Japan was unloved by global investors for much of the past decade but a rigorous corporate governance shakeup has put it firmly back on the radar this year.

Two of the nation’s largest indices – Nikkei 225 and TOPIX – are up 26.8% and 24.8% respectively in 2023 as international investors came flooding back to the region.

Various failed attempts at reform have left markets disappointed in the past, but if it can truly deliver this time around, international investment could come flowing in on a large scale, according to Albemarle Street Partners chief investment officer Fahad Hassan.

Total return of indices in 2023

Source: Google Finance

Hassan said: “Though risks around sustaining momentum remain, catalysts have aligned to make Japan look investable again.

“If the economy and corporate performance keep improving, don’t count out Japan claiming a bigger share of the ACWI after years of being forgotten. Japan’s rally may have legs if fundamentals strengthen.”

Likewise, IBOSS CIO Chris Metcalfe said he is confident that the rally into Japanese equities isn’t just a 2023 story, but the start of a long-term interest into the region from global investors.

He upped exposure to Japan across his portfolio range again in August as the long-term investment case for the region continues to strengthen.

“We have become increasingly convinced by various managers and commentators that Japanese companies will follow through on corporate reform,” Metcalfe said.

“This, coupled with a more general shareholder-friendly approach, has led us to revisit the overall investment case for Japan. We see this increased allocation as a long-term change, not a short-term tactical one.”

This was echoed by James Sullivan, head of partnerships at Tyndall, who said the widespread interest in Japan should not be brushed off as a passing fad.

Instead, it is important to know that “the renaissance we are seeing in Japan is actually the fruition of many years of hard yards and improving attitudes towards shareholders”.

Nevertheless, Sullivan did note that the flurry of enthusiasm for Japanese equities this year may have over-inflated some names.

Kobe Steel, Advantest and Toyota Tsusho were among the most popular stocks in the Nikkei 225 over the past year, with their share price rocketing 201.8%, 139.2% and 84.9% respectively.

Share price of stocks over the past year

Source: Google Finance

Sullivan added: “Things are looking far better for Japan today than they have for some time in terms of sentiment, however there is a short-term fear that valuation multiples may have overshot in the short term as the investment community jostled for increased exposures.”

However, others might argue that Japanese equities still looks very cheap despite the boom in sentiment this year.

Orbis Global Equity manager Ben Preston more than doubled the Japan exposure of the MSCI World benchmark, allocating 14% of his portfolio to the region.

He and many other international investors may have leapt into Japan this year, but Preston said there are still an abundance of cheap shares there that have a lot of room for growth.

“If you look beyond the favourite stocks of the world – whether that’s Apple or Microsoft – you can get some great bargains when you go where others fear to tread,” he said.

“I think one of the best areas for that is Japan, where investors have been unexcited for many years but you’re now seeing people picking up some great value shares there.”

While foreign investment may have turbocharged some of Japan’s most renowned names, there is still many strong companies that have yet to make it onto the global radar, with the Orbis manager noting that the price to earnings ratio between Japan and the rest of the developed world is still “very attractive” and earnings per share have grown faster in Japan than in the US, “which people still struggle to believe”.

The comparatively overpriced stocks in the US – which is the largest constituent in the MSCI ACWI, accounting for 62% of the index – could make Japan a much more attractive alternative.

US equities have rebounded strongly this year after a poor 2022, but Preston said they are still too expensive and have some way to fall yet before they reach a realistic valuation.

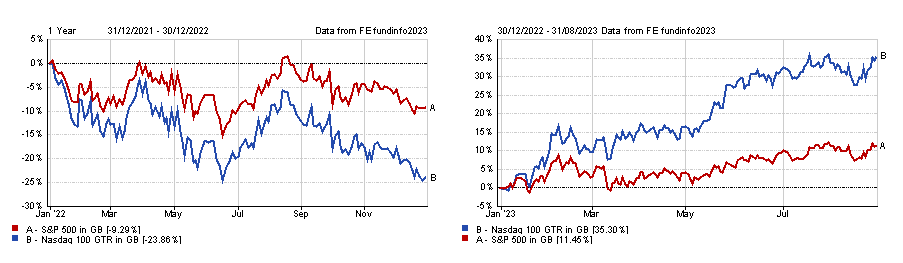

Total return of indices in 2022 and 2023

Source: FE Analytics

In the meantime, global investors may try to find strong companies at a good price elsewhere, which could take some of concentration away from the dominant US towards places like Japan.

Preston added: “When bubbles unwind, they don't always do so in a straight line and if you look back at previous bubbles you'll see that there was a resurgence in stocks after the initial decline only for them to disappoint all over again.

“So this year’s rally is not an unexpected development and it doesn't change the big picture that those large-cap tech stocks in the US have been overvalued for some time and will continue to come back to Earth.”