Investors face a litany of choice when it comes to picking a fund, but some asset managers have more top-rated portfolios than others.

To assess the most-consistent fund groups, Trustnet looked at those with more than 10 portfolios in their stable with an FE fundinfo Crown Rating.

The criteria for the crowns is made up of three parts, each with a reference to a benchmark – an alpha-based test, a volatility score and a consistency score, calculated over a three-year period.

The top 10% of funds in the Investment Association universe are given a rating of five, with the next 15% allocated a four-crown score.

The next 25% are allocated three crowns, while next and final 25% of funds are allocated a two- and one-crown rating.

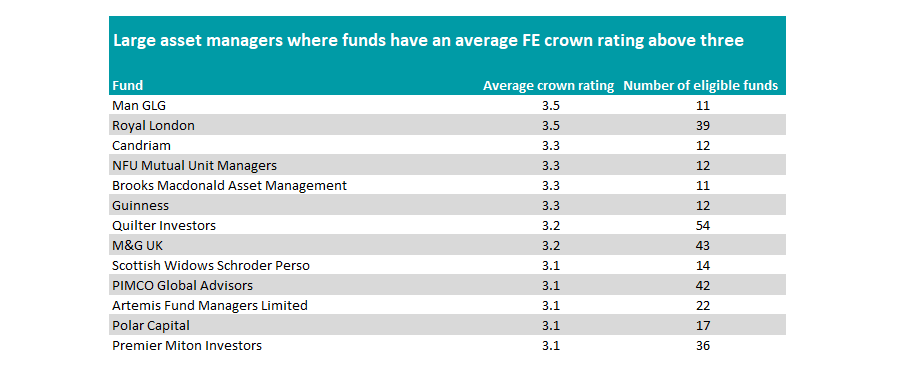

No fund groups with 10 or more portfolios achieved an average rating of four, but Royal London and Man Group came out on top with an average rating of 3.5.

Royal London tops the list however as it has more funds in its house, with 34 portfolios. Of these, nine have a five-crown rating, including the £5.7bn Royal London Short Term Money Market fund, as well as the £4.2bn Royal London Short Term Fixed Income fund. Both are run by FE fundinfo Alpha Manager Craig Inches and Tony Cole.

On the former, analysts at FE Investments said: “The team now takes into account sensitivity to interest rates and credit to position the portfolio. This investment remains a highly secure one. The management team has great access to money market instruments, given the fund size. It is also one of the cheapest funds in the sector.”

Source: FE Analytics

Man Group has fewer funds on the list (10) but an equal average rating, spearheaded by Man Balanced Managed and Man GLG Japan Core Alpha, which were both awarded five crowns.

NFU Mutual, Candriam, Brooks MacDonald and Guinness Asset Management were in joint second with an average crown rating of 3.3.

Quilter Investors, M&G and PIMCO were other asset managers with more than 40 funds to make the list above, while Premier Miton was just behind with 36 qualifying names in its stable.

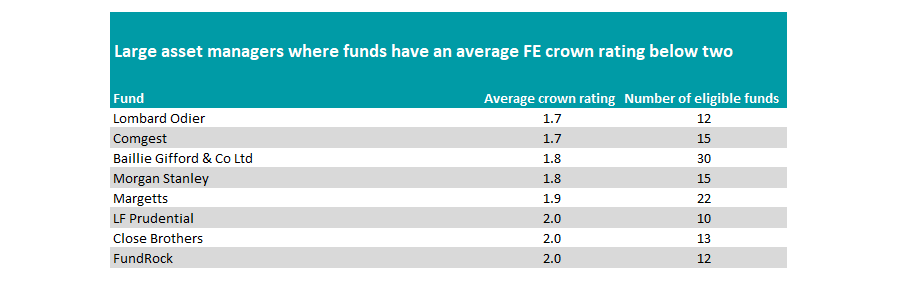

Turning to the fund groups with the most disappointing average crown rating, Lombardi Odier and Comgest share bottom spot with a score of 1.7 crowns across their 12 and 15 respective qualifying portfolios.

Neither have a five-crown rated fund among their stable. At Lombard Odier, seven of its 12 funds have a one-crown rating, while Comgest has 10 such scores.

Source: FE Analytics

It has been a tough three years for fund groups with a predominantly growth strategy. Although these firms had a bumper 2020, when Covid restrictions meant everyone stayed at home and used more technology, these gains have largely washed through as the period in question starts midway through that year.

The following two years have been marred by rising interest rates to combat higher inflation, the war between Russia and Ukraine and a general move away from globalisation towards more onshoring.

This has impacted growth stocks, such as tech names and healthcare companies, and boosted the traditional value companies including miners, financials and utilities.

Edinburgh-based Baillie Gifford – synonymous with the high-growth investment philosophy – has been among the worst hit during this shift. For much of the past decade its funds have had consistently high crown ratings, but at the most rebalance it was revealed that no portfolios in the firm’s 30-strong fund stable had achieved a top five-crown rating.

Only two – Baillie Gifford Sustainable Income and Baillie Gifford UK Equity Core – had a four-crown rating, while 17 had the lowest score of one.

Morgan Stanley – another firm with a penchant for high-growth investing – has also suffered. Both firms have an average crown rating across their portfolios of 1.8.

Tomorrow Trustnet will reveal the boutique managers with between two and 10 funds that have the highest and lowest average crown ratings.