Cash might be one of the most attractive assets right now, but investors need to be aware that this could quickly change to their detriment, wealth manager Quilter has cautioned.

The interest rate hiking cycle that central banks have embarked upon in recent years means investors can earn more than 5% on cash deposits. Unsurprisingly, 2023 has witnessed large sums of money flowing into cash ISAs and a jump in investor interest in money market funds.

Lindsay James, investment strategist at Quilter Investors, said: “For most people, cash feels like a safe place to be, and with rates where they are at the moment, many have taken the decision to take 4% or 5% per year with what appears to be very little risk. However, there are a couple of things at play here that suggest sitting in cash isn’t quite as risk free as people think.”

The first risk is inflation, which erodes the value of cash over time. While cash rates are currently high relative to recent history, there are still below the headline rate of inflation – meaning savers are still losing money in real terms.

Quilter also pointed to the fact that the Bank of England held interest rates at 5.25% at the last meeting of its Monetary Policy Committee. There is speculation that interest rate hiking cycle is close to its end and that the Bank will be forced to cut rates at some point in 2024 if the economy weakens.

This causes the problem of ‘reinvestment risk’ – as soon as interest rates do come down, savings rates will be the first to be brought down and the return on cash slashed.

The final problem is missing out on the initial market reaction to lower interest rates.

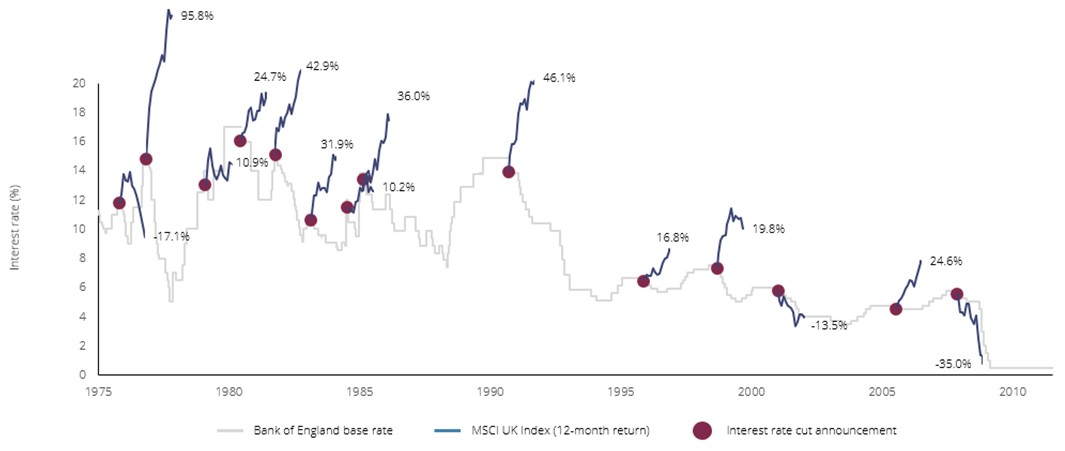

One-year returns after the first cut in interest rates following series of rate hikes

Source: Quilter Investors

“Cuts to interest rates are likely to act as immediate stimulants to financial markets and thus if you are sat in cash, you will likely miss out on the best days – something that can cost you significantly in the long run,” James said.

“Missing out on the recovery, which is often where the best returns can be made, can considerably impact the value of your pot when it comes to utilising it. This will also impact those in fixed-term savings deposits, who have no choice but to miss out on any market recovery that does take place.”

Research by Quilter suggests returns have been particularly strong in the year after the Bank of England cut interest rates following the end of the rate hiking cycle.

The MSCI UK index returned 46.1% in the 12 months following the first cut in rates in 1990s while the UK stock market jumped 95.8% after rates were cut from their 15% peak in the mid-1970s.

The wealth manager did point out that not all moves are as extreme as these two examples but argued that the market reaction is strongest in the early part of a rate cutting cycle.

A similar trend can be seen outside of equities. A 10-year gilt bought at a yield of 4.8% would generate a return of approximately 13% if the yield on the bond fell by 1%, showing the benefit of a rate cut to those who remained invested in fixed income.

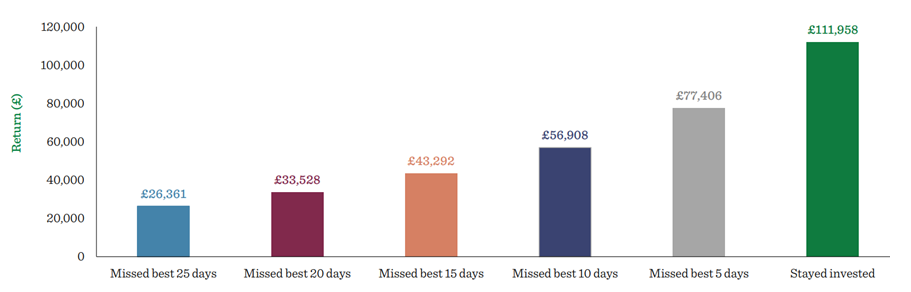

These findings highlight the importance staying invested in stocks and bonds regardless of where cash rates sit today, according to Quilter. The chart below shows that missing just the 10 best days in the market could result in an investment being almost halved in value compared with remaining invested in the stock market.

Impact of being absent from the market

Source: Quilter Investors as at 30 Jun 2023. Total return over between 30 Jun 1993 and 30 Jun 2023 on initial investment of £10,000 into the MSCI AC World

“The warning signs are clear for investors,” James finished. “Investing is a long-term game, but it is one that gives you the best opportunity to grow your wealth in real terms regardless of inflation. Cash may seem like a safe asset to hold but have too much of it at your peril.”