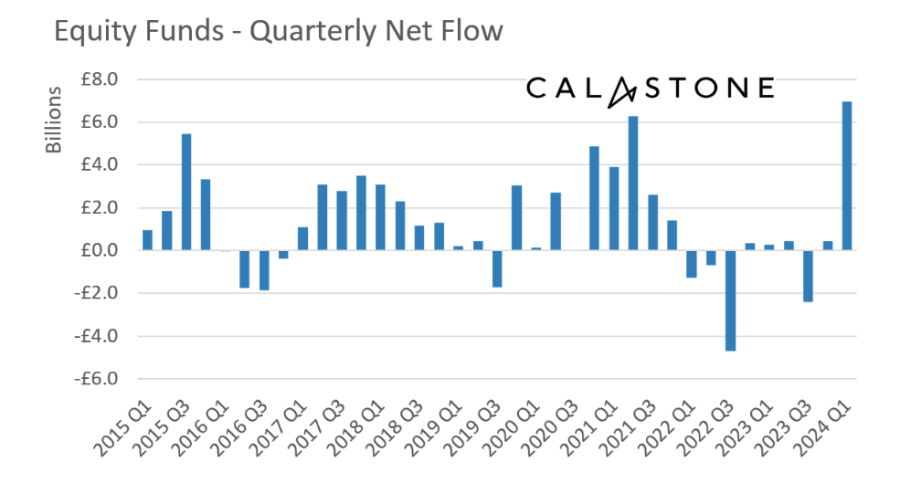

UK investors established a new record of inflows into equity funds in the first quarter of the year, after pouring a total of £7bn into the asset class since January, with £2.3bn added in March alone, according to data from Calastone.

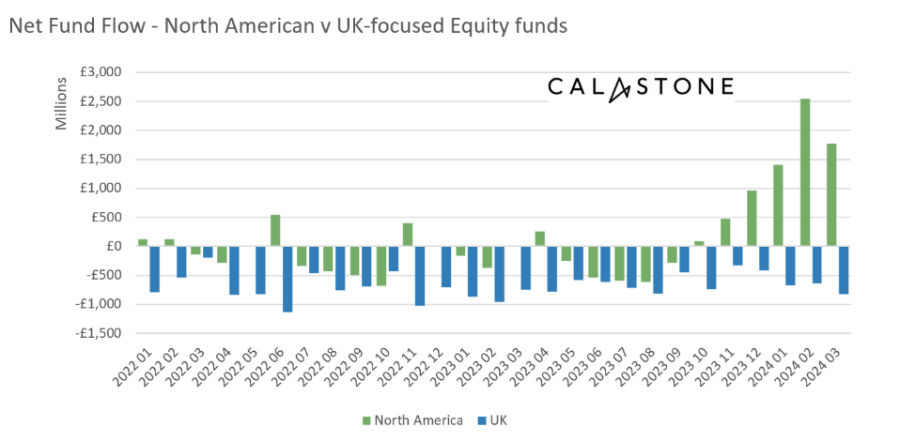

North American equity funds have been the main beneficiaries, as they attracted a record £5.7bn of UK investors’ capital in the first quarter of 2024. This is three times more than in the fourth quarter of 2020 – the previous best quarter – when they absorbed £1.8bn. In March 2024 alone, UK investors added £1.8bn into US equity funds.

It is worth nothing that UK investors have poured more money into North American equity funds in the four months since December 2023 than they have in the previous nine years combined.

UK investors also favoured global equity funds, as they added £3.3bn in the first quarter of this year and £1.2bn in March alone, although no record was broken on that occasion.

Source: Calastone

Meanwhile, UK equity funds recorded their 34th consecutive month of net selling, as outflows surged to £823m in March. This was the worst month for the asset class since February 2023 when investors withdrew £962m.

Over the whole first quarter of 2024, UK investors removed £2.1bn from funds focusing on domestic equities, resulting in the fourth worst quarter for UK equity funds.

Edward Glyn, head of global markets at Calastone, said: “UK equities are certainly cheap, but investors worry where the growth is going to come from to drive earnings higher. Add a relentless narrative of gloom about the prospects for the London stock market and it’s hard to persuade anyone to hold UK-focused funds.

“Meanwhile the US earnings recession is over – profits are once again on the up and that seems to be the main catalyst driving fund inflows and higher share prices.”

Source: Calastone

Elsewhere, emerging markets did not break any record either, but the £700m of inflows in the first quarter of 2024 were almost three times the historic quarterly average. Emerging markets equities also came third in March in terms of investors’ preference, with inflows of £362m.

Calastone also noted inflows into funds focusing on individual countries such as India, Japan and South Korea. However, Asia-Pacific and China-specialist funds experienced outflows. Meanwhile, healthcare dominated inflows into thematic funds.

Although Europe ex UK equity funds had a strong run of inflows in recent months, these dwindled more than 90% compared to the three-month average to just £37m last month.

Environmental, social and governance (ESG) funds also enjoyed inflows of £691m in March, although this amount is inferior to those of the previous two months.

Among other asset classes, fixed income funds experienced an acceleration in inflows, reaching their best level since June 2023, as UK investors added £460m to their holdings.

Glyn added: “Bond markets have had a rough start to 2024 as hopes for rate cuts were pushed further out into the future. Yields have risen to levels last seen in November (which pushes prices lower) and are proving increasingly attractive to investors keen to lock into relatively high levels of income and who believe there is the prospect of capital gains to come when rates fall.”

However, mixed asset funds and the property sector continued to suffer from outflows.