Investment consultancy and research company Square Mile has backed, Monks, Keystone Positive Change and Polar Capital Technology after it recently added investment trusts to its Academy of Funds recommended list for the first time. The global portfolios were among the 18 trusts to gain ratings at the first time of asking.

Monks, from the Baillie Gifford stable, received an ‘AA’ rating, which is the highest rating of the three trusts. An AA rating means that Square Mile has a “high confidence” that a fund will meet its stated objectives over an investment cycle. In this case, Monks aims to outperform the FTSE World Index by at least 2% per annum over rolling five-year periods.

Managers Malcolm MacColl, Spencer Adair and Helen Xiong focus on growth companies and hold between 70 and 120 positions in their trust. They typically allocate 2% or more to their highest conviction ideas but 1% or less to holding they perceive as riskier.

The portfolio also holds high risk/high reward ideas, but those positions tend to be small at circa 0.5%. Yet, those riskier investments may account for 15% to 25% of the overall portfolio. The managers also aim to diversify the drivers of growth to avoid situations where only a few themes would dominate the portfolio.

While the trust should perform well when the market steadily advances, Square Mile warned that it is also likely to lag when the market gets ahead of the fundamentals or if it sells off heavily.

Square Mile analysts added: “This is a long-term strategy and holders should bear in mind that often the most attractive opportunities present themselves during periods of market distress. This could exacerbate short-term losses and holders should not expect smooth quarter-on-quarter returns.”

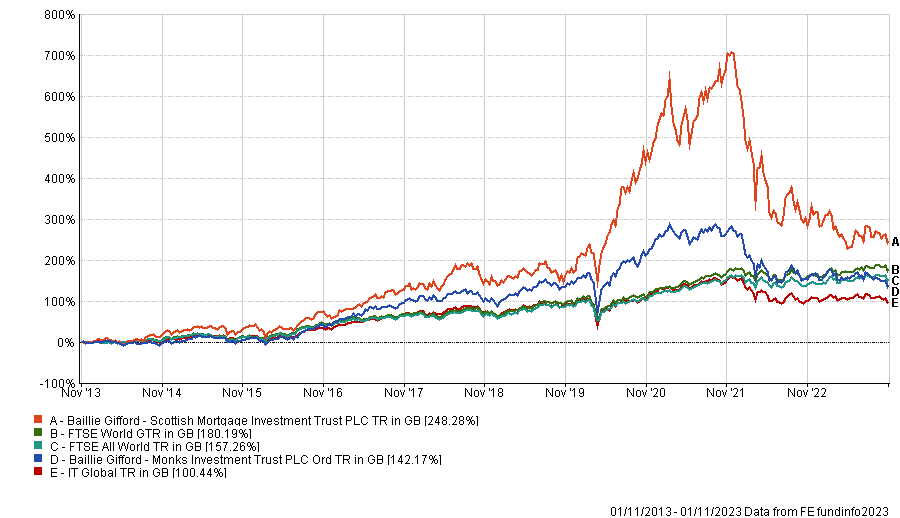

Performance of trusts over 10yrs vs sector and benchmark

Source: FE Analytics

Over the past decade, Monks has outperformed the average investment trust in the IT Global sector but has failed to beat the index. It also lags Scottish Mortgage – its largest rival stablemate – by more than 100 percentage points.

Another stablemate of Monks, Keystone Positive Change received a ‘Responsible A’ rating, highlighting Square Mile “confidence” that the trust will reach both its financial and responsible targets over an investment cycle.

Managers Kate Fox, Lee Qian and Edward Whitten build their portfolio around four impact themes: social inclusion & education, environment & resource needs, healthcare & quality of life and “base of the pyramid”.

Companies also have to demonstrate their growth potential through the ability to double their share price over five years and have a minimum market cap of $500m.

The portfolio holds between 25 and 50 stocks, but no individual stock should account for more than 10%. Moreover, the trust must invest in a minimum of six countries and six investment sectors to ensure diversification.

The trust also has a mandate to invest up to 30% in unlisted companies, which is one of the main difference with its open-ended version Baillie Gifford Positive Change. While private companies currently represent a small portion of the trust’s assets, Square Mile does not exclude that this allocation could increase.

Square Mile also stressed that the investment team has only been responsible for the trust since February 2021 and that its rating is, therefore, based on the longer track record of the equivalent open-ended fund.

Performance of trust since February 2021 vs sector and benchmark

Source: FE Analytics

Although the trust has underperformed both its sector and benchmark since the new management team took over, Square Mile said that the trust has the “right ingredients” to deliver on its stated objectives and should serve investors well over the long term.

Unlike the two previous trusts, Polar Capital Technology focuses on tech names and sits in the IT Technology & Technology Innovation sector. Square Mile awarded the trust an ‘A’ rating, stressing that it should be able to meet its objective over the long term but that there will be times when it will fall short.

Analysts at Square Mile said: “Our expected outcome for the fund of delivering 2% annualised outperformance of the Dow Jones World Technology index per annum, is ambitious and challenging in equal measure. However, the quantum is reflective of how active the managers are in their management of the fund.

“Investors should note that given the fund tends to have a bias to smaller and medium-sized businesses within the sector, the fund is likely to lag when market performance is led by the largest companies in the index.”

In spite of this, Square Mile highlighted the size of Polar Capital’s technology investment specialists and the experience of the trust managers as distinct advantages.

Managers Nick Evans and Ben Rogoff use a bottom-up stock selection to build their portfolio but also consider top-down considerations such as investment themes as well as areas of sustainable secular growth. They typically hold between 70 and 90 stocks in the trust, with individual positions rarely exceeding 3% of the portfolio.

To make it in the portfolio, potential investee companies should be profitable, rapidly growing and have enough funding to support their growth trajectory. The managers also prefer companies operating in businesses with high barriers to entry and tight management cost controls.

Performance of trust over 10yrs vs sector and benchmark

Source: FE Analytics

Square Mile also highlighted the team’s strong sell discipline, as the managers will set a price target for each stock, which varies depending on the sector on which the investee company operates.

The trust has returned 362% to investors over 10 years and has been one of the best performing investment trusts of the past decade, only lagging 3i Group and Allianz Technology Trust.