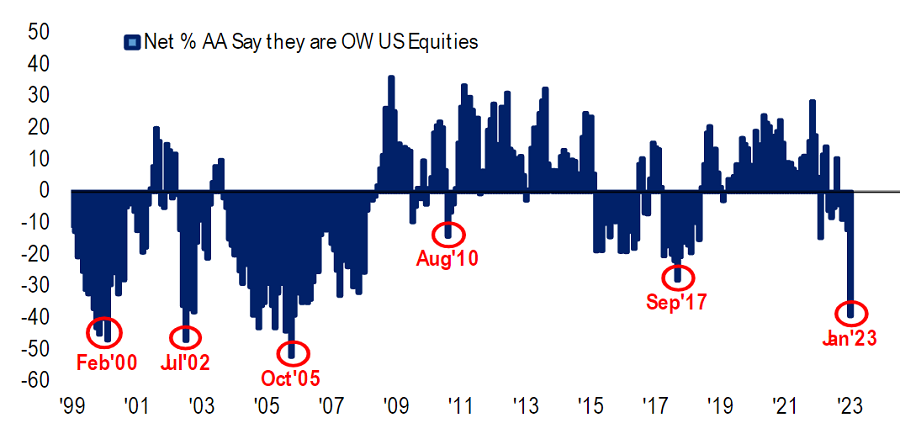

The allocation to US equities has plunged this month, according to a closely-watched sentiment survey, as fund managers buy into European and emerging market stocks.

The latest edition of the Bank of America Global Fund Manager Survey found a net 39% of asset allocators are underweight US stocks at the start of 2023. This is the lowest allocation in 18 years – November 2005 was the last time the weighting to the US was lower.

The underweight is also a 29 percentage point increase on December’s levels, which is the largest month-on-month increase to US equities in the survey’s history. Bank of America said the US equity allocation has “collapsed” this month.

Net % of fund managers overweight US equities

Source: Bank of America Global Fund Manager Survey

At the same time, the allocation to eurozone stocks “spiked”, the survey found. There was a 14 percentage point increase in January, taking the balance of managers overweight the region to 4%.

January marks the fourth consecutive month of managers adding to eurozone stocks, taking the allocation to the highest since February 2022.

Meanwhile, there was a 13 percentage point increase in those overweight emerging market equities, with a net 26% of managers overweight. “Investors have been overweight emerging market equities for two straight months, after having been underweight for most of 2022,” the bank’s strategists added.

There were more modest additions to Japanese and UK allocations this month, although both areas remain net underweights.

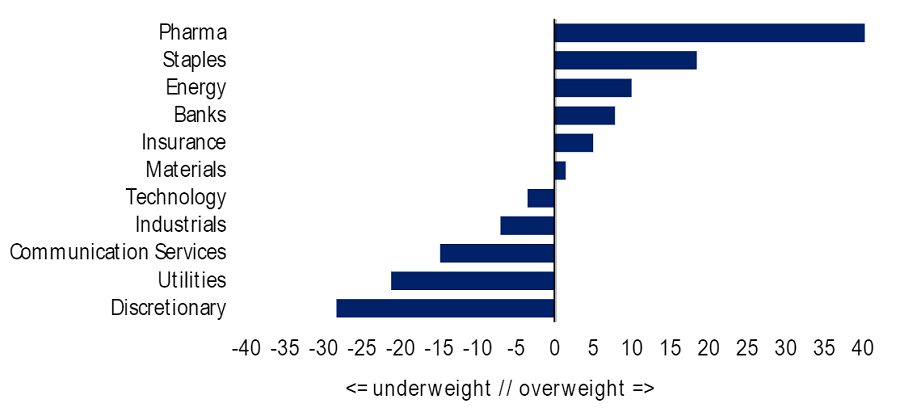

On a sector level, fund managers are most overweight pharmaceuticals, consumer staples and energy stocks. The biggest net underweights are to consumer discretionary, utilities and telecoms companies.

% of fund managers overweight and underweight equity sectors

Source: Bank of America Global Fund Manager Survey

On the whole, however, professional investors still appear to be on the defensive with a net 33% of fund managers currently underweight equities. There’s a net 1% underweight to bonds with asset allocators being overweight cash and commodities.

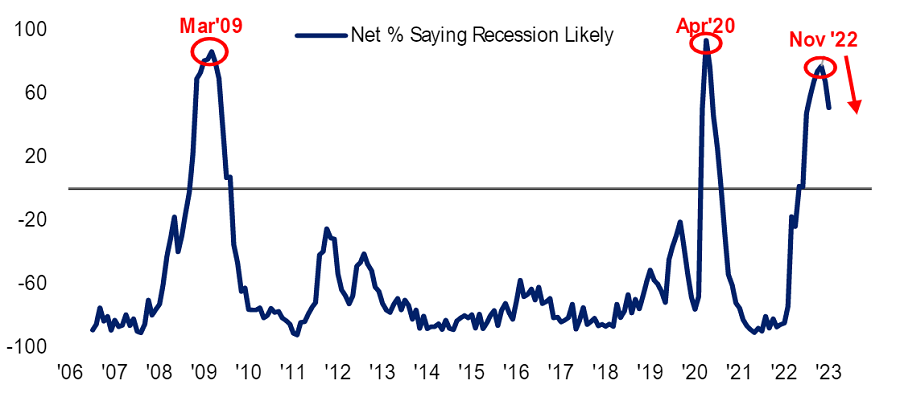

But there some tentative positive signs within the survey. Bank of America’s strategists said fund managers “are still bearish but a lot less bearish” than they were in the final quarter of 2022.

Fears of recession appear to have peaked among fund managers, with a net 77% saying a recession was likely back in November. But this has fallen to a balance of 68% in January.

“Prior peaks in recession fear were big turning points in asset prices,” the bank added.

% of fund managers saying recession is likely in the next 12 months

Source: Bank of America Global Fund Manager Survey