Income-seeking investors can find rich pickings amongst the investment trust sector, with many trusts offering yields above government bonds plus the prospect of capital gains and an extra kicker if discounts narrow.

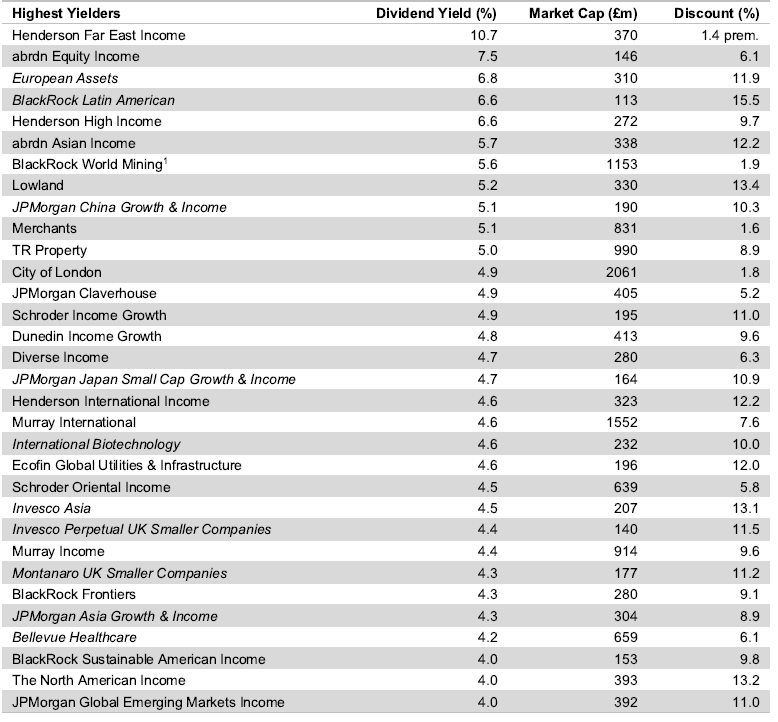

Wealth manager Stifel found that 32 trusts investing primarily in equities have a yield of 4% or more and a market capitalisation above £100m. This compares to yields of 4.5% and 4.4% from two-year and 10-year gilts, respectively.

The highest-yielding equity investment companies

Sources: Stifel, Datastream as at 29 Apr 2024

Almost all of the trusts on Stifel’s list have increased their dividends in the past year as revenues from their underlying equity portfolios have grown, the exception being BlackRock World Mining.

Iain Scouller, managing director, investment funds at Stifel, said: “For those investors prepared to take equity risk, we think the yields on these trusts are relatively attractive.”

Before diving in, experts cautioned investors to research why yields are high in the first place.

Shavar Halberstadt, an equity research analyst at Winterflood Investment Trusts, said: “There is nothing wrong with investing in a trust because of its yield, but we encourage investors to assess whether this is share price-driven, enhanced by leverage or intrinsic, and which profile best suits their risk appetite.”

Edward Allen, private client investment director at Tyndall Investment Management, agreed. The first question to ask is whether or the dividend is covered, he suggested.

“If not, you are just paying income out of capital. Others use derivatives to boost their income, selling away some of the potential gain to boost income,” he said. “Again, I’m not a fan, as this blunts the potential total return of the investment.”

Dividend yields are a function of the income offered, as well as the share price. If a fund is trading on a steep discount to net asset value (NAV), the yield may be high as a result. Therefore, Winterflood makes a distinction between funds offering a high dividend and those that are simply out of favour, Halberstadt explained.

“To disentangle the effects of discounts to NAV, we looked at the highest dividend yield on NAV instead. If you exclude special situations (i.e. returns of capital driven by managed wind-downs), examples of relatively high income on an absolute basis are Henderson Far East Income, Chelverton UK Dividend, Aberforth Split Level Income and abrdn Equity Income, all with NAV yields ranging between 7% and 11%.”

To complicate matters further, some investment companies are “manufacturing” yield by funding a revenue shortfall out of capital, Scouller said. For instance, Montanaro UK Smaller Companies paid a 4.5p dividend for the year ended 31 March 2023, when its revenue earnings per share were 2.3p and the capital return was -21p per share. The dividend paid was only 0.51x covered by revenue earnings, he noted.

Ryan Lightfoot-Aminoff, investment trust research analyst at Kepler Partners, said some trusts use revenue reserves to pay dividends in leaner years, having replenished the coffers during better times.

Halberstadt added that financing dividends from revenue reserves enables “a smoothing of dividend volatility over multi-year periods and the potential generation of dividend growth even when portfolio income stagnates”.

Trusts can also use debt financing – or gearing – to magnify their yield on NAV, he continued. “This is relevant for instance for Chelverton UK Dividend and Aberforth Split Level Income, who each have debt levels exceeding 30% of NAV.”

Another factor to consider is whether a trust’s yield appears to be high because of special dividends that may not continue.

Meanwhile, James Carthew, head of investment companies at QuotedData, warned investors to look out for value traps, where yields are high because the share price is cheap and likely to fall further. The best way to avoid value traps is to steer clear of the highest decile of high-yield equities, he noted.

“I think this explains Henderson Far East Income, which produces a yield far higher than most competing Asian income trusts yet its long-term total returns are by far the worst in its peer group (an average of 4.7% per annum over the past 10 years compared to 6.6% for abrdn Asian Income – the next worse – and 10.3% for Invesco Asia – the best),” Carthew said.

“Similarly, abrdn Equity Income is the worst-performing trust in its peer group (2.4% per year over 10 years, compared to 4.0% for Lowland, the next worse). However, there is another factor at play here, both trusts have highish exposures to smaller companies, which have been lagging their larger peers.”

At the other end of the spectrum, Carthew believes Henderson High Income is a better choice.

“It has a trick up its sleeve when it comes to generating its attractive yield. It borrows money long term at fixed rates and invests that in higher-yielding bonds. That generates income that goes toward the dividend and allows David Smith, the fund’s manager, to avoid the value traps and buy lower-yielding stocks with better business models and faster dividend and earnings growth. Investors in Henderson High Income get the best of both worlds, therefore.”

In some cases, a high income can be indicative of a timely investment opportunity, Allen pointed out. “Trusts paying a high income out of received income might indicate an area out of favour with markets and a potential opportunity; some Asian income trusts fit this bracket, and potentially some of the UK trusts too.”