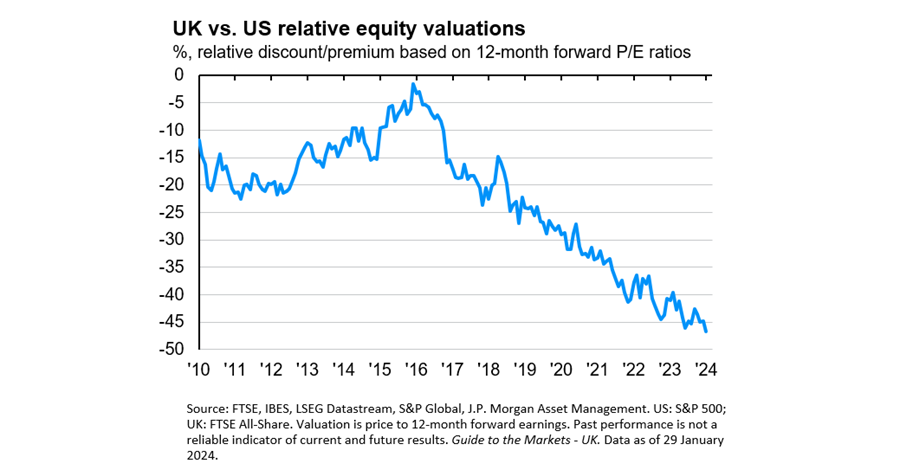

The UK stock market is in the doldrums. Outflows are stacking and valuations are low, both against historic standards and versus other regions as UK equities have slumped to almost half the price of glittering US stocks. Yet despite the pessimistic picture, fund managers are enthusiastic about the bargains on offer.

As a case in point, Columbia Threadneedle Investments has been increasing its UK equity exposure for the past nine months. “We’re of the opinion that much of the bad news for the UK economy is likely to be in the price,” said investment manager Paul Green. “The UK market is also yielding more than UK government bond yields.”

One of the reasons the UK is cheap relative to the mighty US is sector composition. The defensive, value-focused UK stock market has a tiny 1% allocation to the world’s most expensive sector, technology, compared to the growthier US equity market’s 30% tech weighting.

Instead, the FTSE 100 has higher weightings to banks and energy, which have typically traded on lower valuations, and this could be the key to the UK’s recovery.

Tom Stevenson, investment director at Fidelity International, said: “Our domestic market will be a beneficiary of any rotation from growth to value, which seems likely given the return to the long-run norm of stickier inflation, higher interest rates and more economic volatility.”

Hugh Gimber, global market strategist at JPMorgan Asset Management, added “with tensions rising in the Middle East, the risk of a further spike in energy prices cannot be ignored”.

“The UK market therefore not only offers investors an attractive valuation and a healthy dividend yield today, but also may be one of few assets to offer an element of diversification if geopolitical risks intensify.”

For a recovery to take root, the stock market needs to attract inflows, but it is fighting against a long-term trend of British savers and pension funds moving into global equities and other asset classes.

Part of the problem is the shift to passively-managed global mandates tracking indices such as the MSCI World, which has a measly 4% allocation to the UK versus 70% to the US.

The share of British households owning UK stocks and shares halved between 2003 and 2022, according to New Financial. Pension funds’ exposure to UK equities has fallen even more sharply during the past 25 years from 53% to 6% of total assets, representing outflows of £1.9trn.

The government does seem to recognise the need to step in and offer incentives, and various solutions have been mooted, said James Penny, chief investment officer at TAM Asset Management. “The Great British ISA is one potential idea to drive UK savings and pensions into UK stocks, which will in turn lure UK companies back to the domestic market to list.”

Meanwhile, valuations may have reached the tipping point where they are low enough to attract investors. This is evident for large-caps – one manager said he was “skipping to work” and felt like a kid in a candy store – but it is even more the case for small and mid-caps, which are expected to lead a potential recovery.

UK small-caps are trading at 9-10x earnings compared to the long run average of 14x, with a high yield (3% for small-caps and 4% for mid-caps) and dividends that are well covered.

Columbia Threadneedle increased its small and mid-cap exposure in October after fund managers said they were seeing the best opportunities of their careers outside of the financial crisis, Green said.

Penny concurred: “Should this turnaround happen and flows begin coming back to the UK, it’s the mid and small-caps, which are trading at historically very cheap valuations, that are getting the investing community so excited. With many UK mid-and-small-sized firms buying back their own stock in record amounts, the stage is certainly set for performance.”

Even after a risk-on rally at the end of last year, Dan Green, manager of the FTF Martin Currie UK Smaller Companies fund, said “valuations are pricing in a worst case scenario” and are still 15% below their last peak. “People ask ‘have we missed the rally?’ but we think we’re just getting started. There’s still a long way to go to revert to mean valuations,” he said.

Interest from private equity investors and international trade buyers, spurring an uptick in merger and acquisition activity, provides evidence that British assets are a bargain. Deals have been done at hefty premiums, rewarding shareholders.

However, Columbia Threadneedle’s Green said that “managers who have had companies bought from them bemoan that these valuations are still at a large discount to their view of intrinsic value.”

For investors, the outlook is still uncertain but there are many reasons to give the UK equity market a second look. To that end, Alex Harvey, senior portfolio manager at Momentum Global Investment Management, believes investors should position themselves ahead of a recovery.

“The equity market embeds forward looking expectations beyond the immediate horizon. By the time the growth outlook for the UK improves, stock prices will already have moved higher,” he explained.

Sean Peche, who manages the Ranmore Global Equity fund, added: “If you wait for the catalyst, it’s like trying to buy a lottery ticket when you already know the winning numbers. It’s too late.”

For investors looking to get back into UK equities, fund selectors revealed their top choices to Trustnet last week.