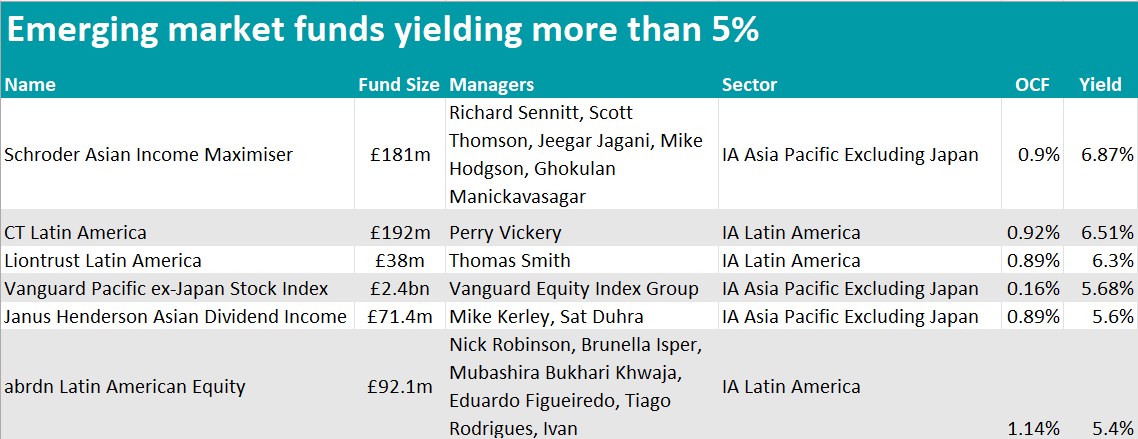

Investors looking for high levels of income from emerging markets should look at the Asia Pacific Excluding Japan and Latin America sectors, data from FE Analytics shows.

There are six emerging market funds that yield more than 5% today (which is approximately what savings accounts offer at present) and all of them come from these two IA sectors.

The best payer, offering an income of 6.87%, is Schroder Asian Income Maximiser. It invests in quality-growth companies based in the Asia Pacific region that deliver a combination of income and capital appreciation.

Source: FE Analytics

FE Invest analysts said: “We like that the fund does not purely buy companies in only the highest-yielding sectors – capital appreciation is equally important.

“The fund has managed to grow the dividend payment consistently, even through difficult periods, when it has done a good job of protecting capital.”

The third and second places on the podium are taken up by two Latin America strategies, CT Latin America and Liontrust Latin America – at 6.51% and 6.3%, respectively.

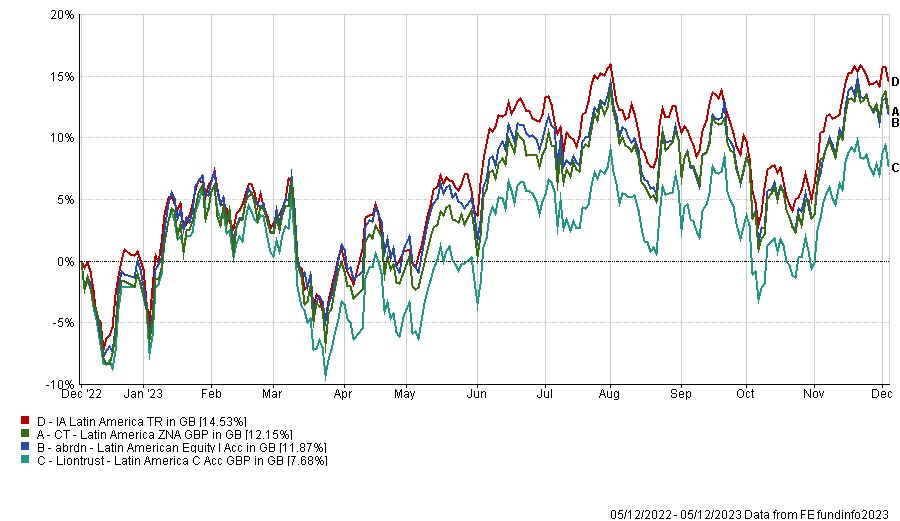

Performance of funds vs sector over 1yr

Source: FE Analytics

The former is mainly invested in Brazil, Mexico, Peru, Chile and Argentina, while the latter is mainly focused in Brazil and Mexico only.

Both these strategies have a concentrated portfolio of approximately 40 stocks and underperformed their peer group over the past 12 months, as the chart above shows.

The largest fund by assets under management was Vanguard Pacific ex Japan Stock Index, a tracker that comprised of only developed markets in the region, excluding Japan and Korea, that pays out 5.68%.

It employs a full index-replication process, meaning that it purchases the same securities in the same weights as they appear in the index, resulting in stronger safeguards than investing directly in some of the emerging markets within the region, according to Square Mile analysts.

They praised Vanguard’s “strong controls” in place to protect the fund in the event of a default, and the risk of loss to fund holders is “remote”. The fund also benefits from the income generated by stock lending, though the impact on performance tends to be small.

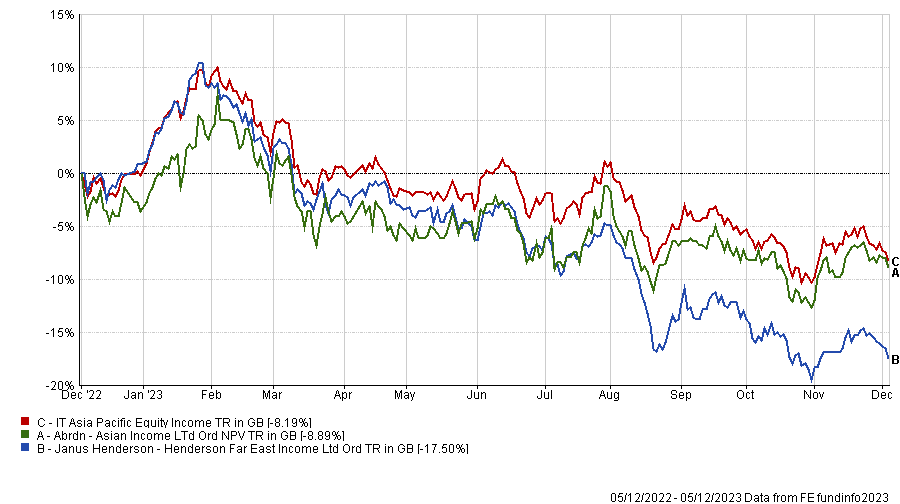

Source: FE Analytics

On the investment trusts side, miles ahead of all other vehicles, Henderson Far East Income yields 11.78% through a portfolio of value-orientated Asia Pacific equities with what the managers deem to be sustainable and growing dividends.

Its main weightings are in Australia (17.1%), China and Hong Kong (14.4% and 12.6%) and South Korea (11.5%), followed by Taiwan (11.4%) and India (11%).

Performance-wise, the fund struggled over the past year, but the managers remain confident about the outlook for dividends, “considering the excess cash being generated and the low level of dividends paid out compared to earnings”.

The only China fund in the list, JPMorgan China Growth & Income offers 5.47%.

Performance of funds vs sector over 1yr

Source: FE Analytics

It struggled recently, as co-manager Rebecca Jiang explained, because of China’s “disappointing” economic recovery as consumer and business confidence “remains weak”.

“Stimulus measures are wide ranging, however the authorities are currently more focused on managing risks to growth rather than underwriting a broad-based recovery. Instead, we will need to wait for the cumulative effects to be felt as we move into 2024,” she said.

“However, we remain optimistic about the long-term prospects for the Chinese economy, which continues to be bolstered by the strong entrepreneurial ethos of China’s private businesses as well as the growing demand from the country’s burgeoning middle class.”

Finally, the Blackrock Latin American investment trust pays investors 5.4%.

It too was challenged by a strong US dollar with a decline in its Brazilian and Mexican names (Brazil was the main underperformer to the end of August 2023), but the managers views are still positive for both economies and Latin America as a whole going forward.