When everything looks cheap, how do you decide what to buy? This is a dilemma facing investment trust buyers, with more than 30% of trusts trading at a double-digit discount.

The answer, according to Charlotte Cuthbertson, co-manager of the MIGO Opportunities Trust, is to look for investment trusts whose discounts are likely to narrow for idiosyncratic reasons, such as Georgia Capital and Chrysalis Investment, and whose underlying assets should perform strongly.

“That’s a really powerful combination and that’s where you get quite explosive returns,” she explained.

MIGO was established in 2004 to take advantage of investment trusts trading at a discount to their net asset value. In normal market conditions, 40-50% of investment trusts might fall into MIGO’s remit but currently it feels closer to 90%, Cuthbertson said. “It would have been quite easy to be a child in a sweet shop but we have been very selective.”

The average discount of MIGO’s top 10 holdings is about 34%, which is “pretty unheard of”, she noted. “In general, it does feel like a moment in time. We will look back on this period and think, gosh, it was just so cheap. It feels like there’s an incredible opportunity in the sector.”

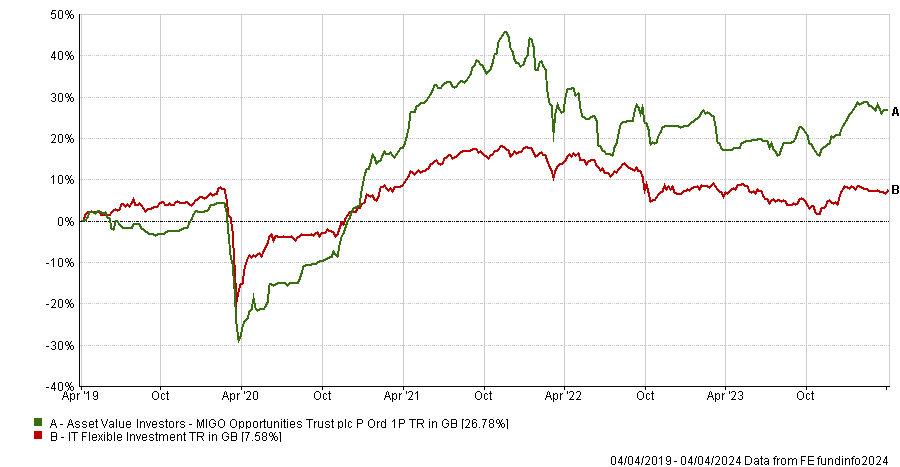

Performance of trust vs sector over 5yrs

Source: FE Analytics

Below she highlights trusts that look particularly compelling on their current valuations.

Frontier and emerging markets

Cuthbertson’s highest conviction investment is Georgia Capital. It has a large holding in the Bank of Georgia, which has performed well, and also invests in several companies with exposure to Georgia’s growing middle class, such as insurers, healthcare providers and private education.

The trust’s underlying assets are performing well and Georgia’s economy is buoyant, but the trust has been hampered by negative sentiment due to concerns over the war in Ukraine, so at one point it was trading on a 60% discount, which has narrowed to 50%. MIGO topped up its exposure when shares were trading at £6; they have risen since to £13.

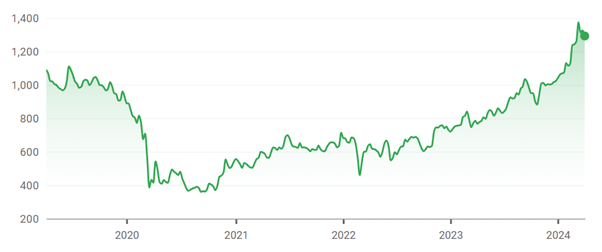

Performance of trust’s share price over 5yrs

Source: Google Finance

MIGO’s second largest holding is VinaCapital Vietnam Opportunity. Vietnam is benefitting from industrialisation and urbanisation and it has not become embroiled in the trade wars between China and the US. The trust is trading at a 22% discount.

Performance of trust vs FTSE Vietnam index over 5yrs

Source: FE Analytics

Georgia and Vietnam are frontier markets but she expects them to become more mainstream destinations for investors. The latter is on the Russell Investments Watch List for a possible reclassification from frontier to secondary emerging market status.

JPMorgan Indian is also in MIGO’s top 10 holdings. The trust had been underperforming but it changed managers in 2022 and Cuthbertson has more conviction in the new team of Amit Mehta and Sandip Patodia, under whom returns have improved.

She has a favourable view of Indian large-caps but thinks mid-caps look overpriced after recent gains. Indian mid and small-caps have been “incredibly hot and have gone up an awful lot.”

Private equity

Another theme in MIGO’s portfolio is private equity. These trusts have been hit harder than other investment companies by concerns about debt and over-gearing in a higher rate environment as well as fee disclosure rules, which make private equity trusts look expensive due to their higher ongoing charges figures (OCF).

Oakley Capital Investment, for instance, is performing well but its OCF is very high, Cuthbertson said. She also likes NB Private Equity Partners. Both trusts have visible underlying portfolios and are trading on wide discounts.

“If we get some resolution on the OCF front, and there is a huge lobby within our industry pushing for this, that should be incredibly supportive for investment trusts. We've been caught in a perfect storm over the past year or so,” Cuthbertson said.

Performance of trusts vs sector over 5yrs

Source: FE Analytics

MIGO also owns Augmentum Fintech and Chrysalis Investment. There is a lingering perception that they invest in young companies but the trusts have evolved since inception and their holdings are approaching profitability – something the wider market has yet to appreciate, Cuthbertson said.

MIGO does not get involved in many initial public offerings (IPO), but the trust did support Chrysalis when it launched in November 2018 because of its compelling investment thesis, backing innovative businesses with the potential to disrupt markets and achieve long-term growth. Then a lot of “hot” money poured into the trust, which began to look overvalued, so MIGO sold the majority of its holding.

Cuthbertson has been rebuilding the position during the past year at a discount. Chrysalis is set to profit from the anticipated IPO of Klarna, the Swedish buy now, pay later firm, which is expected to list at a valuation of $18-20bn. The trust also owns Starling Bank, which is performing well.

Chrysalis was widely criticised for awarding £112m in performance fees to its managers Nick Williamson and Richard Watts in 2011 – a year when its net asset value rose 57%, only to nosedive the following year. The trust’s performance fees have since been reduced and Cuthbertson said its corporate governance has improved.

“There are a few war wounds from Chrysalis but thankfully we managed to miss much of the pain on the way down,” she said. “It’s been a noisy trust.” The underlying portfolio now looks interesting at a sensible valuation, she added.

Performance of trust vs sector since inception

Source: FE Analytics