Income strategies have protected investors significantly more than any other strategy over the past decade, but their total returns have paled in comparison to the high-growth funds that shot higher when the S&P 500 was flying, research from Trustnet has found.

In this series, we use the upside capture ratio to identify the funds that have made the most money during rising markets and downside capture ratio for those that did well when markets fell.

An upside capture score of greater than 100% means a fund has made more than the market when it has been rising. The opposite is true for the downside capture ratio. Both scores are calculated against a relevant benchmark: for the IA North America sector, we used the S&P 500 index. Previously we looked at emerging markets funds and global portfolios.

At the top of the pile were a pair of tracker funds that follow the tech-heavy Nasdaq 100. The names at the top of the index, including the likes of phone maker Apple, software firm Microsoft, online retailer Amazon and computer chip maker Nvidia, have rocketed in the past decade.

For much of this time, the era of loose monetary policy, including low interest rates and quantitative easing, meant investors had to project way into the future to get growth.

This bolstered these tech names, with investors willing to back them on potential, as immediate gains from bonds and dividend payers was relatively anaemic.

Gains were turbocharged during the pandemic due to lockdowns, but waned in the aftermath as interest rates rose to combat inflation and investors looked towards the traditional value names to recover.

In 2023, these companies have rocketed again, however, on the back of an artificial intelligence (AI) boom that has swept a number of tech stocks to new highs.

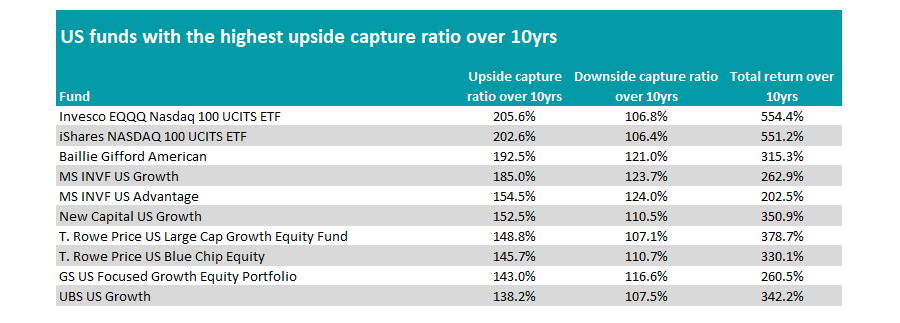

Invesco EQQQ Nasdaq 100 UCITS ETF has been the biggest beneficiary from the latest sector recovery. It tops the list of funds with the highest upside capture ratio when the S&P 500 is rising (205.6%) and has been the best returner in the IA North America sector over the decade, up 554.4%.

Narrowly in second was iShares NASDAQ 100 UCITS ETF. It too has an upside capture figure above 200%, which means that it made double the returns of the S&P 500 index during the good times.

Both also have reasonable downside capture ratios just above 106%, meaning they fell by slightly more than the S&P 500 index when it dropped, but by far less than they gained on the upside.

Source: FE Analytics

The first active fund on the list of those making the most of the good times is Baillie Gifford American.

Up 315.3% over 10 years, the portfolio run by Gary Robinson, FE fundinfo Alpha Manager Tom Slater, Kirsty Gibson and Dave Bujnowski has been a high risk, high reward proposition, with its upside capture ratio and downside capture ratio on the high side.

The Edinburgh-based fund group has had a tough time in the past few years as its growth style has come under pressure, but this fund remains in the top 20 of its sector over the decade.

Other names on the list with similar characteristics to the Baillie Gifford fund include MS INVF US Growth and T. Rowe Price US Large Cap Growth Equity Fund.

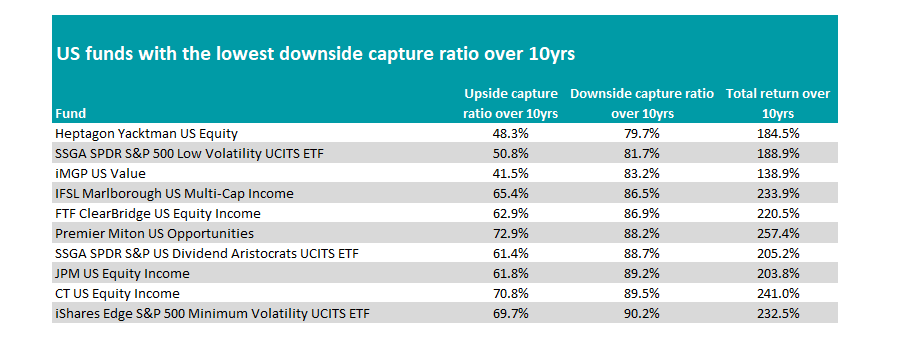

Turning to those that protected on the downside, income strategies tended to be investors’ best bet as they avoid the high-octane tech stocks, which typically don’t pay a dividend – instead choosing to use any spare cash to reinvest in the business.

IFSL Marlborough US Multi-Cap Income headlines the list. Managed by Brad Weafer, Tim Farina and Tim Robinson, the portfolio has the lowest downside capture ratio of the income specialists (86.5%), just ahead of FTF ClearBridge US Equity Income, JPM US Equity Income and CT US Equity Income. Passive strategy SPDR S&P US Dividend Aristocrats UCITS ETF also made the list.

Source: FE Analytics

Heptagon Yacktman US Equity had the lowest downside capture ratio of the entire IA North America sector at 79.7%, but its lack of tech names meant that it struggled to keep pace when the S&P 500 shot higher.

The best performer on the list however was Premier Miton US Opportunities, which protected investors but still made a meaningful return. Up 257.4% over 10 years, the portfolio managed by Nick Ford and Hugh Grieves still trailed the index’s 284.9% however.