UK equity funds targeting smaller companies, dividend payers and value stocks are among those that fund pickers expect to outperform if the UK market continues to perform strongly.

After years of underperformance, the domestic market is staging a comeback.

As investors have struggled to get to grips with trade volatility stemming from the White House, formerly top-performing markets such as the S&P 500 have struggled. Meanwhile, the UK has rallied as investors have pivoted out of the US, with the FTSE All Share surging by 9.4% this year, one of the better developed market results.

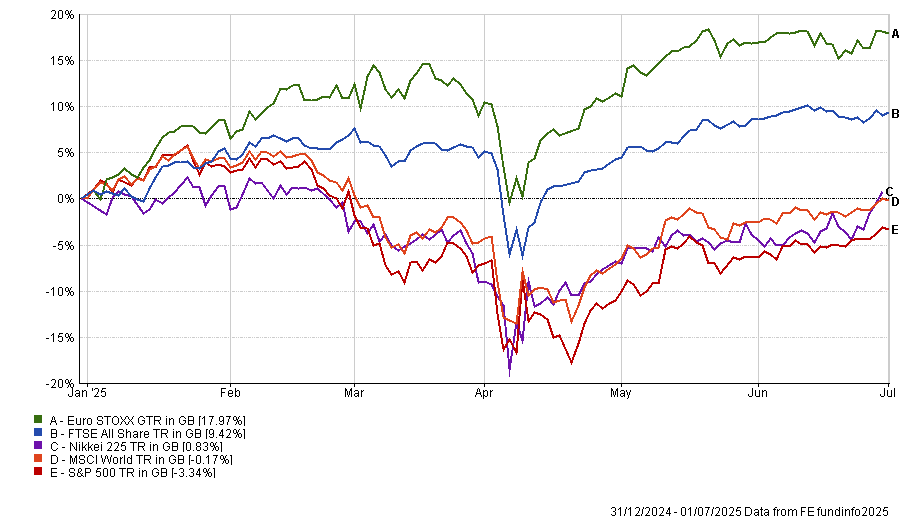

Performance of indices year to date

Source: FE Analytics. Total return in sterling.

For some managers, this could signal the start of a genuine long-term rally for the UK market. Below, experts identify funds that have already benefited from the recent rally and might be poised to continue outperforming.

Jack Driscoll, fund analyst at FE Investments, highlighted George Ensor’s RGI UK Listed Small Companies fund, saying: “The UK market rebound has finally rippled down to smaller companies.”

This has benefitted this strategy, which invests 80% of its capital in the smallest 10% of the market. As a result, Ensor’s fund is up by 6.5% so far this year, beating the average peer in the IA UK Smaller Companies sector.

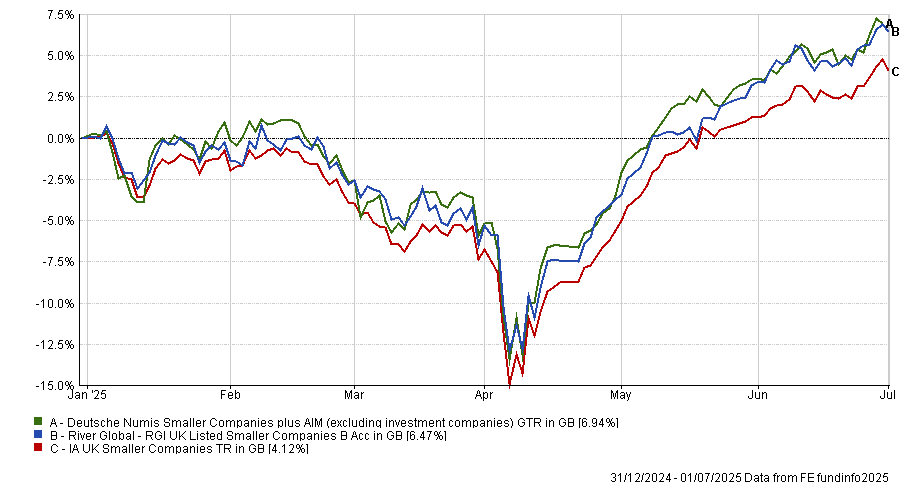

Performance of RGI UK Listed Small Companies vs the sector and benchmark year to date

Source: FE Analytics. Total return in sterling.

Driscoll added that RGI UK Listed Small Companies has a large weighting in cyclicals, which “gives direct exposure to the domestic economy”. This has been a tailwind this year as the Bank of England has entered a gradual rate-cutting cycle, benefitting the fund’s 14% allocation towards financials.

Its 70-stock book is another advantage because it “leaves headroom to top-up outperformers without adding concentration risk”. This allows Ensor to run his winners if optimism towards the UK persists.

However, because it is targeting the smallest companies at an already volatile market capitalisation, it is most suitable as a satellite holding for investors. This added volatility means the fund would be most suited for investors with a higher level of risk appetite and at least a five-year time horizon, Driscoll explained.

For an alternative that could suit both growth and income investors, Paul Angell, head of investment research at AJ Bell, identified Henry Dixon’s Man Income fund.

The fund targets UK companies across the market cap spectrum that are paying a yield in line with or better than the market average, he explained.

“Their investment process centres on identifying two types of stocks: those trading below their replacement cost (i.e. what it would cost today to replace a company's assets and operations) that are also cash-generative; and those where the market appears to be undervaluing profit streams,” Angell said.

There are plenty of undervalued and unloved companies in the UK, giving the fund a broad opportunity set, he noted.

This has allowed Man Income to benefit from the recent rally, narrowly beating the FTSE All Share, as seen below. Despite strong returns, it “remains cheaper than the market on a circa 10x price-to-earnings ratio”.

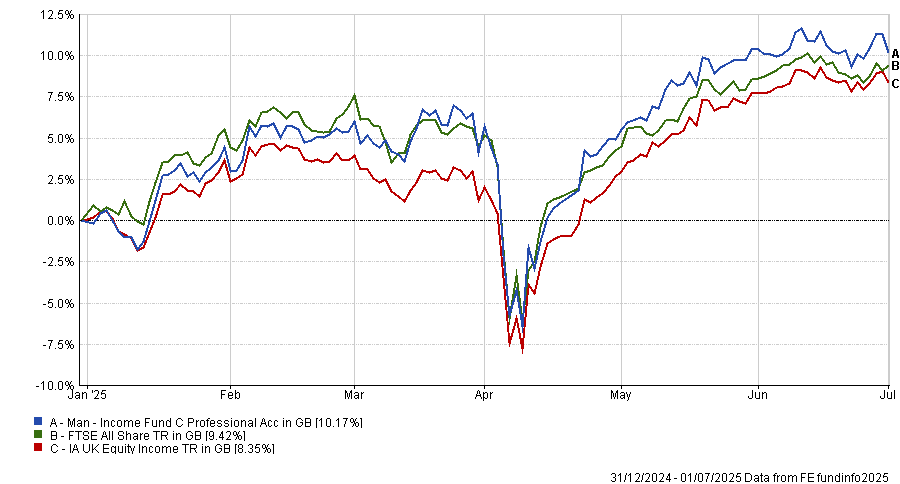

Performance of Man Income vs the sector and benchmark year to date

Source: FE Analytics. Total return in sterling

Long-term returns are also strong, with the fund posting top-quartile results in the IA UK Equity Income sector over the past three-, five- and 10-year periods.

In terms of risk tolerance, Angell suggested that a low allocation would suit more cautious investors.

Finally, Forvis Mazars’ associate investment governance director and model portfolio manager James Rowlinson pointed to Jupiter UK Dynamic Equity.

While he accepted there was initial uncertainty about the strategy after manager Ben Whitmore departed last year, new manager Alex Savvides has “set the fund up for future success”.

Jupiter UK Dynamic Equity's value tilt has been a benefit this year as investors have pivoted away from growth towards more defensive and cautious stocks. Improving sentiment towards the UK and a rotation away from the US has naturally boosted the valuation of bargain stocks.

Additionally, Savvides has made beneficial changes to the overall approach. Instead of just taking good value stocks, he has emphasised overlooked names with improving outlooks, which have significant rerating potential.

Already, this change in strategy is paying off, with names such as Burberry and ConvaTec surging this year on the back of improved sentiment. As a result, it has made a top-quartile return in the IA UK All Companies sector, beating the UK market by around four percentage points.

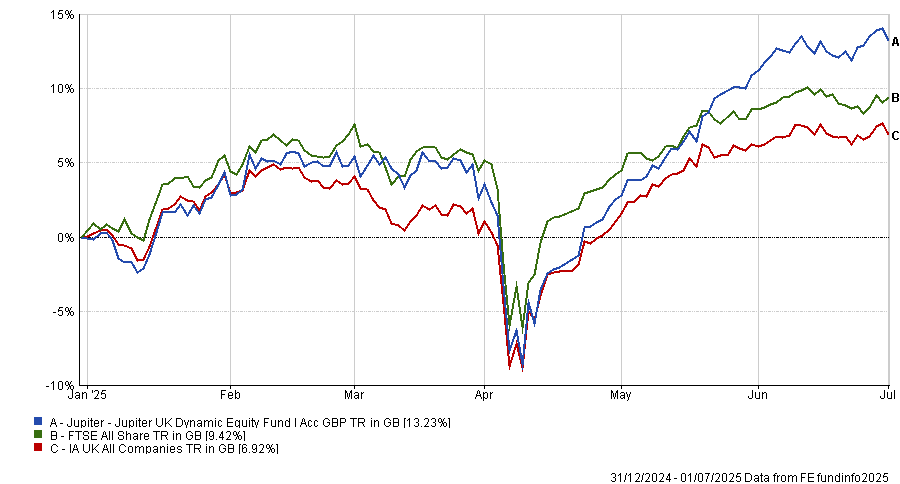

Performance of Jupiter UK Dynamic Equity vs the sector and benchmark year to date

Source: FE Analytics. Total return in sterling.

While the fund can in theory go anywhere on the UK market, it has a slight tilt towards mid-caps and a beta of more than one. As a result, investors should treat it as a source of diversification in a balanced portfolio, by pairing it with another fund that has a complementary style, Rowlinson concluded.