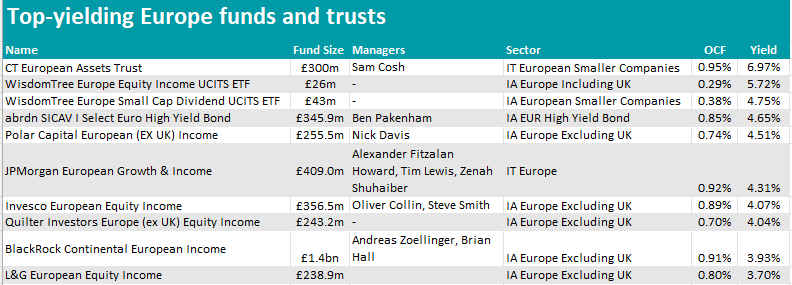

Only two income-paying European investments currently manage to achieve better yields than cash, data from FE Analytics has shown.

An analysis of yield-paying funds in all the European Investment Association and Association of Investment Companies equity and bond sectors returned that only 2 out of 125 pay above 5%, which is approximately what savers can get from UK cash accounts almost risk-free.

The top position in the list was held by Columbia Threadneedle’s European Assets Trust, which came in at a strong 6.97%.

Source: FE Analytics

The strategy, with £299m of assets under management (AUM), is run by Sam Cosh, whose primary aim is to achieve growth of capital by investing in small and medium-sized companies. On top of that, a distribution policy pays out dividends from a mix of income and capital reserves.

The trust has recently suffered due to the prospect of interest rates remaining higher for longer, as well as a worsening economic outlook in Europe in which credit supply gets tighter, as the manager explained at the end of November.

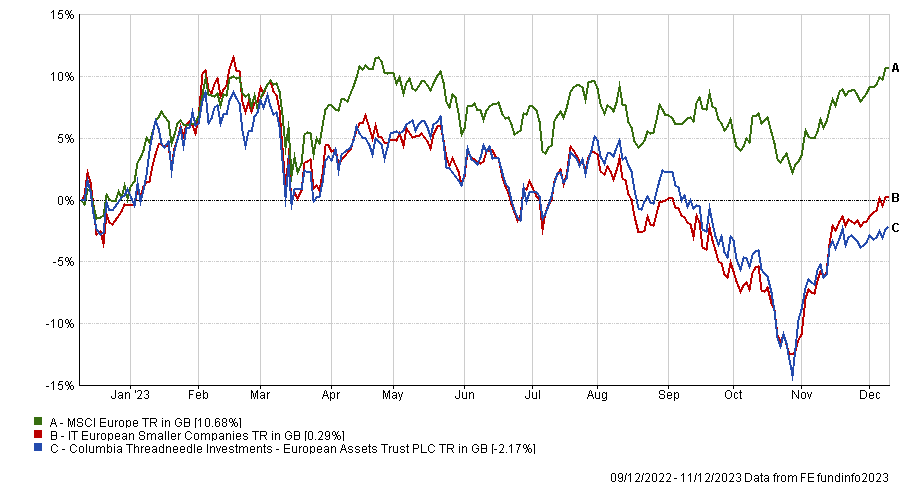

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“Smaller companies, which tend to be more reactive to macroeconomic events, underperformed larger companies in October,” he said.

“Our portfolio, with its bias towards high quality companies well placed to grow their earnings, underperformed the MSCI Europe ex UK SMID Cap Index benchmark index.”

The largest detractor was helmet inlay provider MIPS, which endured pandemic-driven oversupply restraints to its orders book, but the overweight also penalised returns.

“One of our largest holdings, packaging supplier Gerresheimer (2.7% weighting), also saw a double-digit decline in its share price after posting slightly disappointing growth numbers for the third quarter due to a decline in demand for injection vials,” Cosh added.

In the funds universe, the only stand-out vehicle was the exchange-traded fund (ETF) WisdomTree Europe Equity Income UCITS ETF.

This fund tracks an index that is composed of the highest dividend-yielding European companies, screened by quality, momentum, liquidity and environmental, sustainability and governance (ESG) criteria.

The companies in the index are weighted annually based on dividends paid over the previous year, meaning that companies that pay more dividends are more heavily weighted, achieving an overall yield for the fund of 5.72%.

Its top country exposure is the UK (24%), followed by France (18%), Germany (15.9%) and Spain (8.8%). The largest holdings include Total Energies (6.4%), Rio Tinto (5.4%) and HSBC (6.7%).

Further down the list, the highest-paying fixed income fund, with a yield of 4.65%, was the €338.1m abrdn SICAV I Select Euro High Yield Bond.

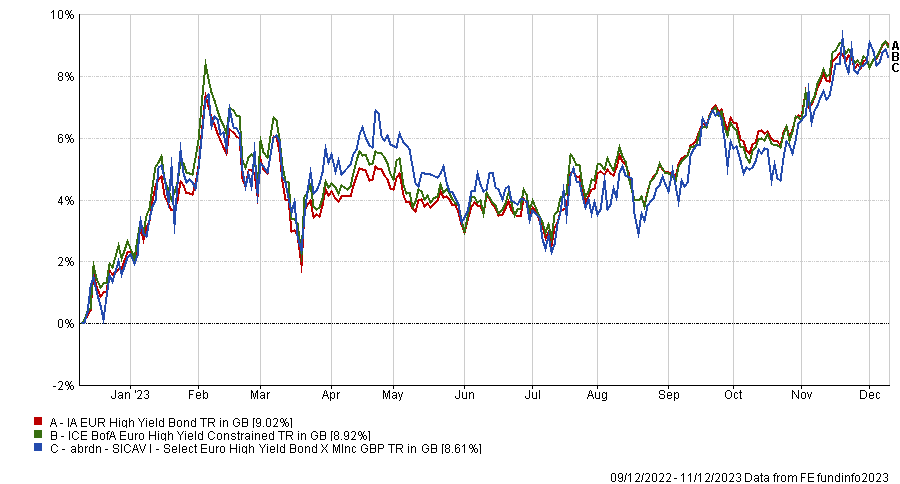

Performance of fund vs sector and index over 1yr

Source: FE Analytics

Managed by Ben Pakenham, it invests in Euro-priced bonds issued by companies, governments or other bodies for a combination of income and growth.

The fund struggled to beat its benchmark in 2018 and 2019, but recovered since 2020 and in the past 12 months as performed close to the index, as illustrated in the chart above.