The performance of US technology stocks linked to artificial intelligence (AI) has dominated the headlines this year but for Alex Wright, manager of Fidelity Special Values, this is mostly due to a temporary resumption of quantitative easing in the US and is not a long-term trend.

In fact, the FE fundinfo Alpha Manager believes that the US market has become too expensive and that investors might want to revisit undervalued opportunities in their home market.

Below, he explains why he sold Marks and Spencer and Kingfisher, how the US is the biggest risk to UK companies and explains why investors need to take valuations into account again.

Performance of trust over 10yrs vs sector and benchmark

Source: FE Analytics

What is your investment process?

I'm looking for things that other people aren't willing to look at because there's an issue, which can either be specific to a company or industry-wide.

We deliberately look into unloved areas and decide where we think the market consensus is wrong. The heart of the process is to look beyond the headline issue for what we think are good companies but not priced as such.

We're generally ready to wait three to five years for a turnaround in perception and fundamentals to happen. But as things often start working out faster, the average holding period is actually slightly more than two years.

Why should investors have your trust in their portfolio?

It's quite differentiated compared to what most investors own. If you look at what people have been investing in over the past 10 years, it's been US growth focused.

Even in the UK, which is often considered as a more value-oriented market, the biggest funds actually invest in growth. Looking specifically at the investment trust space, we only have one truly value competitor, while the others are either growth or a blend of both.

You hold a few non-UK stocks. Why is that?

We have the ability to invest up to 20% overseas, with much of this allocation currently in Europe where there is value as well. We use this overseas exposure for sectors where the choice is limited in the UK or when we find a particularly attractive name.

For instance, we hold OMV, a European oil company, which we think is much more cheaply valued than Shell and BP. We've also got Roche and Sanofi in pharmaceuticals, which we believe are more diversified and much better value than AstraZeneca in the UK.

A lot of people claim we are underweight the UK because we own these non-UK stocks. Yet, since we have a mid- and small-cap bias, which tend to be more domestically focused, we're actually overweight the UK in terms of UK pound based earnings. We're about 40% exposed to the UK economy, whereas the market is about 25% exposed.

Are there positions you’ve exited in the past 12 months?

There was a huge amount of wariness around the UK economy and UK consumer businesses last summer, so domestic consumer-facing businesses were very cheap. As a result, we built positions in Kingfisher and Marks & Spencer but sold them over the past 12 months.

In the case of Marks and Spencer, it’s very much because part of our thesis played out. The turnaround on the food side has really come through and that's been reflected in the stock price at the same time. But some of the things we thought would happen in terms of the turnaround on the Ocado business hasn't come through. We were also a little bit concerned about the clothing and home side.

The situation with Kingfisher is a little bit different. Our thesis hasn’t materialised. We thought people would spend more on DIY as they are spending more time at home since Covid but it hasn’t really happened. Kingfisher’s market share has been pretty stable and declined a little bit in continental Europe. We've sold out because the upside isn't there and probably lost about 10% to 15% on that position.

The UK market has been unloved for several years. Could that continue?

The good news is that underperformance bottomed out in mid-2020. The market was then flat for about 12 months and it has been marginally outperforming global markets since mid-2021. So after a very bad period, things are starting to look up a bit.

The key risk is the global economy and particularly the US economy. US economic growth has been surprisingly robust over the past 12 months and people are not expecting a recession anymore. It really goes against economic history. A rate hiking cycle of this magnitude has always caused a recession. With the macro, you can never say never, it could be different this time, but it rarely is.

The US is the world's biggest economy and the second biggest market for UK-quoted companies, so that’s the key risk on an absolute basis.

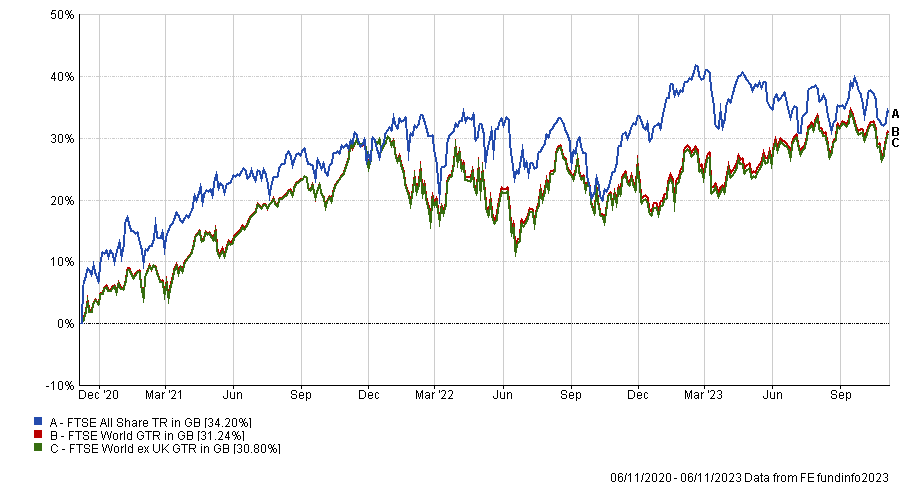

Performance of indices over 3yrs

Source: FE Analytics

What could help UK equities?

People need to reallocate on the basis of valuations. We started to see that happening in 2022 until we had a resumption of quantitative easing this year in the US when Silicon Valley Bank collapsed. It took us back to the kind of market we had post 2016 where there were huge amounts of money being pumped into the US economy.

We saw people getting excited about AI stocks this year, but I think that's just a narrative. In reality, what happened is that the Fed injected money into the economy. Because of where inflation is, they’ve stopped it and went back to quantitative tightening.

I don't see an environment where people could keep ignoring valuations. Therefore, I don’t see the world's most expensive market continuing to outperform either.

You said in 2021 that private markets are the biggest value bubble. Is it still your view?

The issue with private markets is that they take their cue from the US market. Private markets have deflated through 2022 and 2023, but I think there's an awful lot further to go. Even though we've seen poor performance, we haven't seen anything like a proper reset.

I would be very wary of venture capital-based investments. You might see a lot of UK investment trusts trading on huge discounts, like 50% or 60%, but that's because their underlying assets are still overvalued by probably 50% or 60%. Those very large discounts are rational. So, I would stick by that view.