There have been more rate cuts in September and October around the world than rate hikes and in the next 12 months there will be more to come, according to FE fundinfo Alpha Manager Ariel Bezalel, who runs the Jupiter Strategic Bond fund.

In his view, markets today are pricing in “too dovish” rate cuts compared to the extent of what’s to come.

“A global rate-cutting cycle has now begun, with some emerging markets having already defeated inflation,” he said. “It’s only a matter of time before one or two countries will start to cut rates in the developed world too. We will see much more aggressive cuts in the next 12 months than everyone’s expecting.”

He predicted the European Central Bank (ECB) will cut rates in the first half of 2024 and the Federal Reserve to do the same in the second quarter of the year, which “should help facilitate the ongoing rally in government bond markets”.

But that’s where the optimism ends, as we are now entering “a pinch point” where we're going to see much more evidence of economic growth around the world slowing down.

“In Europe today, growth has already pretty much stalled out; China has been wrestling with the property bubble and bust; and in America there are lots more signs that the jobs market is now starting to turn,” Bezalel said.

“With the rate hikes we've had over the past couple of years, a recession is inevitable, and inflation is set to crumble over the next year or so.”

In a scenario with increasing corporate warnings and waning global demand, the manager said although there are pockets of interest in corporate credit, cyclicals are “best avoided”. As such, he’s been shifting to more defensive sectors, led by pharmaceuticals and telecoms.

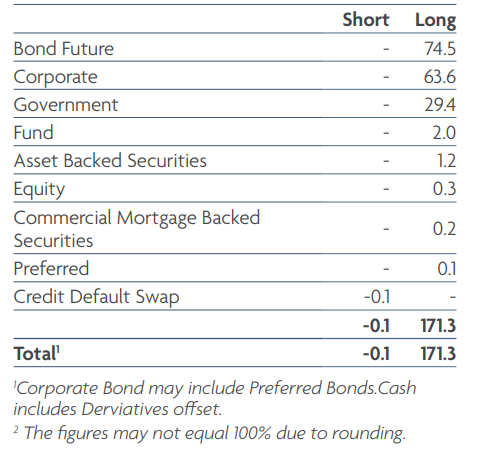

The fund is taking the longest duration its history (9.4 years), with a breakdown of its allocation highlighted below.

Asset allocation (% of net assets) of the Jupiter Strategic Bond fund

Source: Jupiter, as of 31/10/2023

Outlooks are still murky enough for Alexander Pelteshki of the Aegon Strategic Bond, to remain even more cautious. While he does think that it’s “hard to imagine” base rates going up any further from here, he believes credit conditions will remain tight in 2024.

“We have seen the last innings of this very unusual and aggressive interest rate hiking cycle and may well have seen peak rates in most major economies now. However, bank lending surveys in the US and EU show continued tightening of credit conditions and reduced corporate and consumer loan demand,” he said.

“This indicates the full impact of monetary tightening has yet to fully travel through the system, so we can expect reduced borrowing to continue into 2024, negatively impacting economic growth.”

But while bank lending surveys may be useful indicators of credit conditions, trying to predict whether major economies are in for hard or soft landings is “tricky”, and investors shouldn’t allocate too heavily one way or another, because trying to solve categorically in favour of either could leave one exposed to substantial risks should they be wrong.

“In a soft-landing scenario, growth would be relatively modest, but not negative, while inflation would likely be contained at around current levels and/or still modestly declining,” said Pelteshki.

“However, in a hard-landing scenario, growth would be negative, demand would fall and with it employment as well as inflation.”

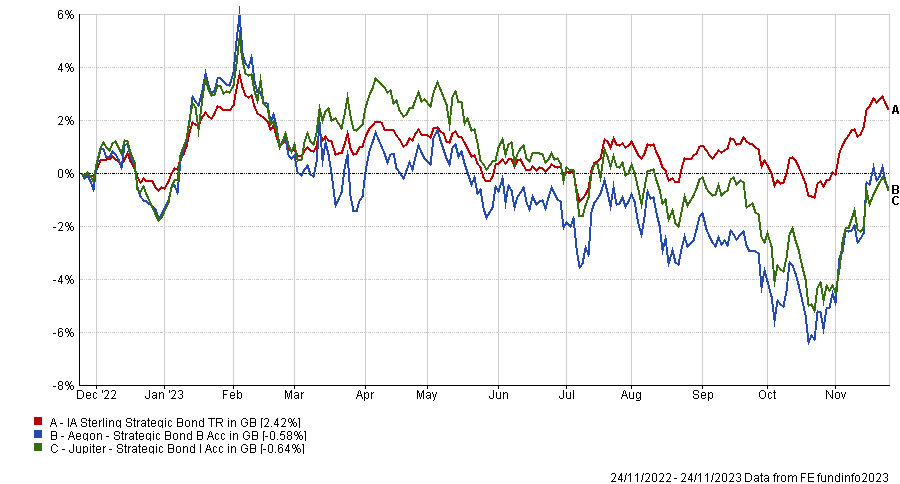

Performance of funds vs sector over 1yr

Source: FE Analytics

In the former case, there would be minimal room for interest rate cuts in the US, with the first coming towards the tail end of 2024, the manager explained.

In the latter, government bonds would likely perform best, as central banks would be forced to ease materially, investment-grade credit would fare second best, while high yield and equities would fare worst, owing to depressed revenues and a rise in defaults.

With these scenarios in mind, an allocation to fixed income “arguably offers the best risk-adjusted return potential that it has had for some time”.

“The asset class currently offers access to historically elevated levels of yield, without over-committing to a binary outcome. Weighing the balance of probabilities from a risk and reward perspective, we find fixed income to be as attractive as it has been in well over a decade,” he concluded.