Many UK companies make the mistake of increasing their dividend payments when their balance sheets can’t handle it, according to Blake Hutchins, manager of the Troy Income and Growth trust.

He said that businesses often pour more money into pay-outs to shareholders, even if revenues are down and capital would be better spent elsewhere.

“There is an obsession in the UK market with having a progressive dividend policy, which can work for companies with responsible pay-outs and produce free cash flow and profit growth, but so many companies can’t do that,” Hutchins said.

“The average company consumes capital and has very volatile earnings and cashflow, so having a progressive dividend policy just doesn't make sense – that’s just poor capital allocation.”

Indeed, many companies that Hutchins looks at consider dividend growth as a priority, even if doing so is detrimental to the business’s financial health.

He said: “They’ll say that they’re very surprised the market hasn't given them more credit for growing their dividend, which you may find bewildering, but it's incredible how many businesses fall into this trap.

“Free cash flow could be negative for those business, yet they decide to grow their dividend in spite of that, and all that means is they’ve just got more debt.”

This is similar to Murray International trust manager Bruce Stout’s views. He told Trustnet last week that many UK companies have hit the ceiling with how far they can grow dividends and better opportunities now lie abroad.

This mindset goes against what Hutchins considers to be the fundamentals of responsible dividend growth. For a company to be able to increase its dividend, it must first have a robust income stream and low cost of capital, according to Hutchins.

If there is not a decent level of free cash flow, it doesn’t make sense for a company to spend more on issuing out dividends.

Long-term value creation and dividend growth supported by cash flow

Source: Troy Asset Management

Hutchins said: “When we’re trying to see if a dividend is sustainable, we love to see a gap between the earnings yield and the dividend yield because it means our companies aren't over distributing focus.

“It also means those companies are retaining some earnings and why wouldn't we want them to retain some earnings which they can reinvest?”

It is for this reason that the Troy Income and Growth team often avoid investing in cyclical companies, as their revenues go through ebbs and flows.

When companies in the energy, mining and banking sectors are in demand – like they have been over the past year – revenue increases, meaning they can afford to pay higher dividends.

These companies also go through periods where they fall out of favour and income dwindles, yet they still feel the pressure to increase their pay-outs.

Fergus McCorkell, assistant manager of the Troy Income and Growth trust, said: “Clearly, these companies can very much have their day in the sun where they absolutely pour cash, and we all know that commodity price inflation is the reason for that.

“During those times, there will be things we hold that can be out of favour, but we would argue it's the consistency that makes it very hard to say where these cyclical companies are going next.”

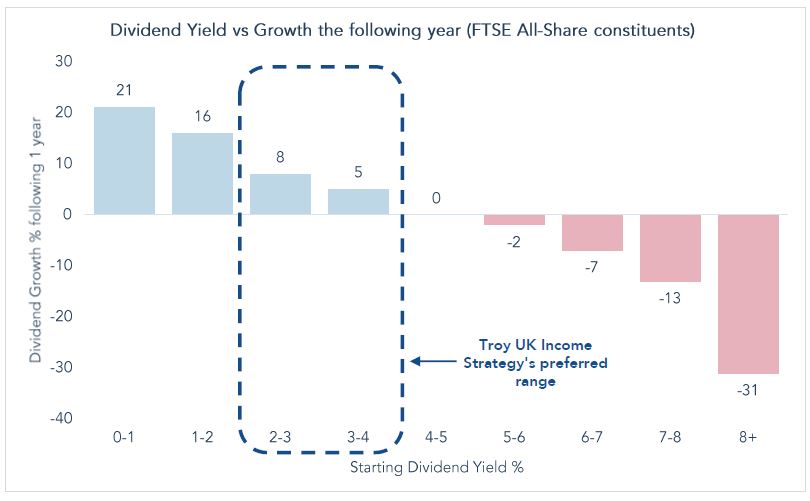

McCorkell is also cautious of a company’s starting yield as a high dividend can result in cuts over the following years. He will typically only invest in companies with a starting yield of 2-4%, as anything above that range tends to shrink.

Source: Troy Asset Management

McCorkell said: “It's an incredibly clear pattern that once you get to a very high level of yield, it correctly shows that the markets worked out the dividend isn't sustainable and it's likely to fall from there.

“At the other end of the spectrum, those high-quality companies tend to be growing very happily, and we really like that middle range of healthy companies with a sensible yield.”

Instead, he aims to invest in “stable, consistent, defensive names with low capital intensity and low cyclicality,” such as healthcare, consumer staples or business software companies.

Ken Wotton, manager of the Gresham House UK Multi Cap Income fund, agreed that many companies in the UK make the mistake of prioritising dividend growth when revenues are weak.

He said: “You do see companies quite often that have become hostage to overly aggressive dividends and feel they can't row back from that, so it is definitely an issue.

“Sometimes companies get into a position where they've made a commitment to a progressive dividend, which means that when something doesn't go quite right, they feel they're absolutely wedded towards growing the dividend, even if that’s not the right thing to do.”

Indeed, many companies think that they are doing the best for shareholders when growing dividends, but they are often doing the opposite.

“If you get into this awful situation where the dividend exceeds free cash flow, don't be surprised when the share price falls, but it's easy to forget that,” he said.

“We would much rather be in a situation where there's just an abundance of free cash flow to cover that dividend, and preferably a company doesn't have any debt.”