UK companies paid out £35.1bn in total dividends in the second quarter of 2025, down 1.4% year-on-year, according to Computershare’s latest Dividend Monitor. Although this isn’t as bad as expected, there is forecast to be more pain for investors in the second half of this year, the firm warned.

Slower dividend growth, unfavourable exchange rate effects and a projected “dearth” of one-off special dividends to levels well below average are expected to push headline payouts (meaning total dividends paid, including specials) lower year-on-year, the report warned.

As such, Computershare has cut its headline forecast for the full year by £1.8bn to £88.3bn.

The effects of unfavourable exchange rates have already been felt in the months April to June, with the dollar’s further fall reducing the headline total for the second quarter by £934m, the report said, which is £260m more than would have been the case if the pound held its early April level.

Computershare expects the impact of the pound versus the dollar to hit the second half of the year harder. If the current exchange rate ($1.37) persists, the foreign exchange loss for the full year could reach £1.7bn, which would remove 1.9 percentage points from the headline growth rate in UK dividends this year.

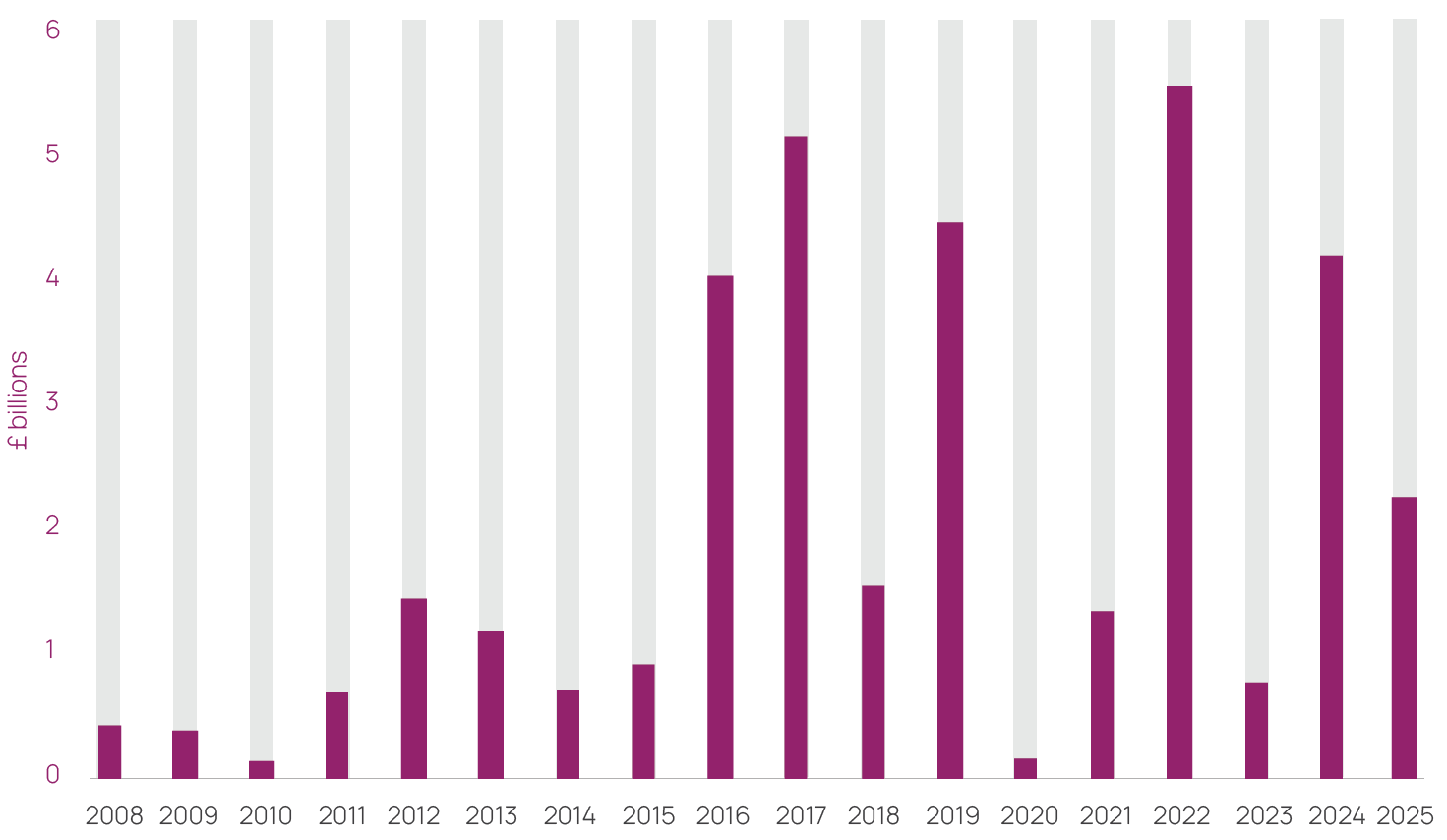

The report also pointed to a poor showing in special dividends during the second quarter of the year, which fell by 46% year-on-year to £2bn as of the end of June, in line with Computershare’s expectations. This sharp drop has knocked five percentage points off the headline growth rate.

Q2 special dividends from 2008 to 2025

Source: Computershare Dividend Monitor

Computershare expects this trend to continue into the second part of the year.

It’s not all doom and gloom for investors, however, as Computershare has upgraded its full-year underlying growth forecast (regular dividends paid by companies) from 2.1% to 2.8%, totalling £85.1bn.

This follows a 6.8% increase in regular dividends in the second quarter, exceeding Computershare’s forecast by £230m to reach £33.1bn.

Rolls-Royce was identified as a standout contributor, having paid its first dividend since 2019 thanks to its widening margins across civil aerospace, defence and power systems, prompting a cashflow surge and the elimination of its debts. The £508m payout made up almost a quarter of headline dividend growth in the second quarter.

Banks were strong performers, with payouts jumping 8.1% and making up just over a third of the increase in three months from the start of April to the end of June. Insurers also fared well, with a 15% rise in dividends, led by Admiral’s recovery in motor insurance.

Meanwhile, mining companies weighed on the total, with payouts down 9.2% after cuts from major players such as Rio Tinto and Glencore. In contrast, precious metal miner Fresnillo increased its regular payout and issued a special dividend on the back of the gold and silver boom.

Computershare noted it has “pencilled in” a bigger decline in mining payouts and allowed for a greater drag from share buybacks over the second half of the year.

Despite the resilience of regular payouts, 22% of companies cut their dividends year-on-year in the second quarter and median growth in company payouts was only slightly ahead of inflation at 4.1%, the report said.