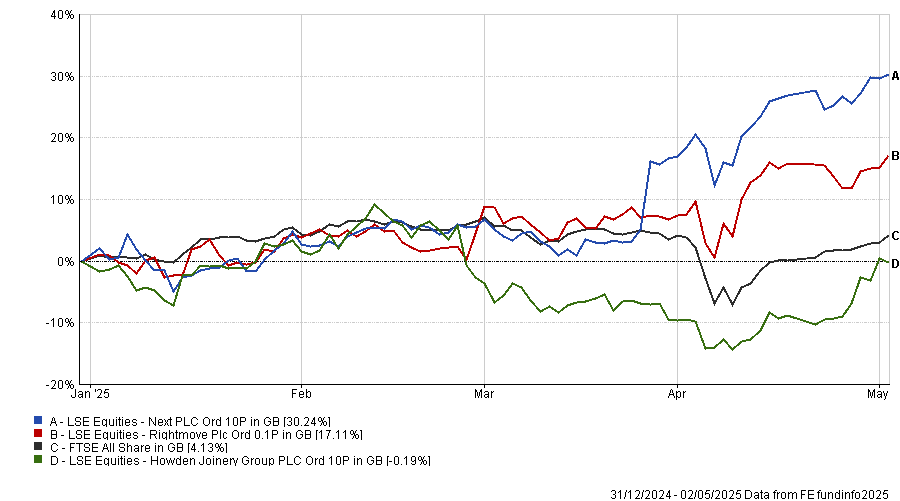

The UK equity market is enjoying a winning streak at present after several years in the doldrums. The FTSE 100 and FTSE All Share indices have regained all their post-Liberation Day losses and are up 6.7% and 5.6% year to date as of 5 May, whereas the MSCI All Country World Index (AWI) has lost 4.8% in sterling terms.

The UK is home to several “truly world-class” companies, according to James Thomson, manager of the £3.9bn Rathbones Global Opportunities fund. There are “little pockets of success” in the UK that investors should be proud of and that offer vibrant opportunities for stockpickers, he said.

The FE fundinfo Alpha Manager has 7% of his fund in the UK, which does not sound like much but is double the MSCI ACWI’s 3.4% allocation.

Below, he highlights three examples of these world-class UK businesses: retailer Next, property portal Rightmove and kitchen manufacturer Howdens Joinery.

Next

Next is fundamentally strong, with a resilient balance sheet and a growing international and online sales platform. These factors have been essential to helping the business beat targets and impress investors, Thomson said.

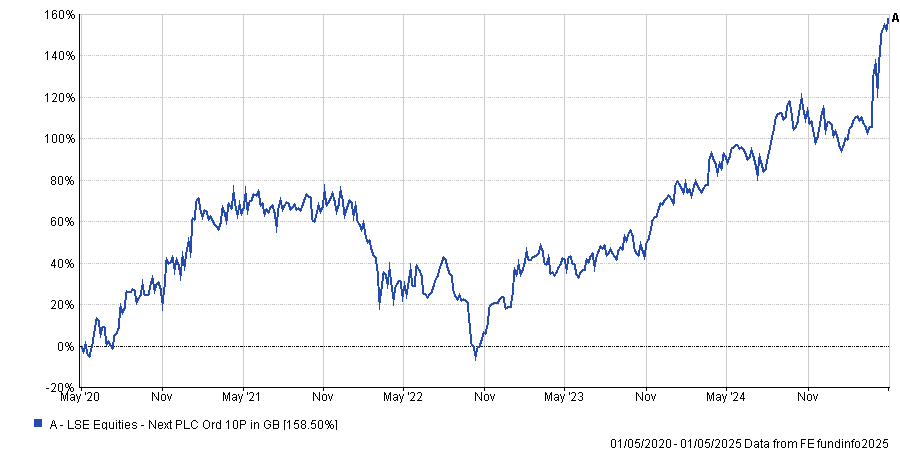

Its share price has risen 30.2% this year to 2 May, including a leap at the end of March when it posted profits of more than £1bn. This builds on strong long-term performance, including a 158.5% surge in its share price over the past five years.

Share price performance of Next over 5yrs

Source: FE Analytics

Thomson also praised the leadership of chief executive officer, Simon Wolfson, who he described as open and candid with investors and customers. With the UK market facing headwinds such as increased national insurance contributions and global uncertainty, this clarity from the management team has further contributed to recent performance, he said.

“You need to be prudent with the street to ensure investors' expectations don't get carried away. When investors’ expectations are managed, it is much easier to outperform. There are a few management teams in the UK that are extremely good at this and Next is one of them,” he concluded.

Rightmove

Thomson identified Rightmove as another compelling UK business. While it shares many of the same qualities as Next, the property portal’s unique selling point is its pricing power. “In terms of all factors common in outperforming companies, pricing power is near the top,” he said.

Rightmove has more than 90% of the property portal market share and enormous brand recognition that has made the company a household name.

“Rightmove’s customers are not people like you or me, they are estate agents who know they have to show their property on Rightmove,” Thomson explained. This level of market influence and recognition gives Rightmove an enormous amount of pricing power, which is reflected in its share price.

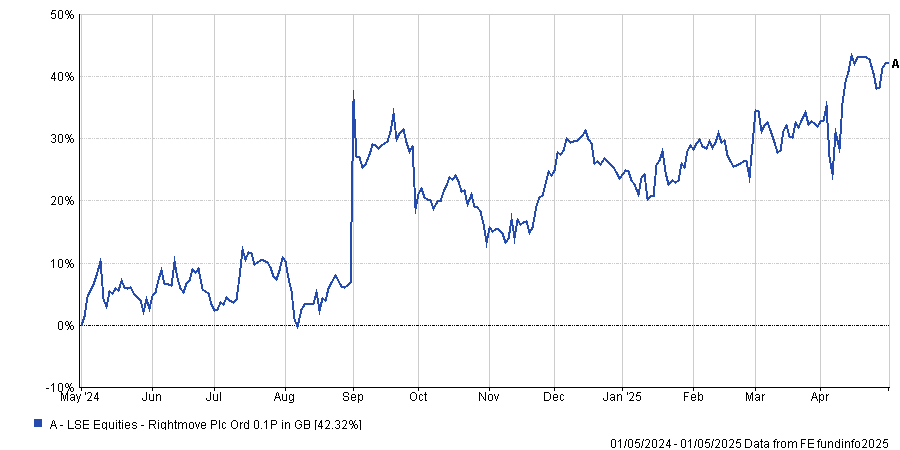

Despite taking an initial hit following the announcement of ‘Liberation Day’ tariffs, the stock is up 17.1% so far this year as of 2 May. Over the past 12 months, it has surged by 42.3%

Share price performance of Rightmove over 1yr

Source: FE Analytics

Howden Joinery

Finally, Thomson identified kitchen supplier Howden Joinery as another genuinely impressive UK company. “I just think it is an incredibly well-run business," he said.

The most important thing when building a new kitchen is availability and ease of access to products. You do not want to have to wait up to six months for your new cooker, he explained.

In the case of Howden Joinery, all its inventory is available in its own supply chain, which means it can deliver products much faster than any competitor. As a result, it is thriving because it offers a reliable and more predictable service than its peers, Thomson said.

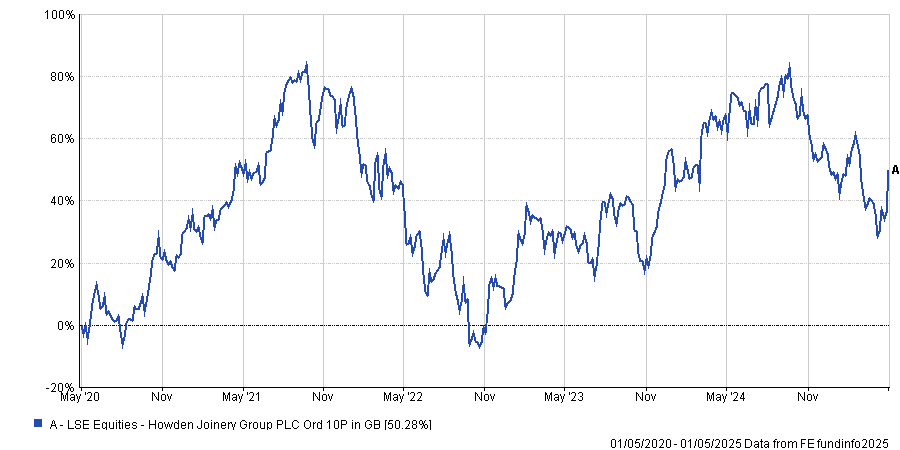

This builds on a good run for the stock over the long term, with the share price up by 50.3% over the past five years.

Share price performance of Howden Joinery over 5yrs

Source: FE Analytics

However, it has struggled over the past year, as people worried it would offset the rise in national insurance by cutting staff. Nevertheless, he argued recent declines do not negate strong fundamentals, great long-term potential and competitive advantages that will allow the company to grow long-term.

Thomson concluded: “In terms of businesses coiled to capture any recovery in consumer confidence in the UK, I would put Howden Joinery at the top of that list.”

Performance of stocks YTD vs FTSE All Share

Source: FE Analytics