Escaping US market risk has been front of mind for many this year, with concerns about an artificial-intelligence (AI) bubble spreading.

As Trustnet unveiled earlier in this series, fund sectors seemingly distant from US market forces actually displayed high levels of correlation to the S&P 500 in the past five years, meaning portfolios might be rising and falling in line with the tech-dominated index more that investors realise.

US risk has also taken over global indices, with the country representing 70% of the MSCI Word index.

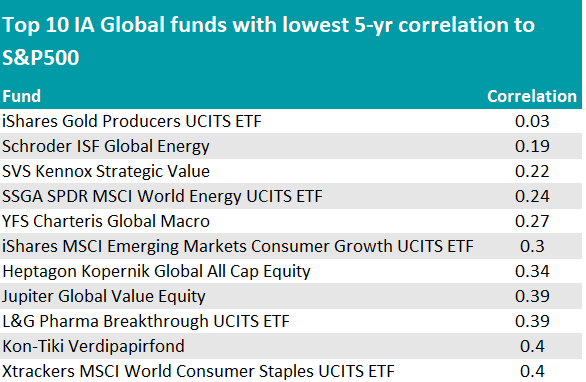

In the 581-strong IA Global sector, 76 funds (approximately 13%) had low correlation to the S&P 500 (below 0.7), meaning they were least following the performance pattern of companies on the other side of the Atlantic.

The lowest five-year correlation was that of the iShares Gold Producers UCITS exchange-traded fund (ETF). With gold’s massive rally this year, the fund now tops the performance tables, topping the IA Global sector over the past 10 and one year, and coming second and third overall in the past three and five years, respectively.

Source: FinXL

Next up was Schroder ISF Global Energy, which aims to outperform the MSCI World SMID Energy index. Its top holdings include Coterra Energy (4.1%), Equinor (3.5%), Repsol (2.9%) and Shell (2.7%). If was closely followed by the SSGA SPDR MSCI World Energy UCITS exchange-traded fund (ETF).

Sandwiched between them was SVS Kennox Strategic Value, whose value tilt differentiates it from the rest of the growth-heavy sector and keeps its correlation low. This small, concentrated portfolio focuses on consumer discretionary stocks (23%) and materials (19%), with a preference for Asian companies (37%) over UK (23%) and North American (18%) names.

Similarly, Jupiter Global Value Equity came a few positions below.

Smaller-companies and all-cap funds were another theme in the list, with the value-driven Heptagon Kopernik Global All Cap Equity leading the category. It is a $2.3bn vehicle which achieved a maximum FE fundinfo Crown rating of five.

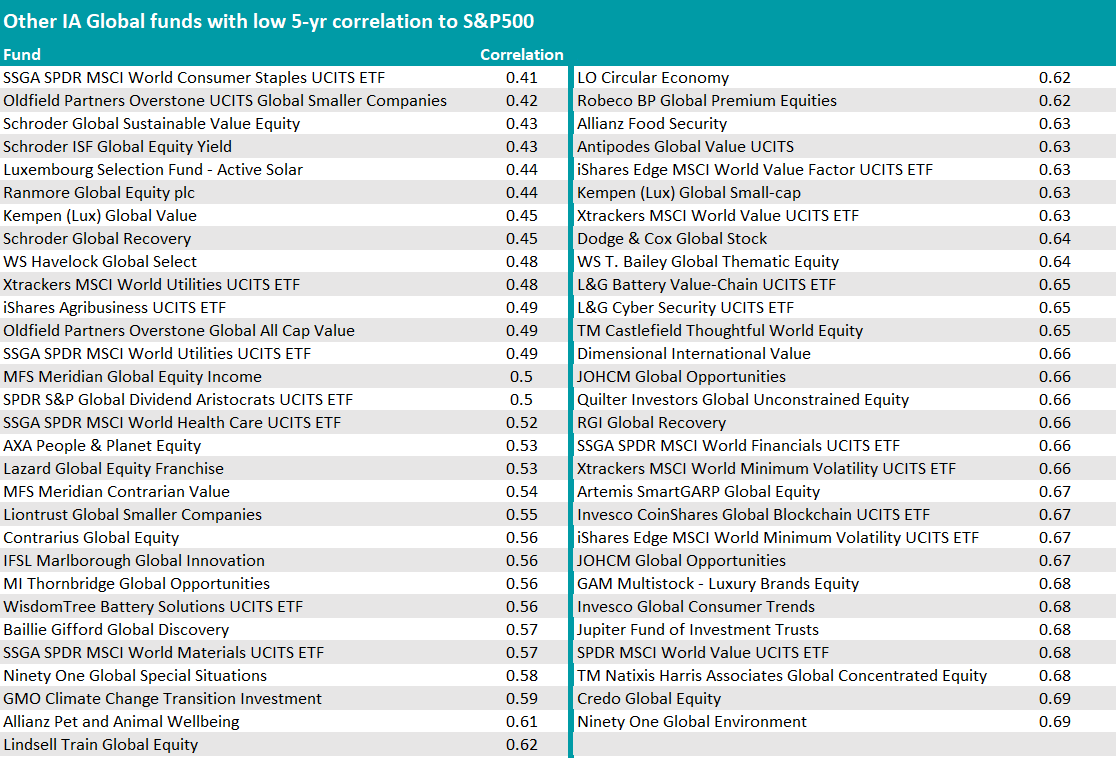

Not too far behind was the small (£53m) Oldfield Partners Overstone UCITS Global Smaller Companies led by Harry Fraser.

A few thematic plays also managed to keep their S&P 500-correlation low, including Active Solar, iShares Agribusiness UCITS ETF and AXA People & Planet Equity.

Source: FinXL

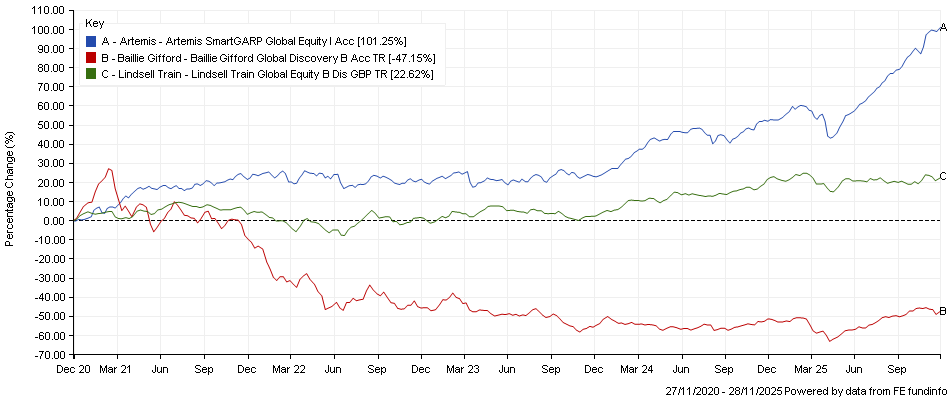

Among the 76 names in the table above, only three are led by FE fundinfo Alpha Managers: Artemis SmartGARP Global Equity, Baillie Gifford Global Discovery and Lindsell Train Global Equity.

Artemis’s Raheel Altaf was highlighted on Trustnet this year as one of the Alpha Managers with the highest returns over 2025; Baillie Gifford’s John MacDougall and his team have lost money last year and over the past three and five years but have achieved better results in 2025 with second-quartile performance so far; while Nick Train’s and James Bullock’s flagship fund has been struggling with significant headwinds in the past few years, as the chart below shows.

Performance of fund against index and sector over 1yr

Source: FE Analytics

Global ETFs dominated the opposite end of the table.

The active funds with the highest levels of correlation were TargetNetZero Global Equity (0.98), PGIM Quant Solutions Global Equity (0.97) and Storebrand Global Plus Lux (0.97).

They were followed by Candriam Sustainable Equity World, FI Institutional Global Developed Equity Selection and GAM Star Composite Global Equity, all at 0.96.