UK investors turned cautious in July, according to the latest Calastone Fund Flows index, selling a net £983m over the course of the month despite stock markets remaining steady.

Last month, most major Investment Association sectors rose, with fixed income peer groups struggling, but this was not enough to dissuade investors to keep their money invested.

The £983m net outflow was the largest since September 2022 and means,over the past three months, investors have now removed almost £2bn from UK funds.

In July, environmental, social and governance (ESG) funds as well as UK portfolios took the brunt of the selling. The former suffered their third consecutive month of outflows, the longest run of selling on record for the asset class, with £376m taken out last month and £1bn removed since the start of May.

Domestic funds’ malaise has been much longer. Investors took another £710m out of domestic portfolios in July, the 26th month of consistent outflows.

At £588m, outflows from North American equity funds were the second highest on Calastone’s record, while there was also net selling of European, Asia-Pacific and country-specific funds.

Global funds (£837m), emerging markets (£305m) and technology specialists (£61m) bucked the trend with inflows.

Edward Glyn, head of global markets at Calastone said: “For now, investors remain very risk averse, choosing the strong rally in global share prices as an opportunity to withdraw cash rather than bank on further gains.”

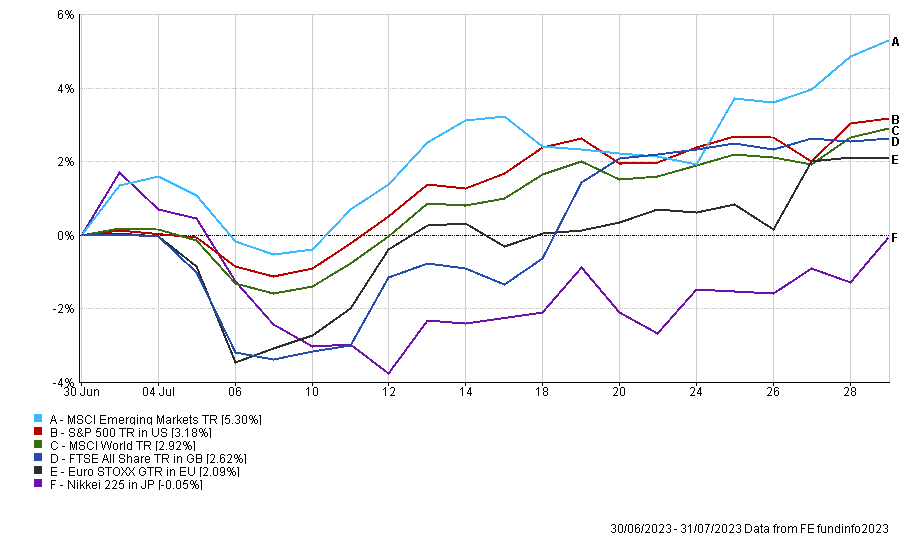

This is despite markets holding up well over the past month, with emerging market equities leading the way, up 5.3%, as the below chart shows.

Performance of indices in July

Source: FE Analytics

Conversely, higher interest rates have pushed bond yields to their highest in more than a decade and investors have sought the relative comfort of fixed income as a result.

Some £347m was added to fixed income portfolios in July, less than half the inflows of the previous month, although there was strong buying towards the end of the month, the report noted.

Oft-forgotten money market funds also were added to last month. In total investors added £403m of net money to the sector.

Glyn said: “The return on a bond can be predicted with near certainty if it is held to maturity, depending on its credit rating, while equity markets are fraught with risk. With the outlook for global economic growth uncertain and corporate earnings estimates being revised down, attractive fixed income yields have tipped the balance for fund investors away from equities for the time being.

“Meanwhile, money market funds offer even higher short-term returns while policy rates are still climbing and their low risk means capital values remain very stable should investors wish to switch back to higher-risk assets in future.”

However, he reminded savers that inflation remains higher than bond yields in many parts of the world, particularly the UK, meaning returns are still negative in real terms.

“But if and when inflation returns to target, locking in at today’s high bond yields for the medium to long term will offer significant benefits to those investors who have committed capital to fixed income funds,” he finished.