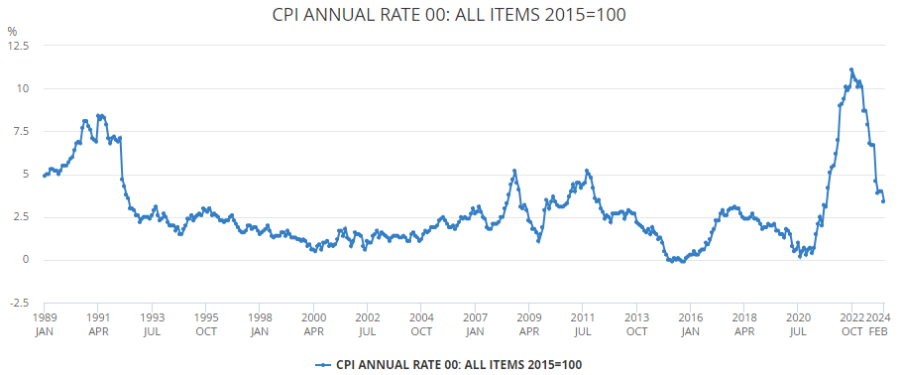

UK inflation slowed to 3.4% year-on-year in February, according to the latest figures from the Office for National Statistics, down from a surprise 4% reading in January.

In the latest print, cheaper food and non-alcoholic beverages were the biggest downward contributors to the drop in inflation, falling from 7% in January to 5% in February. This negated the effects of higher fuel costs.

It is a far cry from the 11.1% peak in October 2022 and signals that consumer may be over the worst of price rises, experts have said.

Source: Office for National Statistics

Zara Nokes, global market analyst at JP Morgan Asset Management, said: “Following a torrid couple of years for UK households, this morning’s inflation print is yet further evidence that the outlook for consumers is brightening.”

There could be more good news to come on the inflation front, with Fidelity International investment director Tom Stevenson suggesting the pace of price increases should “continue dropping through the spring” as cheaper gas and electricity from April drives household energy costs lower.

Many expect inflation to hit the Bank of England’s 2% target by the spring, although James Lynch, fixed income investment manager at Aegon Asset Management, was even more optimistic.

“Looking forward over the next few months we still expect to see CPI inflation in the UK to start with a 1% as soon as the April print. In large part thanks to the fall in food and the OFGEM energy price cap change,” he said.

However, Stevenson warned that further reductions would not be permanent. “Inflation may briefly touch the Bank’s target in the next few months but is not expected to settle at 2% until 2026,” he said.

It is nonetheless positive news for the Bank of England, the experts agreed, with the Monetary Policy Committee meeting tomorrow to make a decision on interest rates.

Nokes said: “While the Bank of England will also cheer the decline in the headline figure, it is unlikely to be convinced that the battle against inflation is won. The Bank will instead be keeping a watchful eye on the medium-term inflation outlook, particularly the domestically-generated inflation originating from the services sector.

“With regular wage growth north of 6% and services inflation still running hot, the Bank will need further evidence that domestic price pressures are cooling before it begins cutting rates.”

Stevenson agreed, suggesting rates are likely to remain at 5.25% until at least June.

Last month two members of the MPC voted for a hike in interest rates, one for a cut and six for unchanged rates.

Lynch added: “Given the sluggish economy, looser labour market, and high confidence that inflation will be below target in the coming months, it is a struggle to see why two members believe interest rates still need to move higher. So if there is a change tomorrow this is where I would expect it to come with a change in the voting pattern.”