Interactive investor customers have shown a preference for income strategies in October, with popular growth strategies Fundsmith Equity and Scottish Mortgage losing their position as the most bought open-ended fund and investment trust.

This changing of the guard reflects the shift from growth to income strategies that has been playing out for around two years as investors have been trying to protect their portfolios from soaring inflation and have looked for funds and trusts offering attractive yields.

Both Fundsmith and Scottish Mortgage remain popular however as they have only dropped one place to second in their respective rankings.

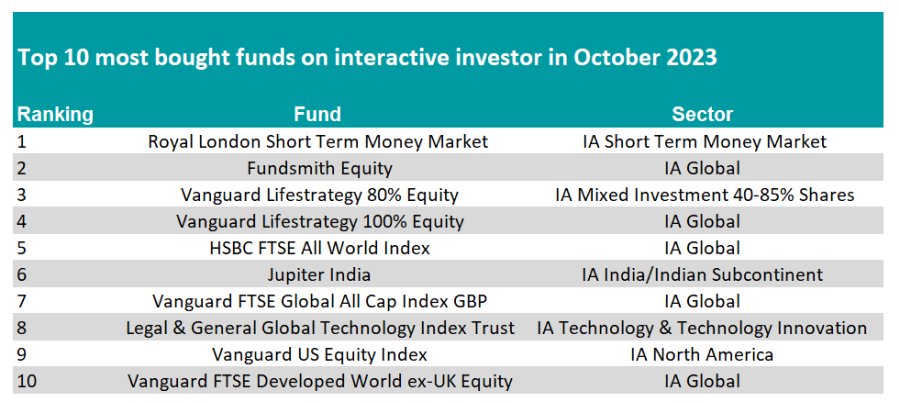

Fundsmith had been the most popular fund since March 2021 but the global equity strategy lost its crown to Royal London Short Term Money Market in October.

The money market fund entered interactive investor’s top 10 most-bought table in April and has been occupying the second spot over the past couple of months.

Money market funds’ yields rise as interest rates climb, which has propelled the Royal London fund to the ranking’s top spot. Its current yield is 5.2%.

Nonetheless, global funds continue to dominate the ranking, as seven of the top 10 most bought funds on interactive investor in October were from this sector.

Top 10 most bought funds on interactive investor in October 2023

Source: interactive investor

Moreover, seven of the 10 bestsellers were passive strategies, showing that this investment approach remains popular with investors. Five of those seven passive funds were from Vanguard.

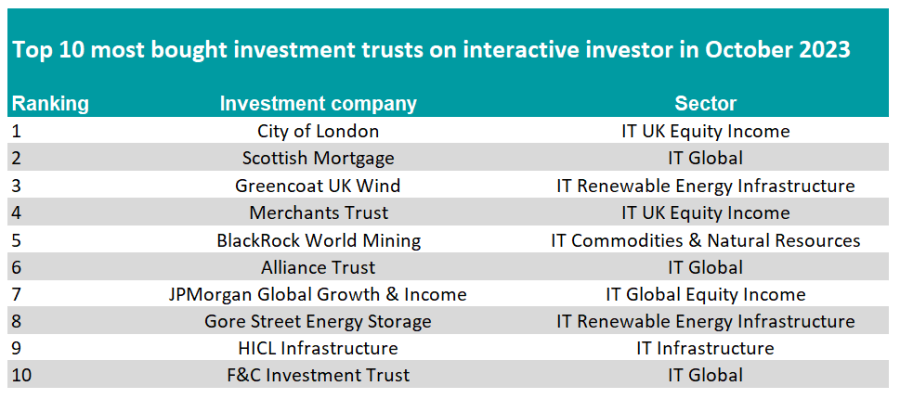

Meanwhile, City of London, a UK equity income strategy, has dethroned Scottish Mortgage which had been the most bought investment trust since June 2019.

City of London, which has been managed by Job Curtis since 1991, is an Association of Investment Companies (AIC) dividend hero having increased its payouts for 57 consecutive years. It regularly features among the top of interactive investor’s bestsellers.

There were six funds with attractive yields among the 10 most-bought investment trusts in October including Greencoat UK Wind, BlackRock World Mining and Merchants Trust, which offer payouts of 6.4%, 7.4%, and 5.7% respectively. The latter entered the list in October.

Two other entrants in the list are infrastructure and renewable energy infrastructure strategies HICL Infrastructure and Gore Street Energy Storage, which have yields 6.9% and 12.3% respectively.

Top 10 most bought investment trusts on interactive investor in October 2023

Source: interactive investor

Interactive investor warned, however, that high yields are not guaranteed and can, in some instance, be a warning sign that the income on offer is not sustainable.

It added that there is no guarantee that high yields will result in market-beating returns from a total return perspective – when both capital and income are combined.