Vanguard’s LifeStrategy range is a favourite among investors who are looking for simplicity and cost-effectiveness. These passive, mixed-asset vehicles come with different risk levels (spanning from 100% to 20% equity risk) and give investors the peace of mind of not having to think about asset allocation themselves.

With £9.1bn of assets under management (AUM), the Vanguard LifeStrategy 40% Equity fund is the second-largest of the range and is usually used by investors who care more about containing losses and fluctuation rather than capturing all of the stock market’s gains.

But these vehicles can be overly simplistic, said Bestinvest managing director Jason Hollands, and some investors will benefit from adding satellite holdings to broaden their exposure to different areas of the market that aren’t covered by the LifeStrategy funds.

Below, three experts recommend which investments to hold alongside this Vanguard tracker. (For the previous two instalments of this Trustnet series, go here for the 100% Equity fund and here for the 60%).

“The Vanguard LifeStrategy funds are designed as one-stop-shop solutions rather than to be blended with other holdings, but they are a bit basic. Vanguard Life Strategy 40% Equity is a fairy vanilla cautious portfolio, investing just in equities and bonds, whereas a well-diversified defensive portfolio should have a little exposure to assets like gold,” said Hollands.

That’s why he suggested the Personal Assets Trust as “a good accompaniment that’s consistent with a more conservative risk profile”. The trust is currently “very defensively positioned” with 34% in US treasury inflation-protected securities (TIPS), 29% in short-dated government bonds (split between gilts and treasuries), 22% in equities, 11% in gold-related investments and 4% in cash.

Performance of fund over 5yrs against sector and index

Source: FE Analytics

“In addition to bringing some exposure to gold to the table, Personal Assets would provide much greater inflation protection through the use of TIPS, where there is no overlap with the Vanguard fund. Its bond weightings are all in short-dated securities too, split equally between US treasuries and UK gilts, whereas the Vanguard portfolio has no duration positioning,” Hollands said.

“The equity exposures also differ. As the Vanguard Life Strategy range invests through index trackers, there is a natural skew towards US mega-cap tech stocks, while the Personal Assets Trust has a more cautious investment philosophy, which would temper Vanguard’s with names like consumer staples giants Unilever and Nestle, Guinness-owner Diageo and credit card giants Visa and American Express.”

Rob Morgan, chief analyst at Charles Stanley, went for a slightly lesser-known fund, Veritas Global Real Return, which could make for an "interesting complementary position in a more cautious portfolio”.

Performance of trust over 5yrs against sector

Source: FE Analytics

The fund invests in high-quality companies with sustainable competitive advantages.

“Lots of funds do this, but there is a twist: volatility is reduced by mechanistically applying a hedge using index futures or put options. This is designed to provide protection or ‘insurance’ against market falls,” he said.

“Net exposure will average 75%, and always be above 45%, so it shouldn’t really be seen as an absolute return fund in the strictest sense. Instead, it defensive equity strategy that aims to capture a portion of the long-term upside from global stock markets in order to beat inflation but reduce the volatility.”

Veritas Global Real Return aims to deliver its return objectives over rolling five-year periods and not a positive return in all market environments. Indeed the fund fell by around 5% over 2022.

“There is quite a lot of risk taken at a stock level with a concentrated portfolio, which is why the fund should be more of a satellite position. The ‘neutral’ position is 75% net long and the managers will flex this according to expected rate of return of the portfolio, which of course depends on valuations. It should therefore appeal to investors who want to participate in stock market returns over the long term but in a more cautious manner.”

Lastly, Anthony Leatham, research analyst at Peel Hunt, went for a combination of three trusts with the objective of increasing income generation through an equally-weighted basket of differentiated, high yield, floating-rate, shorter-duration strategies.

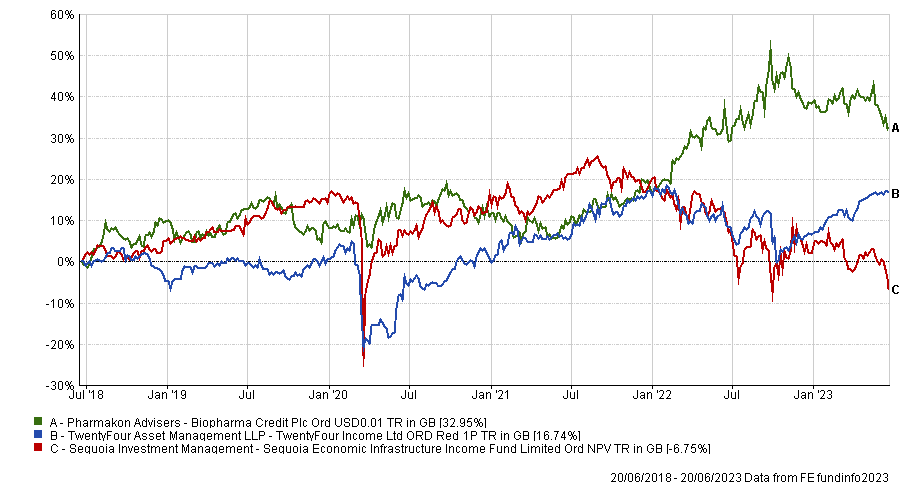

Performance of the three trusts over 5yrs

Source: FE Analytics

His first pick was TwentyFour Income, which offers exposure to floating rates via European asset-backed securities (ABS) markets with a focus on quality.

“The trust trades on a 1.5% premium and offers a dividend yield of approximately 8%. It proved resilient throughout the pandemic, with the credit protection measures built into European ABS structures supporting the cash flow profile,” he said.

The second choice was Sequoia Economic Infrastructure Income, which trades on a wider-than-average 13% discount, despite offering an attractive 8.6% yield.

“With substantial floating-rate exposure (57%), the portfolio is focused on economic infrastructure debt, which has a relatively low correlation to other asset classes and a history of low default rates. This global strategy lends across a diverse range of (defensive) sectors, including TMT, power, transport and renewables. In November 2022, the dividend target was increased 10% to 6.875p, backed by robust dividend cover,” the analyst said.

Finally, Leatham’s third allocation was to BioPharma Credit, which generates income returns from debt investments backed by life science products (drugs, devices and diagnostics) that are already approved, removing clinical trial and approval risk. It is 90% invested in senior secured loans, 81% of which are floating rate, with the balance in fixed-rate loans.

“The trust is currently trading on 8.7% discount and, based on the 2023 dividend target of circa 7%, puts the shares on a prospective yield of 7.6%,” he said.

“By combining these high-yielding strategies, investors can access differentiated sources of yield and boost the income generation of a portfolio, without necessarily increasing equity risk alongside the 60/40 mix of the Vanguard fund.”