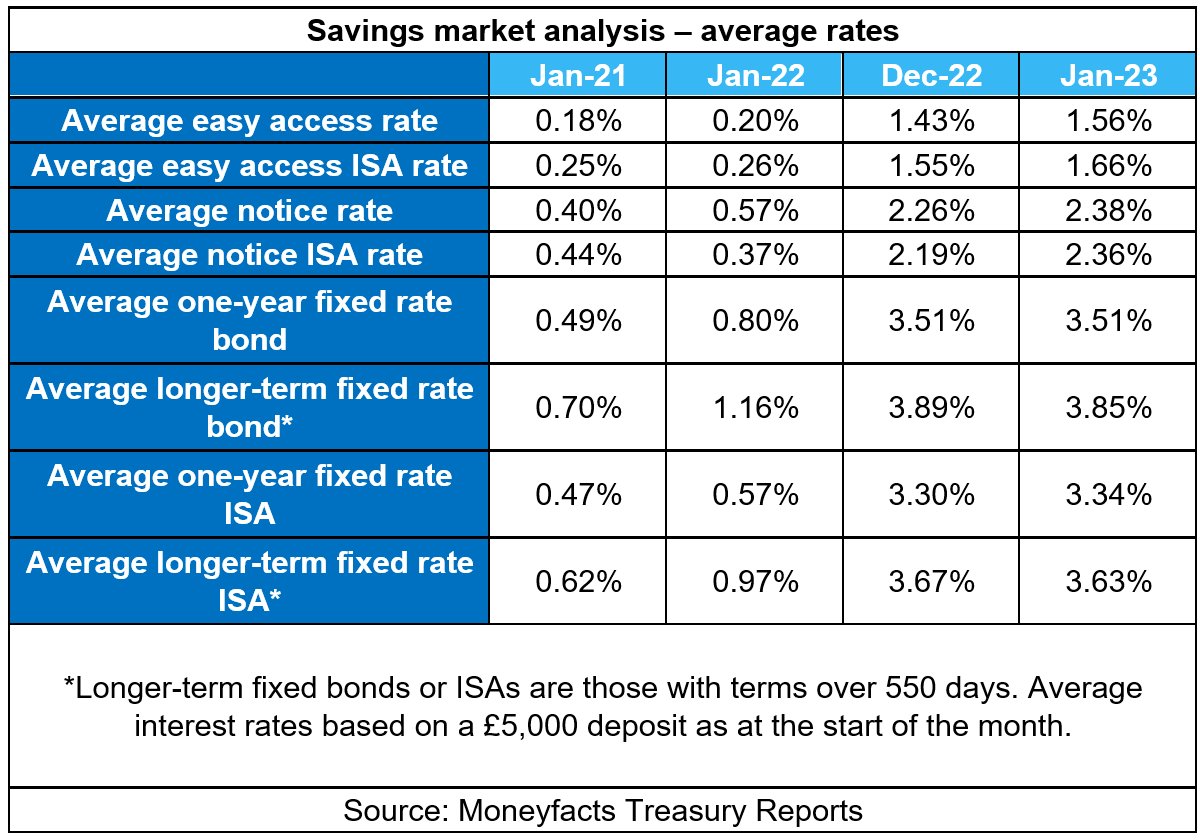

Other signs that the market is slowing down can be found in the latest Moneyfacts UK Savings Trends Treasury report, whose data (illustrated in the table below) highlighted how the average one-year fixed bond rate has remained unchanged at 3.51% for the first time since January 2022, while the average longer-term fixed bond has fallen to 3.85% for the first fall since March 2021.

However, there are still opportunities to be found.

Easy access and notice rates are now averaging their highest levels in 14 years, while variable rates rose for the 11th consecutive month. It is the first time that this has happened since Moneyfacts records started in 2007.

Springall suggested that, as the cost-of-living crisis persists and savers may need to dip into their pots, easy access and notice accounts could be the most suitable options that offer flexibility.

“As the Bank of England moved to increase the base rate in December 2022, it was somewhat inevitable to see a drop in the proportion of savings accounts that pay above base rate,” she said.

“The consecutive rises to base rate should spur savers to check their existing savings accounts, particularly as challenger banks and building societies offer some of the best rates on flexible accounts.”

Among easy access options, HSBC offers the best annual rate at 3%, with an account that can be opened online and pays monthly. Unless stated otherwise, all figures are based on a £5,000 lump sum starting pot.

The next-best options are Tipton & Coseley Building Society and Zopa, whose accounts pay 2.9% and 2.86%, respectively. These can be opened by mail or in branch for the former, or by mobile in the case of the latter.

Turning to notice accounts, savers will find better interest rates if they are willing to part from their cash for 90 days or longer.

At a 90 days’ notice, Investec Bank pays 3.22% monthly, while a 120 days’ notice will take the interests slightly higher at 3.6% with Hinckley & Rugby Building Society and 3.5% with Furness Building Society, which marginally surpasses or covers the base rate of 3.5%.

In the fixed-rate space, the best interest is found in the three-year bonds, where Hinckley & Rugby Building Society, Investec Bank and Vanquis Bank all pay 4.5%. The first option pays yearly and is the only one that can’t be opened online; the second is paid on maturity and the third account either monthly or on the anniversary date.

Doubling your lump sum to £10,000 will open up the possibility to save it with SmartSave, which offers the highest rate you can find today, 4.56%. The account can be opened online and pays on maturity.