Tech stocks, European companies and the commodity-heavy Latin America sector were the main beneficiaries of a bullish month for markets, according to data from FE Analytics.

November was a strong month for investors as central banks in the US, UK and Europe paused interest rate hikes, bolstering growth stocks. Markets tend to price in rate movements in advance, so the strong month for some areas of the market could be a reflection of the belief the hiking cycle is now over.

Inflation figures – particularly in the UK – have also come down, with the latest consumer prices index reading of 4.7% significantly lower than this time last year. The same was true in the US, where inflation stands at 3.2%, and Europe (2.4%).

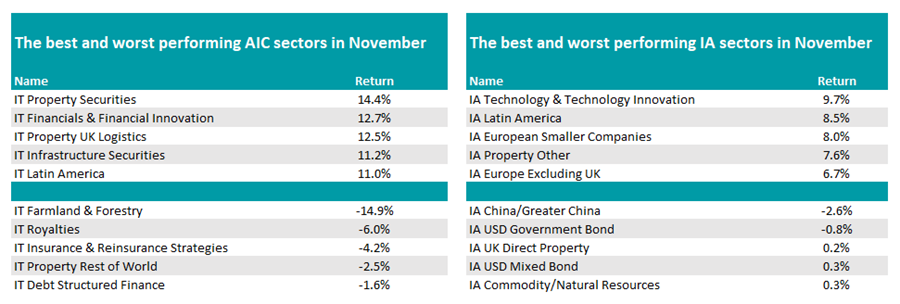

Technology names led the way forward last month at a sector level, with IA Technology & Technology Innovation at the top of the charts. The average fund in the peer group made a 9.7% over the course of the month.

These stocks tend to benefit most when interest rates are paused as their future earnings are measured against the return investors can get now for little risk.

Source: FE Analytics

IA Latin America came in second after another strong month for commodities. Ben Yearsley, director at Shore Financial Planning, said: “Gold had a good month gaining $61 to finish at $2,055 an ounce as geopolitical tension and possible falling rates are good for the shiny stuff.”

However, he noted that it was “slightly strange” given the new Argentinian president announced he was abolishing the central bank, while the price of oil fell in November.

“Europe and property were the other notable areas of good performance last month – it’s amazing what a perceived peak in rates does for certain sectors. Bad news, i.e. the likelihood of a European recession, is now good news again as it will herald rate cuts,” Yearsley added.

Indeed, IA European Smaller Companies and IA Europe Excluding UK both cracked the top five in third and fifth place respectively, with IA Property Other splitting the two.

Only two sectors made a loss last month. IA China/Greater China and IA USD Government Bond fell 2.6% and 0.8% respectively.

On the trust side, the ++property and infrastructure sectors did well, while specialist areas such as IT Farmland & Forestry and IT Royalties took the biggest dive.

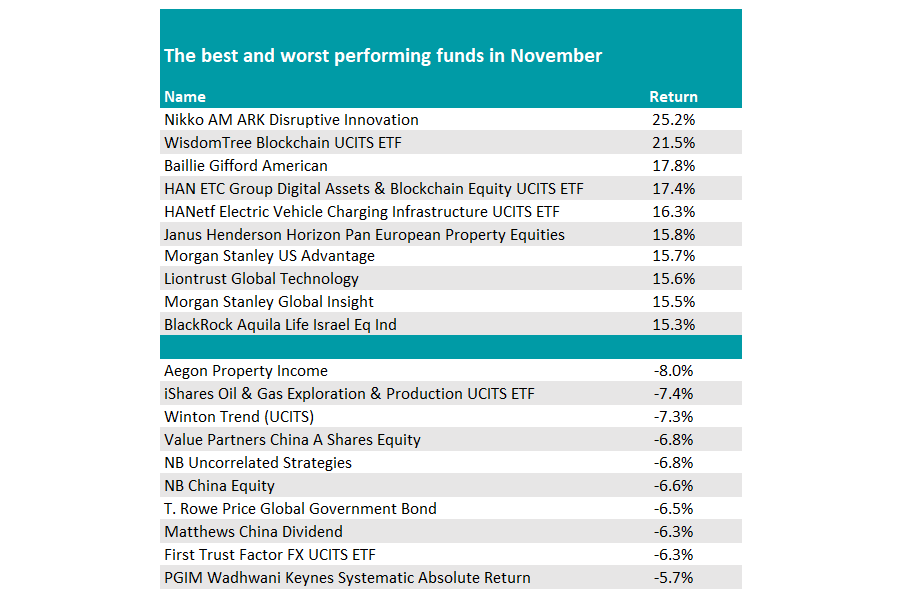

Turning to individual funds, Nikko AM ARK Disruptive Innovation took the top spot with a return of 25.2% while there were also strong gains for the likes of Baillie Gifford American and Morgan Stanley US Advantage, which have been volatile over the past few years.

These funds are heavily skewed towards the technology sector and have had strong months mixed in with some particularly poor ones in recent years. While central bank rate hikes have been a headwind, the rise in artificial intelligence (AI) has powered some pockets this year.

“With traders pencilling in a first US rate cut in May 2024 and probably only two cuts in total next year, it seems strange high growth stocks have rebounded so much. The cost of capital doesn’t fall that much,” Yearsley said.

Source: FE Analytics

Conversely, the bottom end of the table was more idiosyncratic. China was the only consistent theme, with three names in the bottom 10: Value Partners China A Shares Equity, NB China Equity and Matthews China Dividend.

Yearsley also noted the NB Uncorrelated Strategies fund, which fell almost 6%. “It did live up to the name last month as most funds went up, it went down,” he said.

On the investment trust side, The Schiehallion Fund shot higher after a disappointing few months near the foot of the table. Three times this year the trust has made a 20% or more loss in a single month, but in November the private equity specialist it rose 45.9%. The soon-to-depart from Jupiter Chrysalis trust also made the top five with a gain of 24.5%.

Yearsley noted: “From an induvial trust perspective, it was the beaten-up unloved trusts that rebounded the most.”

Source: FE Analytics

On the downside, Reconstruction Capital made a 41.4% loss, while Digital 9 Infrastructure and Grit Real Income Group were both down more than 30%.