Investors aiming to make the highest returns from the emerging markets would have been better off avoiding the behemoths of the IA Global Emerging Markets sector, according to Trustnet research.

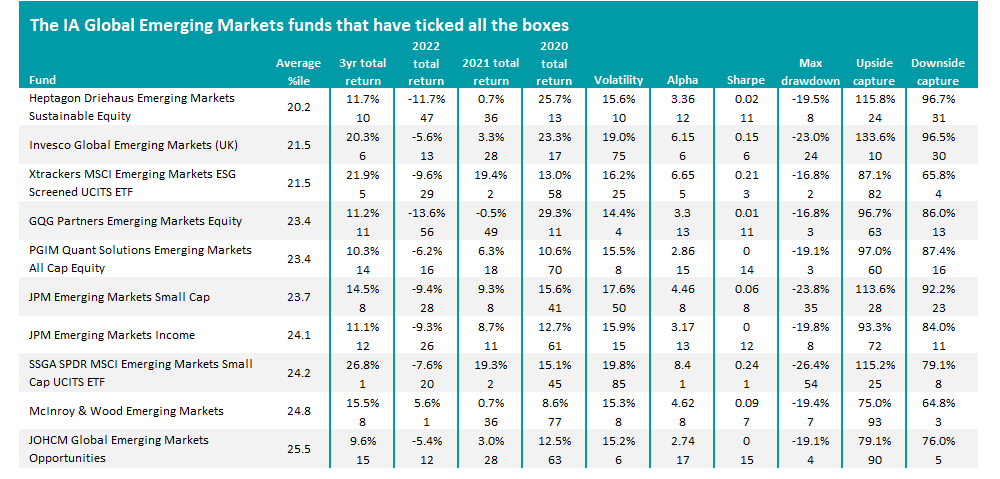

In this ongoing series, Trustnet looks for funds that have beaten their peers on all fronts over the past three years, ranking funds on 10 different risk and return metrics: cumulative three-year total returns, volatility, alpha, Sharpe ratio, maximum drawdown, upside capture and downside capture over the past three years, as well as returns in each of 2022, 2021 and 2020.

We then work out an average percentile score for each fund across the 10 metrics and the lower the average percentile, the better the fund has performed overall. When a benchmark for IA Global Emerging Markets funds is needed, we’ve used the MSCI Emerging Markets index – the most common benchmark in the sector.

Performance of fund vs sector and index over 3yrs to end of 2022

Source: FE Analytics

After running the numbers, the Heptagon Driehaus Emerging Markets Sustainable Equity fund came out on top with an average percentile score of 20.2 – thanks to strong three-year returns coupled with low volatility and maximum drawdown.

Managed by Driehaus Capital Management, the fund looks to capitalise on market inefficiencies that are caused by investors’ cognitive biases – which the managers believe follows “predictable and investable patterns” – and, as its name suggests, will only invest in companies with strong environmental, social and corporate governance (ESG) attributes.

However, the £74m fund is not widely available in the UK at present so investors may not be able to access it, depending on their platform of choice. Indeed, many of the 10 IA Global Emerging Markets funds with the best average percentile scores in this research are relatively small and might not be well-known to most investors.

Source: FE Analytics

GQG Partners Emerging Markets Equity is the largest on that list with assets under management of £1.5bn, although this is another that is only found on a limited number of platforms in the UK.

Several of the highlighted funds are also relatively small, meaning they are likely to be off-the-radars of many investors. Xtrackers MSCI Emerging Markets ESG Screened UCITS ETF, PGIM Quant Solutions Emerging Markets All Cap Equity and McInroy & Wood Emerging Markets, for example, run less than £100m.

JPM Emerging Markets Small Cap, which has an average percentile score of 23.7, might be better known. It is £1.1bn in size and is up 14.5% over the past three years, making it one of the best performing members of the peer group.

The fund is run by FE fundinfo Alpha Manager Amit Mehta and Austin Forey, both of whom have worked on the portfolio for more than 10 years. The fund has a bottom-up approach that looks for high-quality companies with “superior and sustainable growth potential”.

JP Morgan has a second fund on the shortlist: JPM Emerging Markets Income, with an average percentile score of 24.1. Formerly run by Richard Titherington, the £677m fund is managed by Omar Negyal, Jeffrey Roskell and Isaac Thong, and has a flexible approach to income investing – the only criteria is that a company needs to be a dividend payer.

Analysts with FE Investments added: “In tough environments, such as 2020 where many companies looked to cut their dividend payments, the fund’s ability to also focus on capital appreciation provides it with resilience and the capacity to maintain total return generation in downward markets.”

Many of the biggest funds in the IA Global Emerging Markets sector, however, are found mid-table: Vanguard Emerging Markets Stock Index (56th of 141 funds), Royal London Emerging Markets ESG Leaders Equity Tracker (82nd), Federated Hermes Global Emerging Markets Equity (86th) and Fidelity Emerging Markets (111th), for example.

Source: FE Analytics

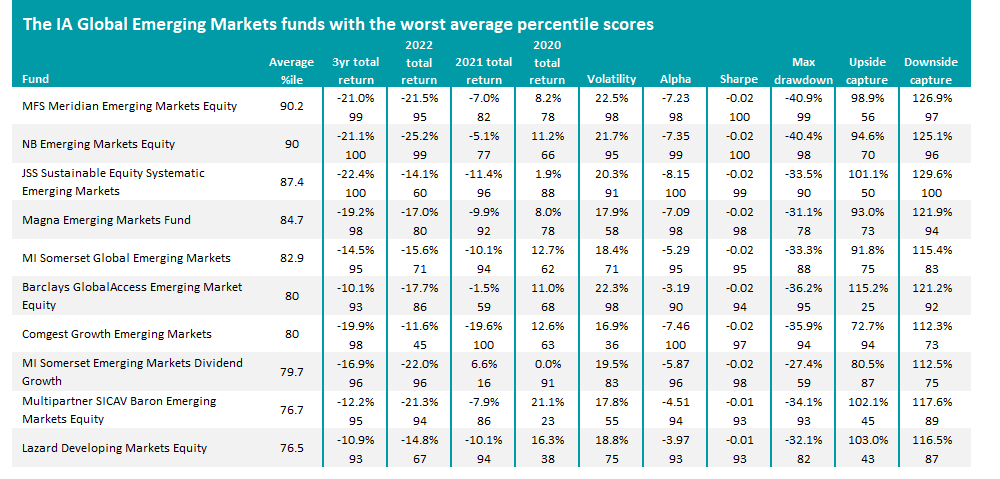

At the very bottom of the rankings in this research is MFS Meridian Emerging Markets Equity, which has an average percentile score of 90.2 after losing 21% over the three years under consideration. With assets of just £65m, however, the fund is unlikely to be held by many UK investors.

The largest name on the above list is the £1bn Comgest Growth Emerging Markets fund, which has lost 20% as growth stocks sold off. Meanwhile, MI Somerset Global Emerging Markets and MI Somerset Emerging Markets Dividend Growth were once among the favourites of the sector but have struggled in recent years.