With experts suggesting that UK investors should have as much as a quarter of their portfolios in domestic stocks, a passive fund aiming to replicate the performance of the FTSE 100 could be a good place to start.

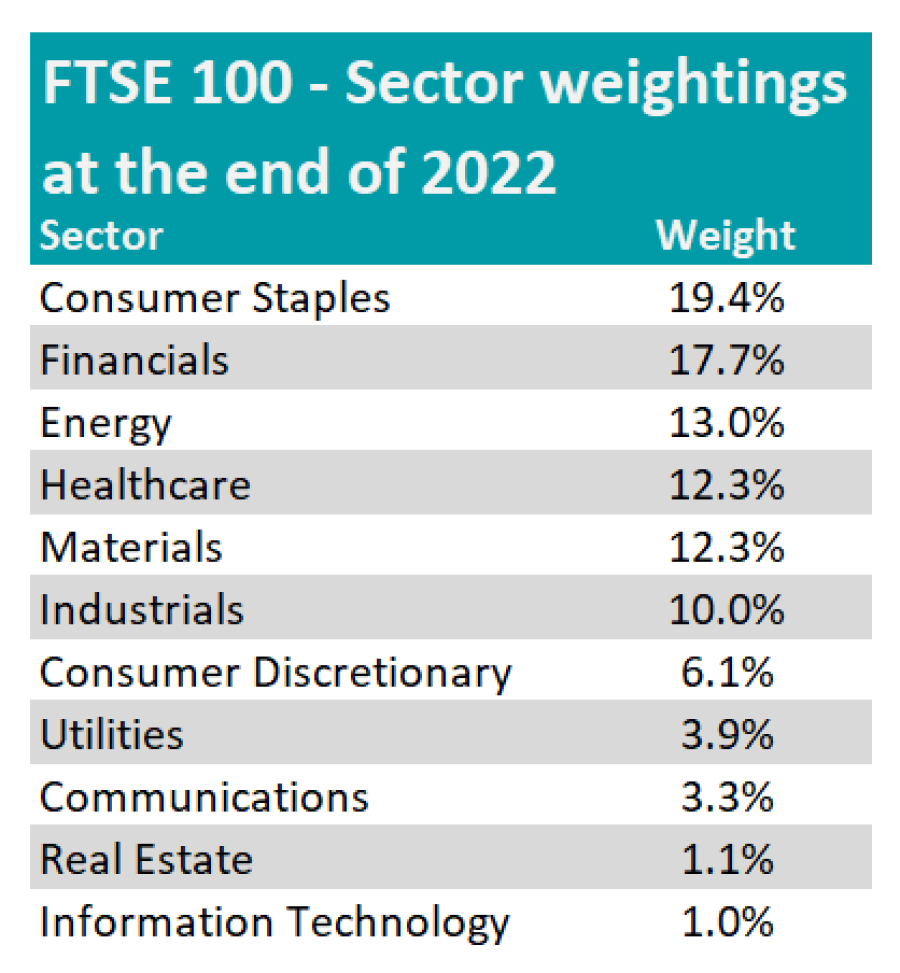

While the UK’s blue-chip index might not have technology leaders like the S&P 500 or luxury giants like the CAC 40, it has its own areas of strength such as financials, energy or consumer staples.

As a result, allocating to the FTSE 100 enables investors to create diversified portfolios and gain exposure to businesses with a global dimension.

FTSE 100 – sector weightings at the end of 2022

Source: Siblis Research

Over five years, £1,000 invested in the FTSE 100 index itself would have turned into £1,173.38, or a gain of 17.3%. But which index trackers have come closest to this result?

There are eight funds in the IA UK All Companies sector that track the FTSE 100 and the one with a return most in-line with the index over the past five years is HSBC FTSE 100 Index.

This £1.5bn fund has turned an initial investment of £1,000 into £1,173.38 (or a 17.2% return) over the period under review, a difference of just £1.68 to the underlying benchmark.

Return of funds over five years for £1,000 invested

![]()

Source: FE Analytics

In its guide to passives, FE fundinfo defines tracking error as follows: “This metric is a measure of the volatility of the difference of the returns between a fund and its benchmark. A fund that perfectly replicates the performance of the underlying index will have a tracking error of 0, as its day-to-day movements will be the same.”

Marks & Spencer UK 100 Companies is the tracker that has deviated the most from the FTSE 100, while Vanguard FTSE 100 UCITS ETF has been the best fund at replicating the performance of the index.

FE fundinfo’s analysts also see fund size as an important metric for passive funds. However, unlike active funds, trackers are better off with a larger size as it allows them to benefit from economies of scale when replicating an index. A bigger size can also be an indication of better liquidity, which implies lower buy/sell differentials.

L&G UK 100 Index Trust, Vanguard FTSE 100 Index Unit Trust and iShares Core FTSE 100 UCITS ETF also came out strongly in this research, with returns on £1,000 that are within £5 of that made by the benchmark.

Vanguard FTSE 100 Index Unit Trust is the cheapest passive fund tracking the FTSE 100 with an ongoing charge figure (OCF) of 0.06%, while iShares Core FTSE 100 UCITS ETF is the largest FTSE 100 tracker with almost £11bn under management.

At the bottom of the table is Marks & Spencer UK 100 Companies, where the £1,153.53 return on an initial £1,000 is £19.85 below the FTSE 100’s return – a gap more than 10 times larger than the best tracker.

It is the most expensive FTSE 100 tracker in the IA UK All Companies sector, with an OCF of 0.51%.